The Leviticus 25 Plan – Overview and Scoring Assumptions

The Leviticus 25 Plan activation period is slated for the 5-year period beginning in 2021 and ending in 2025.

The Leviticus 25 Plan – Each participating U.S. citizen will receive a $60,000 deposit into a Family Account (FA) and a $30,000 deposit into a Medical Savings Account (MSA).

All U.S. citizens are eligible to participate, contingent upon agreement to specified recapture provisions.

These general provisions include:

– Waiving all federal income tax refunds for a period of 5 years.

– Waiving all benefits from means-tested welfare programs, income security programs, SSI, and SSDI claims for a period of 5 years.

– Enrollees in the Medicare, VA Healthcare system, Federal Employees Health Benefits (FEHB), and RICARE will be subject to a $6,000 deductible for primary care and outpatient services annually for a period of 5 years. (See full plan for more details)

Primary scoring assumptions:

The Plan assumes an 80% participation rate by U.S. citizens. Wealthier Americans would choose not participate, due to the comparative benefit of income tax refund amounts. Many individuals of lower socioeconomic sector would also choose not to participate, due to the comparatively high benefits profiles that they would not wish to give up.

The Plan assumes that participating families would use significant funds to pay down / eliminate debt, and that these longer-term, lower debt service obligations would enhance the financial security of participating families for several decades beyond the opening activation period. Federal, state, and local government entities would benefit from longer-term tax revenue growth and reduced citizen dependence on government-based entitlement program benefits.

The Plan assumes that dynamic new efficiencies would emerge in the healthcare system – with more families managing/directing healthcare expenditures through their MSAs.

The Plan assumes that apart from the recapture provisions, there would also be significant tax revenue growth for federal, state and local government entities from free-market economic revitalization, more people working and paying taxes, and from the elimination of various income tax deductions (e.g. mortgage / HELOC interest expense).

The Plan assumes that there would not be a massive full-scale move back into the means-tested welfare programs, income security programs, SSI, and SSDI at the end of the initial 5-year activation period.

The benefits of a free market economy and newfound economic liberty for American families would provide positive economic inertia throughout years 5-10, and for several decades beyond. Recapture provisions would provide an estimated substantial federal budget surpluses for each year of the initial 5-year period. Economic growth over the following 10-15 years would generate sufficient recapture funding and tax revenue growth to offset the entire initial Federal Reserve balance sheet expansion.

Significant inertia from The Plan would also provide on-going, market-based growth benefits over succeeding years that far exceed any prospect for healthy economic growth that may be expected under America’s current big-government, central-planning approach.

Dynamic benefits would be generated from:

Massive liquidity gains and debt reduction at the family level.

Immediate, sweeping reversal of government “central planning” approach.

Major reversal in work disincentives embedded in social welfare program structures.

Economic growth, improved productivity and job creation.

Stabilization of housing market.

Strengthening bank capitalization.

Minimizing the role of government in managing, directing, and controlling the affairs of citizens.

________________________________________

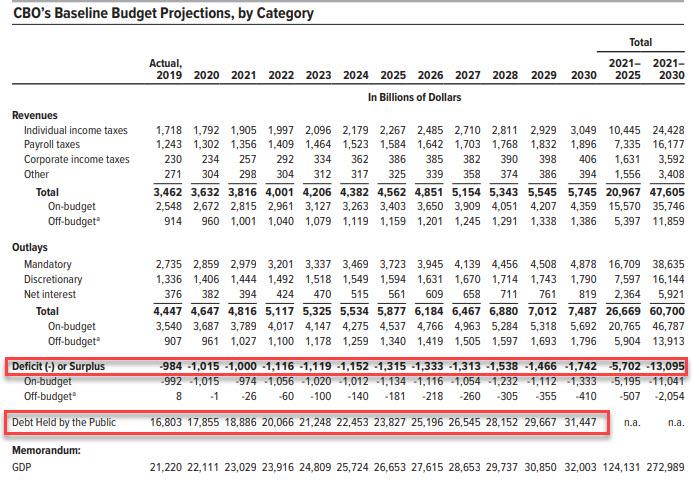

2. Federal Budget Deficit Projections – Congressional Budget Office

The Budget and Economic Outlook: 2019-2029 projects budget deficits ranging from $1.015 trillion in 2020, up to $1.315 trillion in 2025, and $1.742 trillion in 2030. Actual deficits for the out years are likely to be higher than CBO projections, based upon history (“actual” versus “projected”).

