Note – Our ‘thumb-twiddlers’ in the U.S. Congress have created this ‘monster,’ and are apparently oblivious to the idea that there may be a better, cleaner, and more direct way, for citizens to benefit from government allocations ostensibly made on their behalf….

…………………………………………………..

20 Largest U.S. Federal Agencies Admit to $2.3 trillion in Improper Payments Since 2004

Forbes, Dec 3, 2020 – Openthebooks.com – Excerpts:

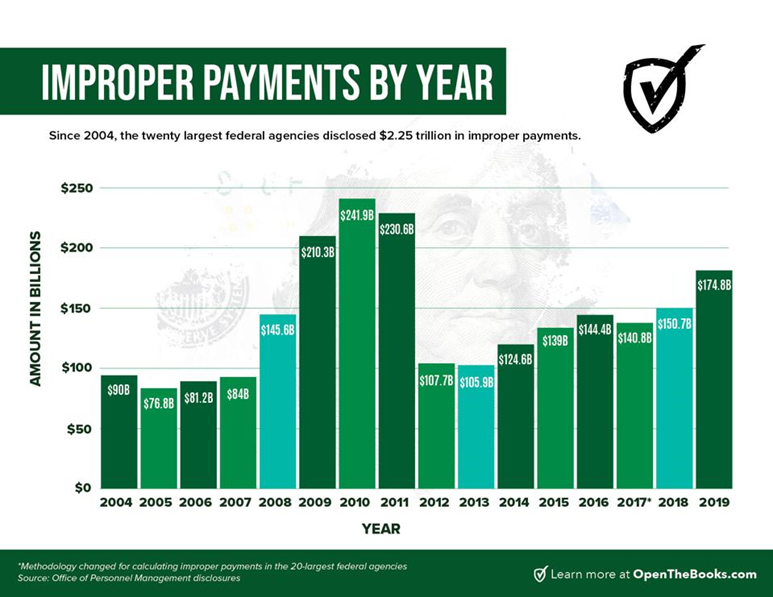

Since 2004, twenty large federal agencies have admitted to disbursing an astonishing $2.25 trillion in improper payments.

Last year, these improper payments totaled $175 billion – that’s about $15 billion per month, $500 million per day, and $1 million a minute.

But what exactly is an improper payment?

Federal law defines the term as “payments made by the government to the wrong person, in the wrong amount, or for the wrong reason.”

When people or companies receive incorrect payments, it erodes trust and hinders the government’s ability to finance everything from defense to health care.

Recently, our auditors at OpenTheBooks.com published a 24-page oversight report analyzing why, how, and where federal agencies wasted our tax dollars last year.

Here are the top 10 takeaways regarding improper and mistaken payments by the 20 largest federal agencies in 2019:

1. Total Mistakes: $175 billion in estimated improper payments reported by the 20 largest federal agencies, averaging $14.6 billion per month – Total (FY2004-FY2019): $2.25 trillion

2. Worst Programs – $121 billion (approximately 69 percent) in improper payments occurred within three program areas – Medicaid, Medicare, and Earned Income Tax Credit.

3. Claw Back – only $21.1 billion of the $175 billion improper payments during 2019 was recaptured — that’s only 14 cents on every dollar misspent. Five-year total: $103.6 billion recaptured/ $747.7 billion improperly spent

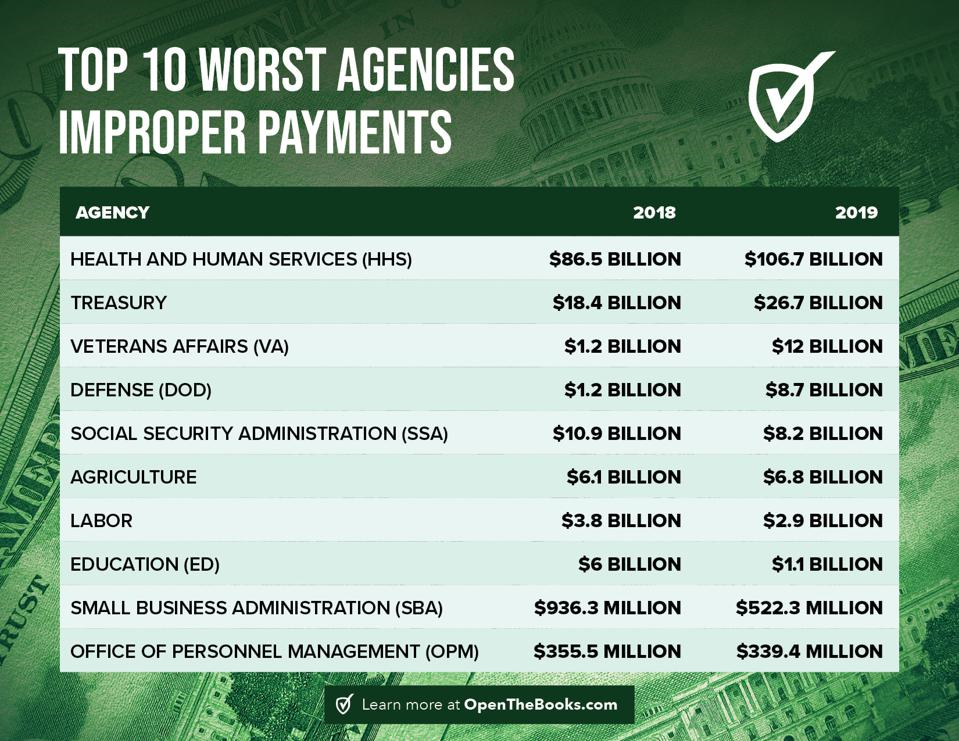

4. Biggest Offenders:

Top agencies admitting to billions of dollars worth of improperly paid bills in FY2018 and FY2019.

5. Dead people: $871.9 million in mistaken payments were made to dead people. Medicaid, social security payments, federal retirement annuity payouts (pensions), and even farm subsidies were sent to dead recipients. Root cause: failure to verify death. Four-year total: $2.8 billion.

6. Ancient Americans: Six million Social Security numbers are active for people aged 112+; however, only 40 people in the world are known to be older than 112 years of age.

7. Worst Upward Trend: Medicaid and Medicare improper payments soared from $64 billion (2012) to $88.6 billion (2017), and, in 2019, to $103.6 billion. Five-year total: $456 billion

8. Best Turnaround: In 2018, the Education Department overpaid $6 billion to college students receiving PELL grants and student loans. In 2019, improper payments were reduced to $1.1 billion – an 85-percent reduction.

9. Improper Income Redistribution: $17.4 billion in improper payments by the Internal Revenue Service (IRS) within the Earned Income Tax Credit program. 25-percent of all payments were improper. Five-year total: $84.35 billion

10. Purchasing Power: What can $175 billion buy? Last year, the federal government wasted the equivalent of a full year of all federal salaries, perks, and pension benefits for every employee of the federal executive agencies. A stunning example of institutionalized incompetence.

_______________________________________

The Leviticus 25 Plan would eliminate billions of dollars in claims and disbursements from Medicare and Medicaid, and eliminate millions of people from the Earned Income Tax Credit pool.

The Leviticus 25 Plan would empower citizens to allocate resources directly for a majority of the things that are now being run through government programs.

This would clean this travesty up in a big way.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3720 downloads)