Some high-ranking economists, along with some elite-class political heavyweights, are carbon tax true believers (WSJ – Jenkins, 11-15-17). The list includes the likes of Kevin Haslet, Greg Mankiw, James A Baker, Henry Paulson, George P. Shultz, Martin Feldstein, Mitt Romney.

The narrative goes like this: “The virtues of a carbon tax are not in dispute. It’s a way to raise money that doesn’t weigh on incentives to work, save and invest.”

In truth, new carbon tax government revenues would simply supply fresh new resources to feed the insatiable appetite of a spend-happy U.S. government.

It would do little, if anything, to restore fiscal sanity within the walls of Congress. It would do nothing to set America back on course for a sustainable, financially-sound, low-debt future.

America needs less government control, not more. We need a citizen-driven economy and free markets, not a government-centric economy with shackled markets and central planning imperatives.

A new carbon tax would increase financial stress and further impair the monthly balance sheets of millions of American families. It would do nothing to seriously strengthen growth in real disposable household income.

It would do nothing to cast off the shackles of government control and free the U.S. marketplace for vigorous, long term economic growth and brighten the future of American families with true economic liberty.

…………………………………

Consider this critical point regarding America’s massive debt burden: Every month hundreds of billions of dollars are obligated to servicing debt. This massive, never-ending debt-service obligation, including household debt, credit card debt, corporate debt, and government debt, exerts a suffocating effect on economic growth. It does nothing to enhance government tax revenue flows. In fact, various forms of debt are even tax deductible – thereby lowering potential tax revenue flows.

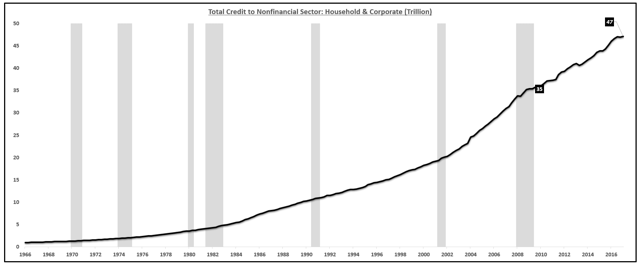

Household and Non-financial Corporate Debt has recently reached the $47 trillion mark.

Total Household and Non-financial Corporate Debt ($Trillions)

There is one economic acceleration plan in America with the power to get America back up on its feet again.

The Leviticus 25 Plan would eliminate massive amounts of debt across America and generate tremendous growth in government tax revenue flows (federal, state, local), producing $1.02 trillion annual budget surpluses at the federal level for each of the next five years.

The Leviticus 25 Plan would provide massive debt elimination for millions of American families. It would relieve financial stress and restore financial health for families all across America. The social benefits would be incalculable.

It would generate electrifying financial benefits to small businesses all across Main Street America.

The Leviticus 25 Plan would reduce the scope of government control over the daily affairs of U.S. citizens. It would restore economic liberty for all America.

It is time to move. There is no other plan in America. Period.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan 2018 – $75,000 per U.S. citizen

The Leviticus 25 Plan 2018 (2576)

“He who will not apply new remedies must expect new evils.” – Sir Francis Bacon