ZeroHedge: Lebowitz: The Fed’s Ever-Growing Golden Footprint

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Excerpt:

What is a Dollar?

The value of a dollar is a figment of your imagination. A “greenback” is a worthless piece of paper backed by an intangible promise- the “full faith and credit” of the U.S. government. Its value rests on a necessary belief that one can transact with it today and tomorrow. Therein lies the value of any fiat currency.

Similarly, gold has little tangible value other than what we ascribe to it. Gold is not currently an authorized currency in any developed nation. But, it is held in proportionally small amounts by many governments as an informal reserve. Besides opinions of worth, the difference between the dollar and gold is gold has provided a means of storing wealth and transacting for millennia. Gold is and has always been the antithesis of fiat currency. There are important differences, such as elasticity, storage, and transact-ability that we will not review in this article.

Decades of irresponsible fiscal spending and monetary tomfoolery slowly but surely reduce the dollar’s value. The loss of its value is not perceptible to most as a dollar is still worth a dollar. For those on the lookout, however, the price of gold is sending a strong message.

Trust in the Dollar

The U.S. dollar is the world’s most trusted currency. Even America’s most ardent enemies transact in dollars and hold them as reserves.

For the last 30 years, the U.S. government has run continual deficits requiring ever greater assistance from the Fed to fund it. The Fed works their magic by adjusting the nation’s money supply to manage interest rates and keep interest expenses manageable.

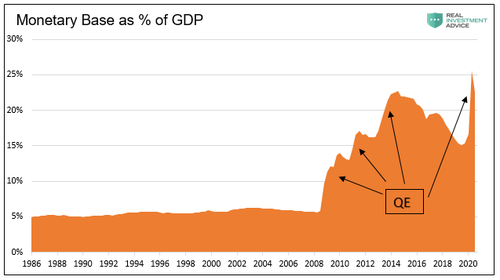

For many years, as shown below, the monetary base was approximately 5% of the nation’s annual economic output. Starting in 2008, however, the Fed took much bolder steps to push interest rates lower. Their actions ensured the government could sustain recurring outsized deficits. Equally important, corporate and private borrowers can service mounting debt levels.

With short-term rates lowered to zero in 2008 and traditional monetary tools not affecting longer-term rates, the Fed introduced QE. QE requires large amounts of Fed purchases of notes and bonds to put downward pressure on the entire yield curve.

Successive rounds of QE occurred well past the end of the financial crisis and are happening again on a grander scale today. The Fed’s goal is to allow the government and other debt holders to fund at low-interest rates. Essentially they need to flood the system with money to make money cheap.

Real Interest Rates

In a free market, the price of a good or service should be commensurate with the supply and demand of the good or service.

When the money supply is manipulated, prices stray from what supply and demand curves say the price should be.

A current example is U.S. Treasury yields or the price of money. Rational lenders/investors should always demand a positive yield accounting for inflation and risk. If not, they lose purchasing power and are better off not lending. Accordingly, the yield on Treasury debt should always equal future inflation expectations plus a risk premium.

The current yield on the 5-year Treasury note is 0.45%. 5-year inflation expectations are currently 2.18%. Even if we assume zero risks, the yield is at least 2.17% below what any rational investor should demand. The -2.17% difference between the nominal rate and inflation rate is called the real rate.

The level of real interest rates is a sturdy gauge of the weight of Federal Reserve policy. If the Fed is treading lightly and not distorting markets, real rates should be positive. The more the Fed manipulates markets from their natural rates, the more negative real rates become.

________________________________

The U.S. government and the Federal Reserve have us on a ‘radar-locked’ Dollar erosion glidepath – that will most certainly accelerate over the next 5 years.

America’s debt load, public and private, will continue to mushroom higher, leading to additional borrowing and ‘monetizing’… and U.S. citizens and their families will get financially whip-lashed in the process.

There is one plan with the raw power to solve this financial ‘death trap’ through massive debt elimination, Dollar stability, the restoration of free market dynamics, long-term economic growth, and financial security for American families.

The Leviticus 25 Plan will generate significant budget surpluses over the initial 5 years of activation, and will pay for itself over the next 10-15 years.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2021 (3937 downloads)