The Federal Debt currently stands at $36.608 trillion, with continuing deficits hitting new records. Household Debt has reached $18.04 trillion. State and Local debt has breached the $2.122 trillion level.

America is drowning in debt.

The good news – there is a powerhouse solution to this mess: The Leviticus 25 Plan.

……………………………………

US deficit sets record with $1.1 trillion in first five months of fiscal year 2025

The new numbers, released Wednesday, showed the deficit between October 2024, and February 2025. The deficit for February alone was $307 billion.

By Misty Severi | JustTheNews.com | Published: March 12, 2025

The United States’ deficit increased by a record-breaking $1.1 trillion during the first five months of the current fiscal year, new data from the Treasury Department showed.

The new numbers, released Wednesday, showed the deficit between October 2024 and February 2025. The unadjusted increase saw a surge of $1.147 trillion, while the deficit for the same period in fiscal year 2024 was $828 billion. The deficit for February alone was $307 billion.

The deficit is largely driven by spending on interest, military programs, public benefits and security, according to the financial news outlet Barron’s. The largest spending costs came from interest paid on the public debt and higher tax credits.

A Treasury department spokesperson told CNBC that there has been limited impact from Elon Musk’s Department of Government Efficiency, which is attempting to reduce wasteful government spending. But the department’s operations have only been active for one month.

………………………………

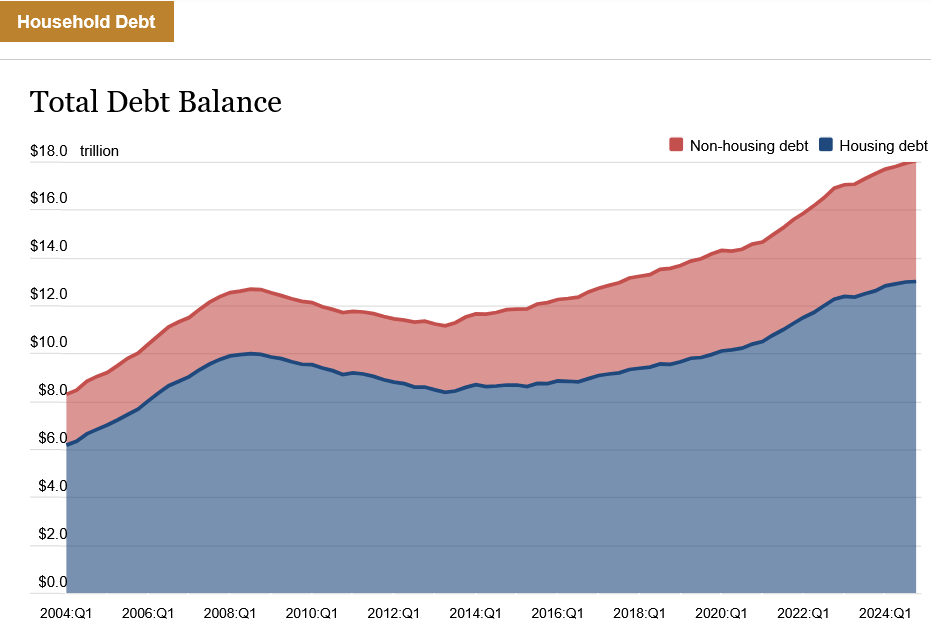

Meanwhile… Household Debt Hits $18.04 Trillion; Auto and Credit Card Delinquency Transition Rates Remain Elevated – NY Fed:

Total household debt increased by $93 billion to reach $18.04 trillion in the fourth quarter, according to the latest Quarterly Report on Household Debt and Credit. Aggregate delinquency rates ticked up 0.1 percentage point (ppt) from the previous quarter to 3.6 percent of outstanding debt in some stage of delinquency. Mortgage balances rose by $11 billion to stand at $12.61 trillion at the end of December. Transition into serious delinquency, defined as 90 or more days past due, remained stable for mortgages, but edged up for auto loans, credit cards, and HELOC balances. Auto loan balances saw an $11 billion increase to $1.66 trillion in the fourth quarter, while credit card balances increased by $45 billion from the previous quarter to reach $1.21 trillion at the end of December.

__________________________________

The Leviticus 25 plan is the one and only economically viable, politically feasible plan currently ‘on the table’ to reverse America’s colossal (and growing) debt dilemma – and get the U.S. back on solid financial ground.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (25891 downloads )