The Fed and other global Central Banks are injecting hundreds of billions of dollars into the credit markets, week-by-week, ‘soaking’ up staggering amounts of ‘U.S. Treasury issuance’ (along with corporate ‘junk’ paper)…

……………………………………………………………

For The First Time Ever, The Fed Will Monetize Double The Total Treasury Issuance

ZeroHedge, Feb 17, 2020 – Excerpts:

… the Fed is nationalizing (or privatizing, depending on whether one views the Fed as a public, or a private – which it actually is – entity) the entire capital market at a pace unseen before in history.

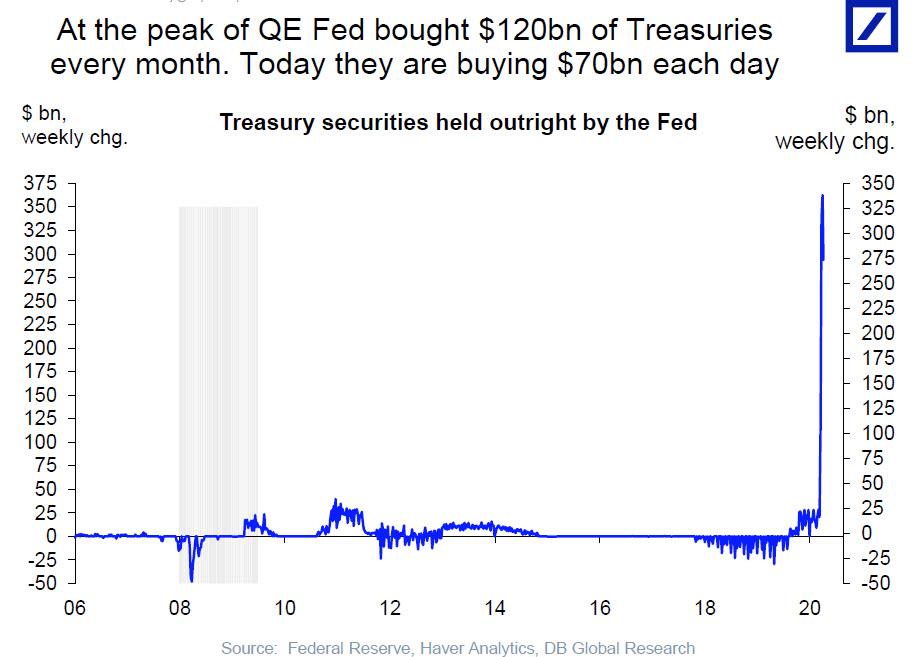

AS the following chart from DB’s Torsten Slok shows, the current pace of weekly Treasury purchases is simply staggering, unparalleled by anything seen before in history.

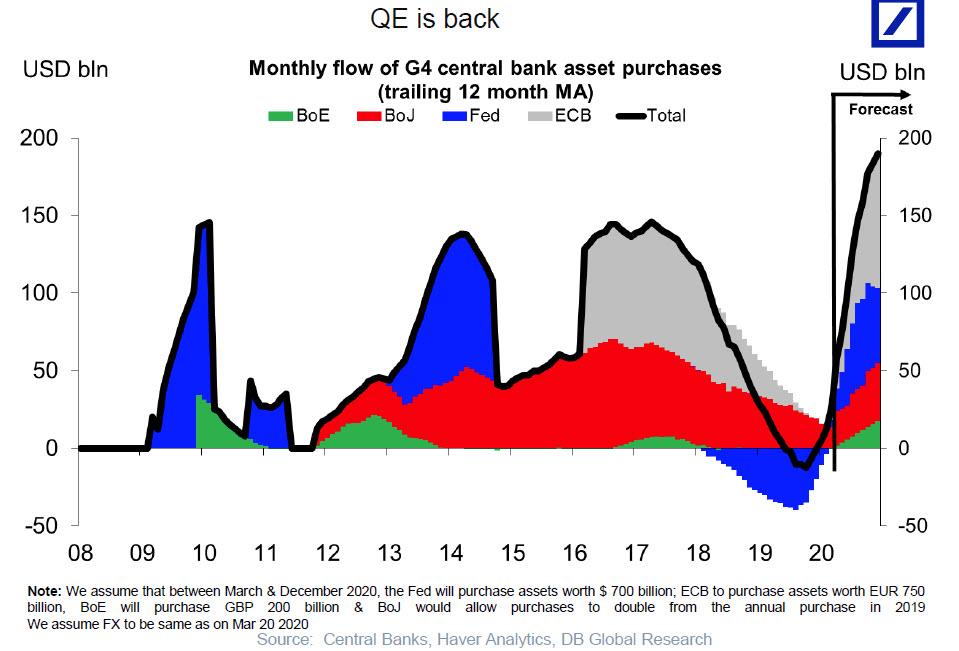

It’s not just the Fed: with QE officially back [full-blown global debt monetization] every single central bank is now actively injecting billions of liquidity into the stock market.

_________________________________________

Note – These massive liquidity infusions are necessary to keep credit markets from freezing up. They will do nothing to serve the interests of long-term economic growth, and help get America’s enormous debt burdens back under control.

They will do nothing to eliminate the massive debt loads that are burdening millions of American families – and elevate their prospects for long-term financial health.

Three is one plan which will…

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$75,000 per U.S. citizen – Leviticus 25 Plan 2021 (3645 downloads)