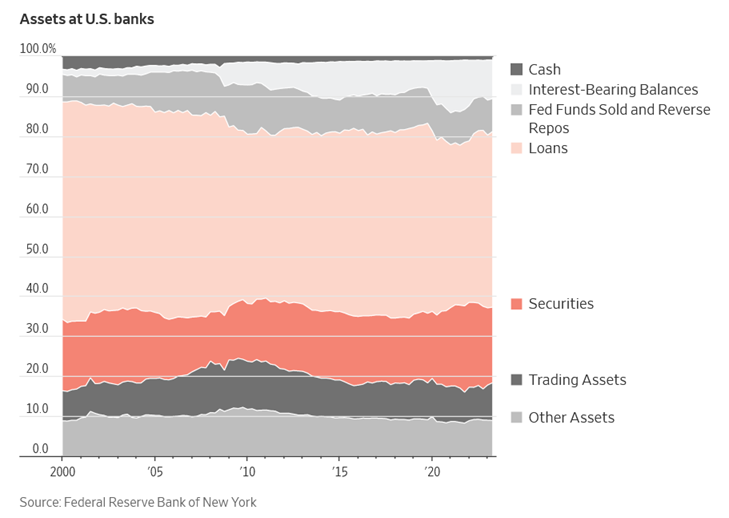

Cash balances at U.S. banks are dangerously thin…

Banking Crisis Plays out at America’s Smallest Lenders WSJ 12-27-23

………………………………………………………………………………..

Banks Terminate 60,000 Workers In One Of The Bleakest Years For The Industry Since 2008

ZeroHedge, Dec 27, 2023 – Excerpts:

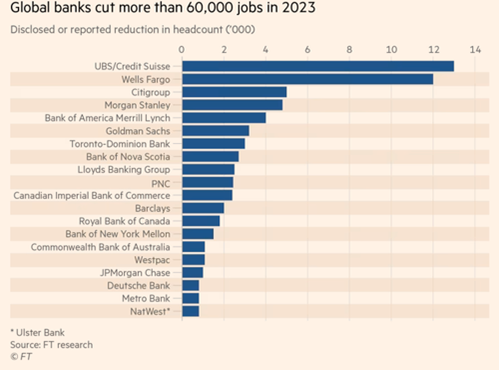

The collapse of three US regional banks – First Republic Bank, Silicon Valley Bank, and Signature Bank – marked some of the largest failures in the banking system since 2008. Central banks contained the “mini-crisis” earlier this year with forced interventions and the mega-merger of Credit Suisse and UBS. Despite the interventions, global banks still axed the most jobs since the global financial crisis.

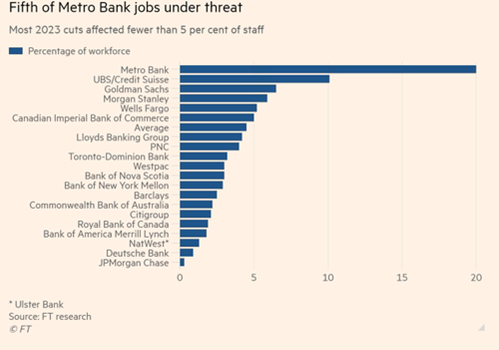

A new report from the Financial Times shows twenty of the world’s largest banks slashed 61,905 jobs in 2023, a move to protect profit margins in a period of high interest rates amid a slump in dealmaking and equity and debt sales. This compared with the 140,000 lost during the GFC of 2007-08.

“There is no stability, no investment, no growth in most banks — and there are likely to be more job cuts,” said Lee Thacker, owner of financial services headhunting firm Silvermine Partners.

FT noted that corporate disclosure data and its independent reporting did not include smaller regional bank cuts, indicating total job loss could be much higher.

At least half of the job cuts came from Wall Street lenders struggling with Western central banks’ most aggressive interest rate hikes in a generation.

The most significant cut of any single bank was at Switzerland’s UBS.

Morgan Stanley reduced jobs by 4,800, Bank of America by 4,000, Goldman Sachs by 3,200, and JPMorgan Chase by 1,000. As a whole, Wall Street cut 30,000 workers this year.

“The revenues aren’t there, so this is partly a response to overexpansion. But there is also a simpler explanation: political cost-cutting,” said Thacker.

Gaurav Arora, global head of competitor analytics at Coalition, warned: “We expect full-year 2024 to be a continuation of the story of 2023.”

Arora’s view of further turmoil aligns with our two recent notes: Banks’ Usage Of The Fed’s Bailout Facility Soars To New Record High and Large Bank Deposits Rise As Money-Market Outflows Accelerate, Small Banks Still Stressed.

“We see banks getting more conservative,” Arora concluded.

_______________________________________

Navigating the Waters: The Current State of Distressed Debt

Wilmington Trust, Mar 16, 2023 – The macro picture for distress

Many loan market analysts have taken a dim view of the distressed space in the next two years. Fitch, for example, sees a band of 2023 institutional leveraged loan default rates between 2.5%–3.0%. They project $47 billion of defaults in 2023 at the midpoint of their forecast.1

Deutsche Bank is more pessimistic, expecting a 5.6% default rate in the United States and a 3.7% rate in the euro market in 2023. Per their estimates, default rates on U.S. leveraged loans will hit a near-record high of 11.3% in 2024, while defaults on euro-leveraged loans will hit 7.1%.2

Undoubtedly, the economic climate is harsh for borrowers. A complex economic cycle continues to spin. Wilmington Trust’s 2023 Capital Markets Forecast highlights an inflationary vortex driven by labor, China, and energy, which creates structural stress.3 This vortex and the resulting monetary policy are exerting its pull across companies’ capital structures.

Mortgage delinquencies – “About five million U.S. households were estimated to be behind on their last month’s mortgage repayment in June 2023. Homeowners between 40 and 54 years made up over 1.8 million households late on their payment. Second in rank were roughly 1.5 million homeowners between 25 and 39 years” -Statista, Jul 23, 2023

According to Kipplinger, “the delinquency rate for conventional loans increased 21 basis points to 2.5%, while the rate for FHA loans increased 55 basis points to 9.5%. The delinquency rate for VA loans increased 6 basis points to 3.76%.”

__________________________________

The Leviticus 25 Plan provides direct liquidity extensions to qualifying U.S. citizens, through a Fed-based Citizens Credit Facility, for the express purpose of massive ‘ground-level’ debt elimination.

This process will provide the banking system with massive new inflows of liquidity to strengthen cash reserves, solve a majority of banks’ distressed debt and delinquent mortgage issues, allow banks to rectify a significant proportion of their ‘maturity mismatch’ issues with fresh purchase of Treasuries and other high-grade credit instruments yielding significantly higher yields.

The Leviticus 25 Plan will generate federal budget surpluses of $619.5 billion each of the first five years following activation, and pay for itself over a 10-15 year period.

It will generate long-term economic growth – not dependent upon debt issuance.

It will restore financial security for millions of American families – and reduce dependence on government programs.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$60,000 per U.S. citizen – Leviticus 25 Plan 2023 (10650 downloads)