Clerk of the United States House of Representatives – Roll Call vote H.R. 7024 (see how your Representative(s) voted): https://clerk.house.gov/Votes/202430?RollCallNum=30&BillNum=H.R.7024

………………………………………..

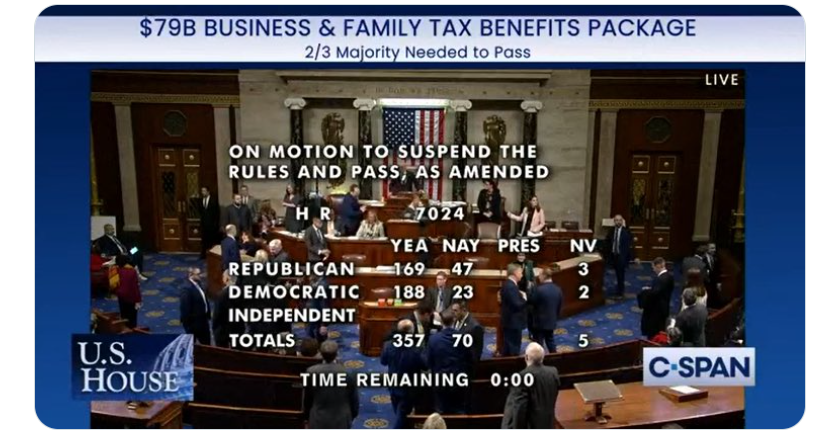

169 Republicans Vote to Expand Welfare, Bill Heads to Senate January 31, 2024 – Excerpts:

169 Republicans joined 188 Democrats to expand welfare. There were only 47 no votes from Republicans.

More Welfare

.@RepThomasMassie on the welfare tax bill: “There’s something in this bill called ‘tax credits,’ but they’re also called ‘refundable.’ So what is a refundable tax credit?

It’s welfare by a different name. We are going to give cash payments, checks to people who don’t even pay… pic.twitter.com/lZGZYImGus | — Rep. Matt Gaetz (@RepMattGaetz) January 31, 2024

“There’s something in this bill called ‘tax credits,’ but they’re also called ‘refundable.’ So what is a refundable tax credit? It’s welfare by a different name. We are going to give cash payments, checks to people who don’t even pay taxes. The hard-working constituents that I represent in Kentucky are tired of getting up at 6am, driving an hour or two to work, working their hind ends off to watch their neighbors collect these checks, of which there will be more of after this bill. It’s just wrong.”…

Where Socialism Works

“SOCIALISM ONLY WORKS TWO PLACES — HEAVEN

WHERE THEY DON’T NEED IT — AND HELL WHERE THEY ALREADY HAVE IT” ~RONALD REAGAN

The Wall Street Journal comments on The GOP’s Spending Boost for Biden

Mind Boggling Support – Social Security and Medicare spending climbed 12% to 13% in the first three months of this fiscal year compared to last. Sweetened subsidies are boosting ObamaCare enrollment. Growing entitlement spending is one reason that government, healthcare and social assistance accounted for more than half of the net new jobs in December, according to the Bureau of Labor Statistics.

The deficit would be even larger if not for the Internal Revenue Service holding back a wave of more stimulus. The agency in September paused processing new claims for the Covid-era Employee Retention Credit owing to concerns over abuse and fraud. By one estimate, the IRS has a $244 billion backlog of claims, which will flood the economy when the IRS processes them.

All of this spending contributes to GDP, at least in the short term. But much of this isn’t productive growth that will improve living standards in the long term, and the bills for all this spending will probably be paid in higher taxes.

That’s why it’s mind-boggling that House Republicans want to help Democrats throw another deficit party … tax credit and extend some business tax breaks through 2025.

Democrats have signed on because they view the child-credit provisions as a down payment on a guaranteed annual income and want to boost flagging business investment this year. The political mystery is why Republicans want to add their signature. The tax bill negotiated by Democrat Ron Wyden and GOP Rep. Jason Smith is another in-kind contribution to the Democratic re-election campaign.

The legislation now heads to the Senate. If the Senate Republicans hoist another surrender flag, Biden would sign the bill.

But it takes 60 votes in the Senate. That’s not a given.

Senators are haggling over spending and immigration legislation. They are scheduled to be on recess for two weeks starting Feb. 12, and aides don’t expect lawmakers to consider the tax bill before then.

“I’m certainly not just willing to let the House pass something and then say, ‘Oh well, we’ll just take that,’” said Sen. John Cornyn (R., Texas), who said he doesn’t feel any urgency to advance the bill. “The price we’re having to pay is pretty outrageous.”

The price is not pretty outrageous, it’s very outrageous.

Question of the Day – Of what possible use are Republicans when the majority vote like Democrats?…

In case you haven’t figured this out, it’s highly inflationary.

…………………………………………………….

Note: According to the Wall Street Journal, Jan 17, 2024, “The overall deal would cover the 2023, 2024 and 2025 tax years and cost roughly $78 billion.”

_______________________________

Main Street America Republicans have a powerful alternative plan.

This Plan will lift working Americans up out of poverty and reduce dependence on government. It will revive a macro economic environment in America where federal, state and local governments will be able to cut taxes for families and small businesses, rather than continually dipping into the budget-busting tax credits ‘cookie jar.’

This Plan will reduce entitlement spending, restore financial security for America’s hard-working, tax-paying U.S. citizens, and, most importantly, generate $112.6 billion federal budget surpluses annually (2025-2029).

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (11487 downloads )