A Record $1.2 Trillion Interest Payments Are Blowing Up The Federal Budget

By Diccon Hyatt | Investopedia | Published September 13, 2024

Excerpts:

Key Takeaways

- The U.S. government will spend a record $1.2 trillion on interest payments in 2024, the highest amount ever recorded.

- Interest payments are driven by a combination of deficit spending, especially during the pandemic, and the Federal Reserve’s campaign of anti-inflation interest rate hikes.

- The trajectory of the deficit could be influenced by the election.

- While both Democrats and Republicans propose new tax cuts and spending that could push up the deficit, Vice President Kamala Harris has proposed tax increases on the wealthy and corporations, to offset them.

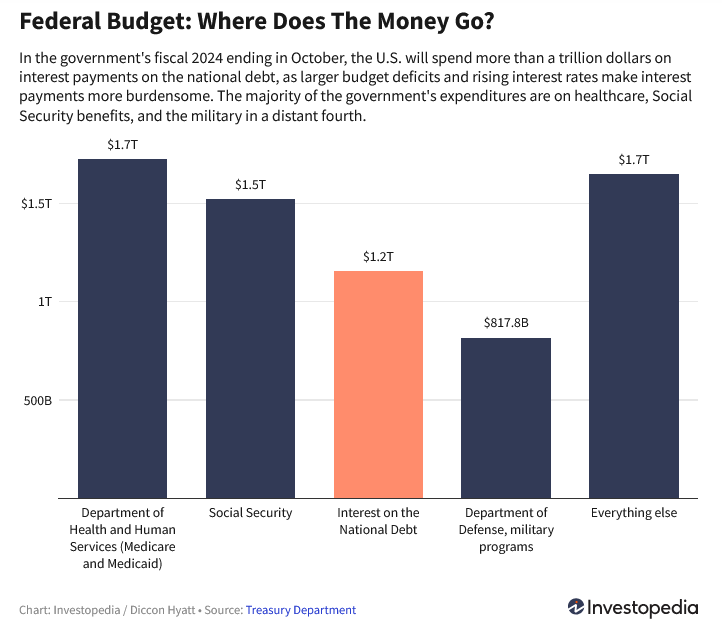

The U.S. government is on track to spend more than $1 trillion on interest payments this year, surpassing military spending for the first time in history.

Interest payments on the national debt (held by the public in the form of Treasury securities) will cost the government $1.2 trillion in the government’s fiscal year ending in October, the Treasury Department said in a monthly report on the budget.1 Net interest outlays are the third costliest item in the budget behind Social Security and Medicare benefits.

Economists have grown increasingly concerned about the potential impact of those payments on the U.S. economy. Interest payments took up 2.4% of the entire U.S. gross domestic product in 2023, and The Congressional Budget Office estimates that could swell to 3.9% over the next 10 years.

Why Is The Government Paying So Much Interest? Two major factors have driven those payments skyward. First, the government spent trillions to support households and the economy during the pandemic, paying for it by borrowing rather than raising taxes. Second, the Federal Reserve raised interest rates starting in 2022 to fight inflation, which pushed up how much the government owes for that debt.

____________________________________

America’s billowing federal debt is a dire national security threat.

There is only one plan on the table with the power to reign in America’s ever-expanding debt and generate annual federal budget surpluses.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (21326 downloads )