Governments love to ‘grow’ their social welfare entitlement programs. Europe is a prime example, and America is hot on their tail…

………………………………………………………………

WSJ: The Entitlements of U.S. Decline

Biden says his plans will make America great again. Ask Europe how that has turned out.

Oct 6, 2021 | Excerpts:

… Europe’s little-discussed secret is that its cradle-to-grave welfare states are financed by the middle class via value-added and payroll taxes. The combined employer-employee social security tax rate is 36% in Spain, 40% in Italy and 65% in France. Value-added taxes in most European economies are around 20%. There simply aren’t enough rich to finance their entitlements.

Democrats in Washington know this, which is why they are resorting to budget gimmicks to disguise $5 trillion in spending into the 10-year budget window. They plan to pay for a few years of spending with 10 years of tax increases on businesses and affluent individuals, but this still only gets them $2.1 trillion in estimated new revenue.

Europe’s vast entitlements also mean less money for security and the military. Only nine or so European countries meet their NATO pledge to spend 2% or more of GDP on defense, and only Greece spends more than 3% as the U.S. does. Germany spends a paltry 1.56%.

The U.S. was able to defeat the Soviet empire in the 1980s because a booming economy spun off enough revenue to rebuild the military. Mr. Biden is proposing to shrink defense in real terms, and his welfare-spending wedge will grow rapidly. There will be no Reagan-like military buildup as China rises.

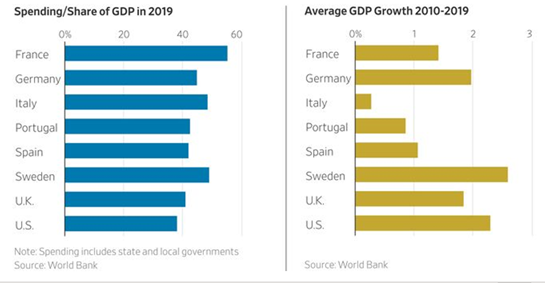

The irony is that some European governments have tried to reform their tax and welfare systems to become more competitive. Germany and Sweden over two decades reformed their welfare and labor policies. Their labor participation and GDP growth have exceeded the rest of Europe’s. Germany’s labor participation rose to 61.3% in 2019 from 58.1% in 2000.

During the 1970s and 80s, Sweden’s tax burden rose to the world’s highest as its welfare system became much more generous. The result: Swedes’ after-tax real incomes stagnated while government debt ballooned. From 1976 to 1995, GDP growth in Sweden was about half the average of developed countries and a third lower than Europe’s large economies.

Sweden’s decline prompted tax and spending reforms in the early 1990s that increased labor productivity, private job growth and incomes. The rate of disposable income growth increased four-fold from 1996 to 2011. Sweden’s average GDP growth from 2010 to 2019 (2.6%) has far surpassed that of most European countries.

___________________________________

America’s current economic trajectory, according to the GAO, is “unsustainable.”

America needs a plan that will shrink the size of government, shrink entitlement spending, re-incentivize work and productivity, eliminate ground-level debt, generate annual state and federal budget surpluses, and restore financial security for hard-working, tax-paying, God-fearing American families.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. Citizen – Leviticus 25 Plan 2022 (3873 downloads)