The Leviticus 25 Plan offers a perfect complement to a coming “regulatory change” in the Supplemental Leverage Ratio (SLR) for banks.

The massive private sector debt reduction generated under The Leviticus 25 Plan would lead to enormous cash inflows for banks. Regulatory change in the SLR would then allow banks greater access to the Treasury market. This dynamic would increase demand for Treasury’s, thereby stabilizing the Treasury market and the U.S. Dollar, and significantly pull down interest rates.

The Leviticus 25 Plan – the most powerful decentralizing economic acceleration plan in the world. There is no other competing plan anywhere in sight.

…………………………………………

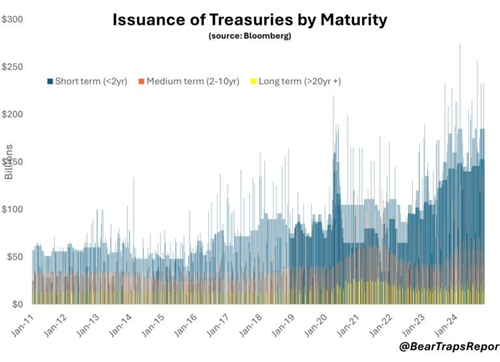

Treasury’s Reliance on Short-Term Debt Exploded in Recent Years

The Bear Traps Report, Dec 20, 2024 – Excerpts:

….We are witnessing a Covid era like spending in 2024 without a pandemic. The Treasury Department has come to rely on short-term bills to fund the government. But with $36Tr of debt, the Treasury has to issue bills almost every day to keep funding the government and to refund maturing debt.

- *CBO data, Bloomberg. The average weighted coupon on the U.S. debt load is about 2.7% vs. over 4.5% for 10-year U.S. Treasuries. As bonds mature, they get refinanced at much higher yields.

$10Tr of Debt Refinancing Next Year – In 2024 Treasury faced around $10Tr of maturing debt. To refinance this debt, it issued a whopping $26Tr of bills and bonds. More than 84% of that paper was short-term bills with a maturity of 6 months or less. Treasury keeps re-issuing bills with a maturity of 4 to 8 weeks or 3,4 to 6 months, which are the most popular maturities in a continuing, ever-increasing roll down of the debt, day after day, month after month.

ALERT – By issuing nearly a colossal load of extremely short-term bills, Janet Yellen succeeded in suppressing bond volatility in an election year and, in our view, strategically placing that bond market volatility into 2025 after the election. You can “why” see above, she wanted LESS long-term paper in circulation markets in the election year.

Now, in 2025 – this paper has to be rolled over and termed out into longer-dated bonds. The USA is behaving like a financially trapped emerging market country. Living on the “front-end” of the yield curve is a VERY dangerous game.

Never, ever forget that 6% today is equivalent to the destructive capacity of 10% twenty years ago. Interest rates up, mean bond prices down. A 1% move in interest rates higher today is an entirely different, far more lethal equation.

Incoming Stress Points – In 2025 the U.S. Treasury faces $9.6Tr of maturities in their so-called publicly held debt. In Q1 alone — the government faces $5.58Tr of maturities (bonds coming due, redemption), but 86% of those are short-term bills that the Treasury department rolls over into new 4-week, 8-week, 3,4, or 6-month bills, among others.

As a result, almost daily bill auctions are coming to a theater near you, as the Treasury Department mindlessly keeps pushing new paper into the market to pay back the colossal amount of maturing debt.

…..

One big bullish catalyst for treasuries would be a regulatory change to exempt treasuries from the Supplemental Leverage Ratio (SLR). It is unclear if and when this would be implemented, although Bessent was hinting at regulatory relief for banks to boost banks’ treasury holdings. Exempting treasuries allows banks to hold more Treasuries on their balance sheets without needing to hold additional capital against them, freeing up the capacity for banks to participate more actively in the Treasury market. Its unclear how much treasury demand that would create, but in 2021, when the temporary SLR exemption was reinstated after COVID, prime dealers reduced their Treasury holdings from $250bl to $125bl in 2 months. A change in the SLR ratio may come but is going to take months before the rules are changed. A phase-out of QT for treasuries would be a more immediate, albeit more modest, relief for the bond market. According to this timeline, the Fed will end up buying $100bl of treasuries in 2025, a big change from the $500bl of treasury sales in 2024.

_______________________________________

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (24703 downloads )