Congressional Budget Office (CBO) Deficit Projections 2020-2030

CBO deficit projections for The Leviticus 25 Plan 5-year target period (2021-2025)

2021: $1.000 trillion

2022: $1.116 trillion

2023: $1.119 trillion

2024: $1.152 trillion

2025: $1.315 trillion

Total deficits projected 2021-2025: $5.702 trillion

Average annual deficit projected 2021-2025: $1.40 trillion

Source: CBO 10-Year Budget Projections (2020-2030) https://www.cbo.gov/topics/budget/outlook-budget-and-economy

________________________________

3. Federal Income Tax Recapture

The scoring model assumes that 80% of U.S. citizens will participate in The Leviticus 25 Plan.

Participants must give up their tax refunds through the Plan’s recapture provisions for the 5-year target period (2021-2025).

According to 2019 IRS Filing season statistics, through Dec 27, 2019:

111,811,000 total refunds were paid out for a total of $320.805 billion. The estimated refund total for the full year, through December 31st: $321 billion.

Refund totals have increased by ~$15 billion over the past five years, from $306 billion (2015) to a current $321 billion (2019), representing an average increase of ~$3 billion / year. A conservative estimated average of $335 billion per year (2021-2025) will be used for this recapture calculation.

Recapture: $335 billion average/year X 80% X 5 = $1.340 trillion

Average recapture per annum (2021-2025) = $268.0 billion

Source: https://www.irs.gov/newsroom/filing-season-statistics-for-week-ending-december-27-2019

_______________________________________

4. Means-tested welfare Recapture

Participants in the Plan must give up all claims for means-tested welfare benefits for the period 2022-2026.

Means-tested welfare spending has grown to $1.15 trillion 2019, and is increasing at an average of approximately $30 billion per year.

Source: https://www.cbo.gov/system/files/2019-06/55347-MeansTested.pdf

Federal: Means-tested welfare outlays are projected to grow from $848 billion in 2022 to $1.014 trillion by 2026.

Federal

2022: $848.0 billion

2023: $888.0 billion

2024: $927.0 billion

2025: $970.0 billion

2026: $1.014 trillion

Total means-tested welfare outlays 2022-2026 = $4.647 trillion

Federal recapture benefit, assuming 80% participation: $4.647 trillion x .8 = $3.718 trillion

Side Note 1: Due to the severe economic downturn during 2020, Means-tested welfare spending may significantly exceed $848 billion in 2022 and at least moderately exceed $888 billion in 2023. Therefore, the Federal recapture benefit may well exceed the currently projected $3.718 trillion.

Side note 2: The U.S. Health Care Freedom Plan provides Medical Savings Account (MSA) funding of $30,000 for each participating member – in lieu of Medicaid eligibility and other health care benefits for 2021-2025 as defined under the CBO’s means-tested welfare line items. An alternative option would be to leave the Medicaid program benefit in place for participants with a $6,000 deductible per year for the five-year period, to cover primary care events and select out-patient services – primarily related to routine medical appointments, Medicaid-eligible prescription events, dental care, and other desired primary care services.

Participant Medical Savings Accounts will also be subject to billing for institution-based emergency care and/or charity care events in the amount of $500 per admission, not to exceed three admissions annually.

Side note 3: State governments will also benefit from reduced means-tested welfare spending obligations.

States share of means-tested welfare spending (2018): $300.0 billion

States’ share is on track to grow by ~$7.0 billion / year). This is a conservative estimate in that it assumes no acceleration in growth over the 5-year period 2022-2026.

2022: 328.0B + 7.0B = $335.0B

2023: 335.0B + 7.0B = $342.0B

2024: 342.0B + 7.0B = $349.0B

2025: 349.0B + 7.0B = $356.0B

2026: 356.0B + 7.0B = $363.0B

Total States’ recapture during the 5-year target period (2022 – 2026) – assuming 80% participation: $1.745 trillion X 0.8 = $1.396 trillion

____________________________________________

5. Medicare Recapture

Each U.S. citizen participating in The Plan will receive a $30,000 deposit into a personal Medical Savings Account (MSA).

