The Leviticus 25 Plan has the raw power to quench such fatalistic views — effecting massive reductions in government outlays and generating enormous, ongoing tax revenue inflows. to bring about dynamic federal, state, and local budget surpluses.

The Leviticus 25 Plan will generate average annual budget surpluses of $36.568 billion for each of the first five years of activation (2026-2030) — vs current CBO-projected average annual deficits of $1.938 trillion.

This represents a monumental $2.304 trillion positive budget gain annually (2026-2030) for the U.S. federal budget, with major gains falling into line, also, for state and local government entities.

__________________________________

Scoring Update Summary:

___________________________________

Note 1: Projected budget surpluses for 2026-2030 do not factor in the additional government tax revenue gains that would accrue from the massive shift in capital away from debt service and into productive economic activity.

Note 2: Projected budget surpluses for 2026-2030 do not factor in the additional government tax revenue gains that would accrue from significantly lower levels of debt deductibility on individual income tax filings.

Note 3: Projected budget surpluses from the Medicaid / CHIP recapture do not take into account the likelihood of fewer citizens actually qualifying for Medicaid / CHIP benefits.

Note 4: Projected budget surpluses from Interest Expense Reductions during each of the first five years of activation (2026-2030) is likely understated due to the fact that ‘debt held by the public’ is projected to increase by 8.5% per year, from $28.278 trillion in 2026 to $40.198 trillion in 2030.

Note 5: The Plan’s funding of individual Medical Savings Accounts (MSAs) with the $6,000 deductible provision per year would result in an enormous drop in the number of claims each year for Medicare reimbursement. Medicare payroll taxes would generate a growing revenue stream, due to stronger economic growth, while outlays would drop significantly from the reduced claims numbers – thereby providing the Fed with a powerful tool to recapitalize the Medicare Trust Fund, vis the Citizen’s Credit Facility.

……………………………………….

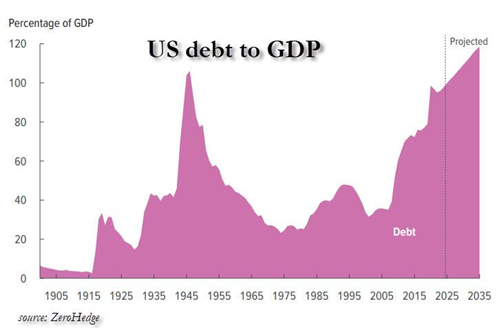

CBO Projects US Debt To Soar By $24 Trillion Over Next Decade, And Then It Gets Much Worse…

ZeroHedge, Jan 17, 2025 – Excerpts:

….According to the latest CBO budget and economic outlook for the decade 2025 to 2035 the situation is hopeless and getting worse, and even though the budget office doesn’t use those actual terms, it does get pretty close.

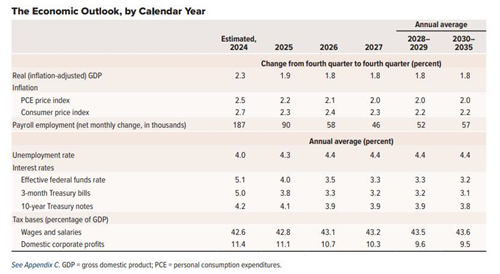

While the economic picture presented by the CBO is hardly shocking, if as ridiculous as always, with zero recessions expected over the coming decade when the CBO projects GDP growing at a 1.8% annual pace, with inflation magically flat at 2.0%, unemployment rate a sticky 4.4% and a 3.2% fed funds rate (translating into 3.8% 10Y yield)…

… it gets more exciting when looking at how all this growth is going to be funded. And the answer, of course, is through trillions more in unsustainable deficits, although according to the CBO these are perhaps sustainable since they never seem to end.

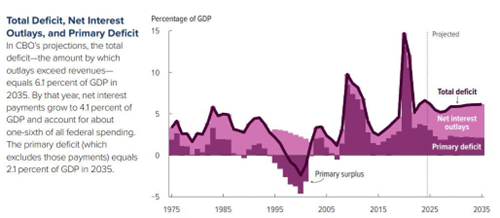

So starting with the deficit projection, the CBO expects a 2025 federal deficit of $1.9 trillion, a number which grows to $2.7 trillion by 2035. And while it amounts to 6.2% of GDP in 2025, and then drops to 5.2% by 2027 as revenues increase faster than outlays, this modestly beneficial trend quickly reverses and in later years, outlays once again increase faster than revenues, and by 2035, the deficit once again equals 6.1% of GDP, a number which according to the CBO is “significantly more than the 3.8 percent that deficits have averaged over the past 50 years.” It goes without saying that the actual deficit number will be far, far greater because even a modest recession will assure a surge in government spending (i.e., much more debt-funded deficit) which however will not result in faster growth.

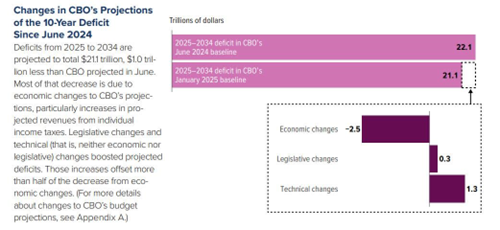

It gets better. In an attempt to entrap Trump, who will very [likely] extend the expiring TCJA, or Trump tax cuts, the CBO amusingly enough cuts its long-term deficit forecast by $1 billion, but not because of higher growth or anything like that, but because it forecasts “increases in projected revenues from individual income taxes” even as “legislative changes and technical (that is, neither economic nor legislative) changes boosted projected deficits.” As a result, the cumulative deficit from 2025-2034 is expected to decline by $1 trillion, from $22.1 trillion to $21.1 trillion.

