Certainly one of the primary reasons the Fed has been in full scale ‘rate-hike mode’ in recent months has been to jack rates up to a high enough, attractive enough level, to create strong demand for government debt at the monthly Treasury auctions.

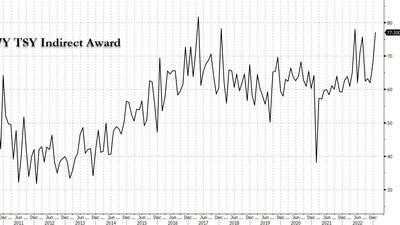

The Fed has stopped buying Treasuries (through back door Primary Dealer channels) and is now actually selling Treasuries from their portfolio – to shrink their balance sheet (announced months ago with their QT initiative). So, somebody (indirect bidders) would be needed to pick up the slack and ‘buy government paper.’

Robust private sector demand would therein be critical for allowing Treasury auctions to proceed in an orderly fashion, ‘allowing’ big government, specifically the Executive branch and its various agencies and the U.S. Congress, to continue happily digging America ever deeper into debt.

So far, so good:

ZeroHedge: Staggering Demand For 7Y Paper Delivers Third Monster Treasury Auction In A Row

A stellar 3Y auction on Tuesday, a record-breaking 5Y auction yesterday and moments ago: a blowout 7Y auction completes a sequence of three monster auctions which have seen an absolute flood of demand mostly by foreign buyers. JAN 26, 2023

____________________________________

The looming problem: higher net interest costs are now getting ‘baked in’ to our ever-ballooning federal budget deficits, which will inevitably lead into a period of U.S. Dollar instability, chaos in the foreign exchange markets and complete disorder in the credit markets.

There is a solution, a powerhouse economic initiative, to solve America’s debt crisis and keep America’s financial affairs in good order. Re-targeting liquidity flows key to a dynamic resolution of this crisis.

It is now time to grant U.S. citizens with the same direct access to liquidity extensions that was so generously extended, through various credit facilities, to scores of ‘too big to fail’ financial institutions during the great financial crisis of 2007-2010, including the likes of: Morgan Stanley, JP Morgan, Goldman Sachs, Citigroup, Bank of America, Wells Fargo, State Street, Deutsche Bank, RBS, Barclays, UBS AG, BNP Paribas, and multiple others…

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (5689 downloads)