The Leviticus 25 Plan assumes 80% participation by Medicare enrollees.

Within this comprehensive economic plan, The U.S. Health Care Freedom Plan provides

Medical Savings Account (MSA) funding of $30,000 to cover the $6,000 deductible for Medicare-eligible primary care events and select out-patient services – primarily related to routine medical appointments, Medicare Part D prescription events, disease state monitoring clinics, and other desired primary care services.

Approximately 62.712 million Americans are currently enrolled in Medicare (2021).

Enrollment is increasing by approximately 1.5 million / year.

For the 5-year target period (2022 – 2026)

2021: 63.0 X .8 X $6,000 = $302,400,000

2022: 64.5 X .8 X $6,000 = $309,600,000

2023: 66.0 X .8 X $6,000 = $316,800,000

2024: 67.5 X .8 X $6,000 = $324,000,000

2025: 69.0 X .8 X $6,000 = $331,200,000

Total Medicare recapture during the 5-year target period (2022-2026): $1.584 trillion

Source: KFF.org – Medicare beneficiaries

________________________

6. VA Healthcare

The Leviticus 25 Plan assumes 80% participation by Veterans Administration healthcare enrollees. Within this comprehensive structure, The U.S. Health Care Freedom Plan provides Medical Savings Account (MSA) funding to cover a $6,000 deductible annually over the course of the 5-year target period (2021-2025).

For the year 2021 there were 9 million enrollees in the VA system.

9.0 million X 0.8 X $6,000 = $43.2 billion annual recapture

Total recapture 2022-2026: $216.0 billion

Source (page 30): https://www.va.gov/health/aboutvha.asp

_________________________________

7. TRICARE

The Leviticus 25 Plan assumes 80% participation by TRICARE enrollees.

Through The U.S. Health Care Freedom Plan, participating members will receive a Medical Savings Account (MSA) funding injection of $30,000 to cover a $6,000 deductible annually for desired primary care and out-patient services over the course of the 5-year target period (2022-2026).

There are currently 9.6 million U.S. citizen beneficiaries in various locations around the world.

Recapture – total (2022-2026): 9.6 million X 0.8 X $6,000 X 5 years: $230.4 billion

Source: https://www.tricare.mil/About/Facts

______________________________

8. Federal Employee Health Benefits (FEHB)

The Leviticus 25 Plan assumes 80% participation by FEHB enrollees.

Participating members will receive a Medical Savings Account (MSA) funding injection of $30,000 to cover a $6,000 deductible annually for desired primary care and out-patient services over the course of the 5-year target period (2021-2025).

There are currently 8.2 million U.S. citizen FEHB beneficiaries. Note – the Federal government also pays approximately 72% of premium costs per enrollee.

Recapture – total (2022-2026): 8.2 million X 0.8 X $6,000 X 5 = $196.8 billion

Source: https://fas.org/sgp/crs/misc/R43922.pdf

________________________________________

9. Social Security Disability Income (SSDI)

Number, average, and total monthly benefits, December 2019:

Workers (8,378,374 million): $10.526 billion

Widow(er)s (246,142 million): $1.649 billion

Adult children 1,140,580 million): $9.44 billion

Total annual SSDI payments: ~$21.61 billion

Total for 5-year target period 2022-2026 (assuming 2% growth per year) = $22.0B X 5 = $110.0 billion

Plan assumes 80% participation, yielding recapture: $110.0 X 0.8 = $88.0 billion

Source: https://www.ssa.gov/policy/docs/statcomps/di_asr/2019/sect01.pdf

__________________________________

Subtotals:

CBO projected deficit summary (2022-2026): $6.271 trillion

Recapture gains (2022-2026):

Federal Income Tax recapture benefit: $1.306 trillion

Means-tested Welfare recapture benefit: $3.718 trillion

Medicare $6,000 deductible recapture: $1.584 trillion

VA $5,000 deductible recapture: $0.216 trillion

TRICARE $6,000 deductible recapture: $0.230 trillion

FEHB $6,000 deductible recapture: $0.197 trillion

SSDI recapture: $0.880 trillion

Net surplus subtotal (before interest savings): $8.131 trillion – $6.271 trillion = $1.86 trillion

_________________________________________________

10. Interest expense on projected deficits 2022-2026

The CBO annual deficit projections within The Budget and Economic Outlook: 2020-2030 include rate expense projections for each year. Due to The Leviticus 25 Plan recapture provisions generating a budget surplus each year (versus non-interest outlays), there will be no interest expense Treasury sales to fund annual deficits.

