Wall Street’s financial sector, in its quest for ever greater ‘yields,’ locked itself into high octane leveraged speculation strategies during the years leading up to the great housing bubble.

The rating agencies gave the underlying assets their ‘Triple-A grade’ kiss of approval (on what proved out to be sewage-grade quality mortgage assets).

Finally, Wall Street’s hedging strategies evaporated when AIG revealed that it did not have the reserves to cover the credit default swaps it had written.

Massive default waves hit the housing market, and the banking sector quickly found itself with gaping capital holes in balance sheets.

Enter the Federal Reserve and U.S. Treasury to re-liquify banks and insurers with trillions of dollars, courtesy of U.S. tax-paying citizens, to rescue the financial system.

In the meantime, the very banks which were ‘rescued’ by taxpayers, turned around and foreclosed on millions of homes.

11.75 million foreclosures during the 2008-2012 period.

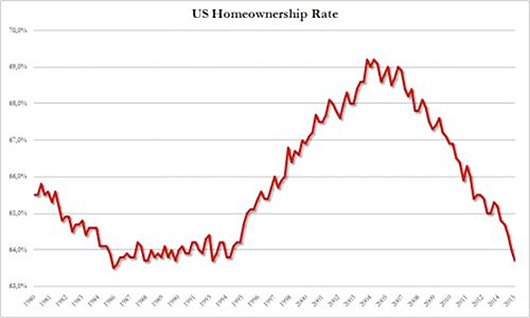

Also in the meantime, the U.S. Homeownership Rate has slumped all the way back down to a level not seen since 1996.

And according to RealtyTrac’s most recent Market Summary, “There are currently 912,073 properties in U.S. that are in some stage of foreclosure (default, auction or bank owned)…

It is time now to restore the financial health of American families with the same direct access to liquidity that was provided to Wall Street during the financial crisis.

…………………………………

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan 2017 – $75,000 per U.S. citizen The Leviticus 25 Plan 2017 (1369)

______________________