Thank you Hank Paulson, Tim

Geithner, and Ben Bernanke – from the bottom of Warren Buffett’s heart…

The U.S. government responded to critical liquidity shortages within Wall Street’s financial sector and a crumbling U.S. economy during the 2008-09 financial crisis, by funnelling trillions of dollars in direct cash transfers, emergency loans, credit guarantees, and balance-sheet-clearing toxic mortgage debt purchases – to many of America’s premier financial corporations.

Billionaire Warren Buffett lobbied hard for the massive bailouts…. and with good reason. At least eight of these companies receiving billions of dollars of taxpayer bailouts were owned by Mr. Buffett’s Berkshire Hathaway.

Buffett’s Betrayal: Rolfe Winkler | Reuters / Aug 4, 2009 – Excerpts:

A good chunk of his [Warren Buffett’s] fortune is dependent on taxpayer largess. Were it not for government bailouts, for which Buffett lobbied hard, many of his company’s stock holdings would have been wiped out.

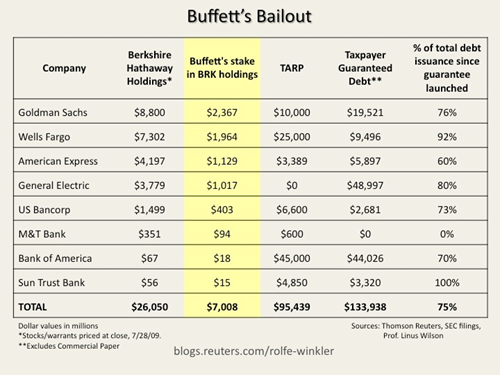

Berkshire Hathaway, in which Buffett owns 27 percent, according to a recent proxy filing, has more than $26 billion invested in eight financial companies that have received bailout money. The TARP at one point had nearly $100 billion invested in these companies and, according to new data released by Thomson Reuters, FDIC backs more than $130 billion of their debt.

To put that in perspective, 75 percent of the debt these companies have issued since late November has come with a federal guarantee.

Without FDIC’s debt guarantee program, even impregnable Goldman would have collapsed.

And this excludes the emergency, opaque lending facilities from the Federal Reserve that also helped rescue the big banks. Without all these bailouts, the financial system would have been forced to recapitalize itself.

Banks that couldn’t finance their balance sheets would have sold toxic assets at market prices, and the losses would have wiped out their shareholder’s equity. With $7 billion at stake, Buffett is one of the biggest of these shareholders.

…………………………………………………………………………………

Meanwhile, back at the ranch in 2015… the country’s second richest man was back, ‘sticking it to’ the very people whose billions of dollars bailed him out seven short years ago – U.S. taxpayers.

Warren Buffett, Slumlord – Predatory Loans, Kickbacks & Preying On The Poor

ZeroHedge, Apr 6, 2015 – Excerpts:

Buffett’s mobile-home empire promises low-income Americans the dream of homeownership. But Clayton [controlled by America’s second richest man, billionaire Warren Buffet], relied on predatory sales practices, exorbitant fees, and interest rates that can exceed 15 percent, trapping many buyers in loans they can’t afford and in homes that are almost impossible to sell or refinance, an investigation by The Seattle Times and Center for Public Integrity has found.

_____________________________________

America does not need ‘wealth redistribution,’ as many socialist-minded politicians are demanding.

We do need, and deserve, equal access to liquidity

U.S. citizens deserve nothing less than to be granted the same direct access to liquidity that was so generously provided by the U.S. Federal Reserve to Wall Street’s wealthy elites during financial crisis years, 2007 – 2012.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$75,000 per U.S. citizen – Leviticus 25 Plan 2020 (3277 downloads)