That way, in one year when the Trump tax cuts are extended, the CBO will throw the book at trump and blame him when it once again revises its deficit forecast dramatically higher.

As for the real reason why the US deficit is about to go exponential has little to do with taxes, and everything to do with the stratospheric levels of US debt, or rather interest on that debt, we find that while things are more or less normal for the next 3 years, then they go vertical, to wit:

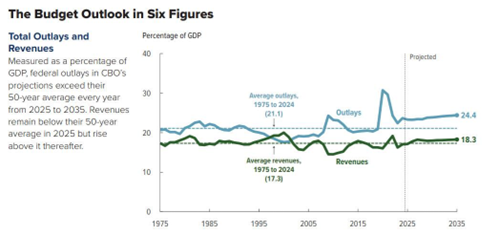

“Federal outlays in 2025 total $7.0 trillion, or 23.3 percent of GDP. They remain close to that level through 2028 and then rise, reaching 24.4 percent of GDP in 2035 (if adjusted to exclude the effects of shifts in the timing of certain payments). The main reasons for that increase are growth in spending for Social Security and Medicare and rising net interest costs.”

Unfortunately, there is no such hockeystick effect to US government revenues which total $5.2 trillion, or 17.1% of GDP, in 2025, then rise to 18.2% of GDP by 2027, which according to the CBO is “because of the scheduled expiration of provisions of the 2017 tax act”, which obviously will not expire and instead will be extended, meaning revenues will not increase and while the CBO knows this, it will instead wait for 6-12 months before letting the hammer fall in its next, far uglier forecast.

But even without the 2017 tax act, the CBO projects that revenues as a share of GDP will then decline over the next two years, falling to 17.9% in 2029, and flatline around 18.3% in 2035. In reality, this number will be far lower, perhaps around 15% if note worse, due to the extension of the Trump tax cuts which means that the next CBO forecast will be substantially worse than the current one.

Alas, this one is also a disaster, and one has to look no further than the CBO’s debt forecast to see that. That’s because while debt held by the public (which conveniently excludes debt used to fund Social Security), is currently at $28.2 trillion, this number nearly doubles by 2035, when it is expected to hit $52.1 trillion.

But wait, wouldn’t debt only increase as GDP also increased, with the relative ratio improving? Actually no, because as the infamous CBO “chart of doom” shows, as debt held by the public rises each year, it does so at a faster pace than GDP; in fact, from 2025 to 2035, debt/GDP swells from 100% to 118%, an amount which as the CBO admits, is “greater than at any point in the nation’s history.”

Now the reason why the CBO published a report that saw a modest improvement in the US fiscal picture over the next decade is not because the US fiscal picture is actually improving, but on the contrary, was to entrap Trump and republicans. As ABC notes, “the analysis paints a difficult picture for an incoming Republican administration bent on cutting taxes in ways that further widen deficits unless they’re also paired with major spending cuts.” Indeed, Trump’s proposed extension of his 2017 tax cuts that are set to expire after this year along with new cuts could easily exceed $4 trillion and his nominee to be treasury secretary, Scott Bessent, warned Thursday that the economy could crash without them.

“We do not have a revenue problem in the U.S.,” Bessent insisted at his confirmation hearings. “We have a spending problem.”

He’s right, but the even bigger problem is that cutting any spending, whether discretionary or mandatory, would lead to unprecedented economic devastation for a country that is used to issuing debt and spending it like a drunken sailor.

While tax revenues as a share of the total U.S. economy are close to the 50-year average, government spending is poised to continue growing, largely because of the unprecedented $1.2 trillion in gross interest expense, a number that will almost certainly never go down again, because even if interest rates do drop briefly, the total amount of debt will just keep rising, more than offsetting any rate decline. Meanwhile, discretionary spending on national security and social programs will account for $1.85 trillion next year. The CBO already has spending in these categories on a downward trajectory as discretionary spending would equal 5.3% of GDP, down from the half-century average of 7.9%.

CBO Director Phillip Swagel told reporters at a press conference Friday that net interest costs are a major contributor to the deficit and “in the coming years, net interest costs are projected to be similar to the amounts of discretionary spending for either defense or non-defense” programs.

And all of that is, of course assuming no recession and a demographic picture that remains unchanged; alas both assumptions are ludicrous….

Unfortunately for the US, it is now way too late to change the inevitable outcome of an existence that has been driven by exorbitant debt-funded spending. Indeed, when it comes to normalizing or “doing no fiscal harm” that ship has sailed, and as much as we would like for there to be some happy ending, we are terrified at what will happen when the brightest minds in the room admit that the Department of Government Efficiency (DOGE) has been a failure, and that nothing can prevent the inevitable US implosion.

More in the full CBO bidget forecast.

__________________________________

The Leviticus 25 Plan – the most powerful economic acceleration plan in the world.

…………………………………….

“He who will not apply new remedies must expect new evils.” – Sir Francis Bacon

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (24516 downloads )