‘Teacher pay’ is a critically important goal for attracting and retaining dedicated, top-notch teachers and providing the best resources for high achievement by America’s school children.

At the same time, rejuvenating financial health for all working American families is a vital cause, all across America.

All working Americans – military, law enforcement, medical / healthcare, maintenance workers, construction, fire and rescue, service workers – are deserving of an opportunity, a comprehensive initiative, to strengthen their families’ financial status and relieve the burden of government interference in their daily lives.

Let’s do some math, and make a comparison between two significant economic initiatives.

Plan 1: The Leviticus 25 Plan – $90,000 per U.S. citizen. $60,000 per U.S. citizen is

electronically deposited into a Family Account and $30,000 per citizen is electronically deposited into a Medical Savings Account.

Who benefits?

Answer: All participating U.S. citizens and their families.

Who pays?

Answer: The Federal Reserve creates a funding facility, a Citizens Credit Facility, to channel liquidity to American families, in the same way that they set up various credit facilities to fire-hose liquidity out to Wall Street’s financial sector during the great economic crises years (2008-2010). Many of these U.S. and foreign banks and insurers were the very institutions that had precipitated the financial crisis with their financial innovation schemes and leveraged speculation – which ‘bled out’ in the form of gaping balance sheet ‘capital holes’ when the big mortgage default wave hit.

How does the Federal Reserve then get the money back, in order to reduce its balance sheet back down to ‘normal dimensions,’ over time?

Answer: Through a series of simple recapture provisions.

#1. Participating families would be required to give up their tax refunds each year for a period of five years.

#2. Participating families would also be required give up means-tested welfare benefits, income security program benefits, unemployment insurance, workman’s comp, SSI, SSDI, and various other social welfare benefits.

#3. For participating families, there would be a $6,000 deductible for five years ($30,000 total) for those enrolled in Medicare, Medicaid, VA, TRICARE, FEHB.

The Plan pays for itself over a 10-15 year period.

How much would The Leviticus 25 Plan benefit a typical teacher’s family?

Case 1: Family of four. Mother teaches – salary $50,000 / year.

Father also works. Two school-age children.

$165,000 balance on 30-year fixed mortgage – maturing in 20 years.

Two modest car loans.

Monthly health care premiums – fairly substantial.

Through the Citizens Credit Facility, $240,000 would be electronically deposited into their Family Account, and $120,000 would be electronically deposited into their Medical Savings Account.

These liquidity grants are tax-free. The net benefit of these grants would be reduced slightly over the course of time through the loss of income tax refunds for five years (estimate: $5,000 per year for five years: $25,000).

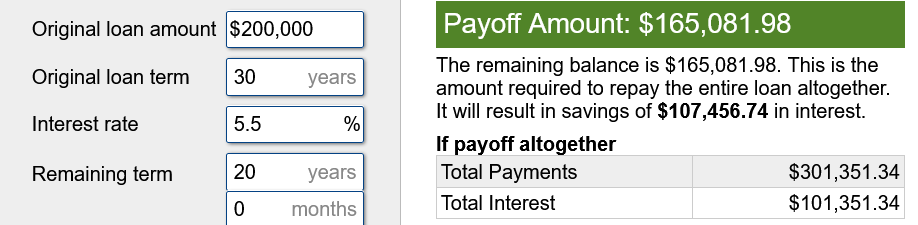

Mortgage payoff example: Family pays off $165,000 balance remaining on a 30-year fixed $200,000 mortgage at 5.5% interest rate / 20 years remaining to maturity with principle and interest payments of $1,136 per month.

Total savings: $165,000 principle and $101,351 interest. Total: $266,351.

Approximate annual savings: $13,600.

This savings amount dwarfs the anticipated $5,000 loss per year from income tax refunds.

Family retains $75,000 in Family Account for additional installment debt reduction, discretionary purchases and savings.

With $120,000 in Medical Savings Account, family chooses to purchase a high-deductible policy with reduced premium costs.

Total impact on family financial health: significant. Benefits: powerful

And even more importantly, all families in America would benefit in similar ways.

…………………….

Plan 2: Raise teachers’ pay by a healthy 15% – via tax increases.

Who benefits?

Answer: Teachers and their families.

Who pays?

Answer: Everyone whose taxes were raised to cover the additional outlay on behalf of teachers. And that would include teachers themselves, whose taxes would also go up – and would therefore slightly reduce the net benefit of a 15% pay raise.

How much would a 15% pay hike actually benefit a typical teacher’s family?

Case 1: Family of four. Mother teaches – salary $50,000 / year.

Father also works. Two school-age children.

$165,000 balance on 30-year fixed mortgage at 5.5% interest – maturing in 20 years.

Two modest car loans.

Monthly health care premiums – fairly substantial.

A 15% pay raise for the teacher in the family would generate additional gross income of $7,500 per year, or $37,500 over a five-year period – before taxes.

This increased income would provide additional resources for some possible modest reductions in mortgage and installment debt, certain discretionary spending, and it might allow for additional modest savings for their children’s future college education.

Teachers and their families alone would benefit financially. Others would not. Mortgage debt reduction: modest.

Health plan premium reduction: none.

Net cash benefit over five years: $37,500.

______________________________________

America needs a comprehensive economic acceleration plan that benefits all Americans – through massive debt reduction and the restoration of economic liberty..

The choice is clear.

The Leviticus 25 Plan will also generate $112.6 billion budget surpluses at the federal level during each of its first five years of activation (2025-2029 – compared to trillion dollar deficits each year into the foreseeable future.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (20778 downloads )