Average Interest Rates on U.S. Treasury Securities – is based upon Treasury Direct “Interest Bearing Debt” report, Jan 31, 2021.

Note: Average Interest Rates are calculated on total unmatured interest-bearing debt. The average interest rates for total marketable, total non-marketable and total interest-bearing debt do not include the U.S. Treasury Inflation-Protected Securities and Treasury Floating Rate Notes.

1-31-2021: Total Interest Bearing Debt Average Interest Rates: 1.687%

Interest expense for each year’s deficit is calculated as an average for the first year, then expensed at full cost for each following year through 2025.

2022: $1.336 trillion/2 X 0.01687 = $11.27 billion

2023-2026: Interest expense: $11.27 billion X .01687 X 4 = $0.76 billion

2023: $1.124 trillion/2 X 0.01687 = $9.48 billion

2024-2026: Interest expense: $9.48 billion X .01687 X 3 = $0.48 billion

2024: $1.081 trillion/2 X 0.01687 = $13.77 billion

2025-2026: Interest expense: $1.081 trillion X .01687 X 2 = $0.18 billion

2025: $1.174 trillion/2 X 0.01687 = $9.90 billion

2026: Interest expense: $9.90 billion X 0.01687 X 1 = $0.16 billion

2026: $1.116 trillion/2 X .0168 = $9.41 billion

Recapture: Total interest expense eliminated by projected surpluses: $55.4 billion

Source: Average Interest Rate on U.S. Treasury Securities: https://www.treasurydirect.gov/govt/rates/avg/2021/2021_01.htm

__________________________________

The Leviticus 25 Plan budget surplus – Totals – 2022-2026:

5-year projected deficit: $6.271 trillion

5-year projected recapture (subtotal): $8.131 trillion

5-year projected interest expense savings: $0.0554 trillion

Budget surplus (projected) 2022-2026: $8.186 trillion – $6.271 trillion = $1.915 trillion

Average annual budget surplus (projected) 2022-2026: $1.915 trillion / 5 years: $383.0 billion per year

__________________________________________

Note 1: Projected budget surpluses for 2022-2026 do not factor in the additional government tax revenue gains that would accrue from the massive shift in capital away from debt service and into productive economic activity.

Note 2: Projected budget surpluses for 2022-2026 do not factor in the additional government tax revenue gains that would accrue from significantly lower levels of debt deductibility on individual income tax filings.

The Leviticus 25 Plan – Projection limitations

There can be no question that The Leviticus 25 Plan would generate healthy, broad-based economic growth from broad-based debt reduction and improved financial stability at the family level, the restoration of free market dynamics in commerce, and scaling back social program work disincentives.

The Leviticus 25 Plan does not attempt to project how much additional tax revenue and reduced cost of government will be realized, above and beyond the Recapture Provisions, over the course of the initial five years of the plan. In that sense, The Plan understates the effect of additional dynamic economic benefits.

Robust funding of Medical Savings Accounts and the elimination of millions of insurance claims and claims resolutions for basic primary care and everyday healthcare purchases swill save millions of man-hours of health care cost on an annual basis. Scaling back government involvement in basic primary care and everyday healthcare purchases for millions of Americans will also generate massive cost savings.

The Plan makes no attempt to project the positive effects of the streamlined, consumer-driven efficiencies that will emerge, and the cost reduction and improvement in services.

The Plan therefore understates the benefits.

The Plan projects an 80 percent participation rate by U.S. citizens. It is assumed that a large number of wealthy Americans will not participate, because their tax refunds are larger than the annual Plan benefits. And it is assumed that a large number of Americans receiving significant government benefits for extraordinary health or economic issues will also not participate.

Cost savings from the reductions in massive social welfare spending and other programs, like unemployment insurance, workman’s compensation, SSI and SSDI can be difficult to quantity, since state and federal funding mechanisms may both be involved in various ways. In that regard, The Plan may understate, or it may overstate, the benefits.