ZeroHedge, Aug 10, 2024 | Via SchiffGold.com, – Excerpts:

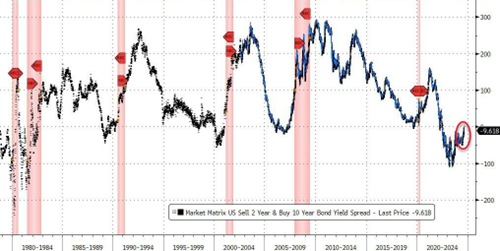

Americans are already struggling to feed their families and pay their bills, but having predicted every US recession since 1960, the steepening bond yield curve is speaking loud and clear that an “official” downturn is nearly inevitable. With bond prices on the rise as the Fed looks increasingly likely to cut rates in September, the yields are going down and the inverted curve is finally leveling out after an epic two-year inversion.

And with stocks now crashing around the world, global uncertainty is rocketing upward in a “Black Monday” event, especially as dizzyingly volatile Japan struggles to contain its post-ZIRP doom loop. In other words, the storm may be arriving in earnest….

The yield curve represents the difference in interest rates between long and short-term bonds, and every time it steepens after becoming inverted, a recession soon follows. It’s become a popular indicator because of its surgical accuracy, and because it tends to flash clear and reliable predictions before other datasets can do the same.

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

Even the Federal Reserve admits that thus far, the yield curve crystal ball has never failed. While there are some different yield spreads that one could observe between bonds of varying maturities, recessions tend to hit when the curve flattens and the Fed cuts interest rates – precisely the current scenario.

Unemployment numbers and equity prices are important as well, and last week, data showed that unemployment has gone up, triggering the “Sahm Rule” – a formula which has predicted the majority of recessions since it was devised in the 1950s by Federal Reserve alumnus Claudia Sahm….

Stock markets also flashed a sea of red last week, with Japanese stocks now tumbling further in the worst day since 1987 and the global sell-off, especially in risk assets, is intensifying. The stock market is not the economy, and as for the jobs reports, those numbers can’t be trusted — but if anything, the real employment data is even worse than indicated by official claims.

And if history is any indication, the inverted yield curve tells no lies even as government and Federal Reserve data seek to paint as rosy a picture as possible to reassure markets and continually justify the academic expertise and professional necessity of central bankers.

_______________________________________

America is ‘eyeball deep’ in all sectors debt: Public Debt, Corporate Debt, Household Debt.

Debt service costs are suffocating the economic health of the country.

Washington Democrats and Republicans have no credible plan to clean up this mess, and restore economic health to Federal, State, and Local governments, and Small Businesses and millions of hard-working, tax-paying families across America.

Main Street America Republicans do have a plan — a massive, across-the-board debt elimination plan for America.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (19682 downloads )