ZeroHedge, Oct 22, 2024 – Excerpts:

The International Monetary Fund lowered its global growth forecast for next year and warned of accelerating risks from surging debt, to global wars to trade protectionism, even as it credited central banks for taming inflation without sending nations into recession.

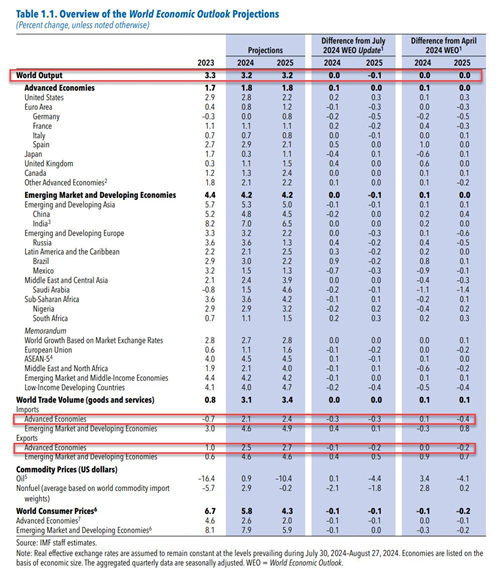

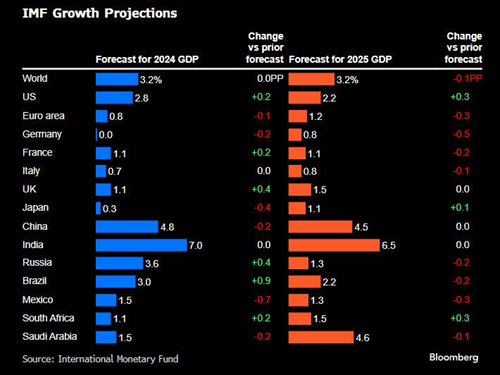

In its World Economic Outlook report published on Tuesday morning, the IMF forecast global output will expand 3.2%, 0.1 percentage point slower than a July estimate It left the projection for this year unchanged at 3.2%.

In terms of next year’s outlook, the IMF forecast for the euro area was downgraded to 1.2%, 0.3% lower than in July, due to persistent weakness in manufacturing in Germany and Italy. On the other end, the US forecast for 2024 and 2025 was upgraded to 2.8% and 2.2%, up by 0.2% and 0.3% respectively, due to stronger consumption, but really because of the endless Biden-admin stimulus in the form of a wartime-level budget deficit which is now at 6% of GDP, and which has led to an exponential surge in US debt issuance.

The projection for Mexico was cut for this year by the most among major economies, as well as for next year, based on the impact of monetary policy tightening. China’s growth outlook for this year was cut to 4.8% from 5% previously on weakness in the real estate sector and low consumer confidence, with the 2025 forecast maintained at 4.5%….

“The risks are building up to the downside, and there is a growing uncertainty in the global economy,” Chief Economist Pierre-Olivier Gourinchas said in a briefing. “There is geopolitical risk, with the potential for escalation of regional conflicts,” that could affect commodity markets, he said. “There is a rise of protectionism, protectionist policies, disruptions in trade that could also affect global activity.”

Bloomberg also notes that while the IMF forecast doesn’t explicitly mention the US election, the November 5 main event looms over annual meetings that will see finance ministers and central bankers from almost 200 nations gather at the IMF and World Bank headquarters in Washington, just three blocks from the White House. Bloomberg recently found that Donald Trump’s vow to impose 60% tariffs on imports from China and 10% duties on those from the rest of the world would likely spur inflation and pressure the Federal Reserve to raise interest rates. The analysis also completely ignored that Trump may simply be using the threat of tariffs as a negotiating tactic meant to spark more beneficial terms of trade.

The global growth forecast comes one week after the IMF flagged its mounting concern about global public debt, which is expects to reach $100 trillion, or 93% of world gross domestic product, by the end of this year. The surge is driven by the US and China, of course….

____________________________________

The United States has a perfect opportunity to lead the world out of this debt-driven black hole…

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (21752 downloads )