Massive debt equals massive debt service obligations, and over the long run – U.S. citizens lose.

It is time for a new plan…

……………………………….

| The Federal Reserve Has Never Printed ‘Money’: Part II

Seeking Alpha, October 19, 2017 – By Eric Basmajian Excerpts: |

|

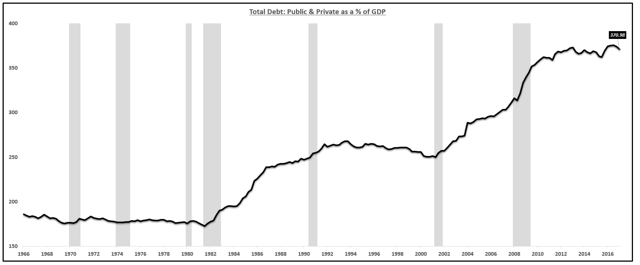

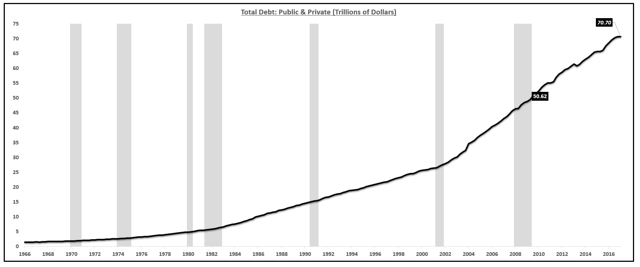

The debt of the four critical non-financial sectors (Federal, State & Local, Corporate, Household) has increased to an aggregate of $70 trillion, or 370% of GDP. |

Source: Federal Reserve, Bank For International Settlements, US Treasury

Total Public & Private Debt (Trillions) (Excluding “Off-Balance Sheet” Items):

Source: Federal Reserve, Bank For International Settlements, US Treasury

The data is very clear that we, as an economy, are massively more indebted than any point during the last recession. As a system, there is $20 trillion more of debt. To put that into perspective, if that debt had an average interest rate of just 2%, that means the economy would be paying an additional $400 billion a year just to service that debt. That is nearly 50% of last year’s total increase in gross domestic product.

As debt levels increase, it takes a greater and greater percentage of the national income to service that debt, causing the saving rate to fall and causing a lower percentage of income to be invested into long-term cash-flow-producing goods and services.

The Federal Reserve, with their zero interest rate policy for an unprecedented length of time, was the primary driver behind this massive debt increase.

[snip]

Economist Lacy Hunt estimates that over the next year, of the current $70 trillion of total debt (Federal, State & Local, Corporate, Household), around 28% or $20 trillion dollars worth will have to be repriced to current interest rates. This is a combination of short-term debt that was taken out 1-2 years ago, as well as longer-term 5-year paper that was taken out in 2013 when interest rates made a short-term low of around 0.70% on the 5-year Treasury.

Using Lacy Hunt’s estimate, $20 trillion that needs to be repriced at an average interest rate that is 80 basis points higher translates to 160 billion of additional annual interest expense.

[snip]

A $160 billion hit to an average $600 billion GDP increase equates to a 25% reduction in growth. Growth has averaged 2.1% over the past 7 years so all else equal, we are looking at growth in the next two years to drop to around 1.6% simply due to an increase in debt expense.

This does not even take into consideration the decrease in disposable personal income growth, the decrease in the savings rate, or the increased rate of monetary tightening from the Federal Reserve, which is designed to stunt inflation and growth.

____________________

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan 2018 – $75,000 per U.S. citizen

The Leviticus 25 Plan 2018 (2552)