World Bank Warns “Wave Of Debt” Could Unleash Historic Crisis, Crush The Global Economy

ZeroHedge, 12-22-10 – Excerpts:

In a report titled “Global Waves of Debt”, the world bank looked at the four major episodes of debt increases that have occurred in more than 100 countries since 1970 — the Latin American debt crisis of the 1980s, the Asian financial crisis of the late 1990s and the global financial crisis from 2007 to 2009.

While not finding anything the IIF didn’t already point out last month, the bank said during the fourth wave, from 2010 to 2018, the debt to GDP ratio of developing countries has risen by more than half to 168%: that was a faster increase on an annual basis than during the Latin American debt crisis.

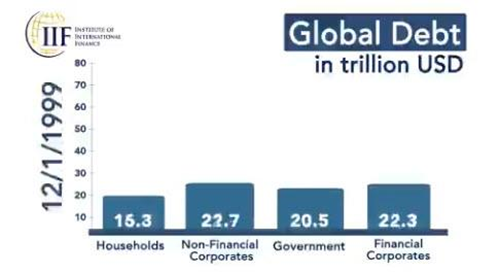

And, as the IIF found previously, the rise in debt has been across both private companies and governments across the world, amplifying the risks if there is another global financial crisis. As a reminder, this is what global debt looked like 20 years ago….

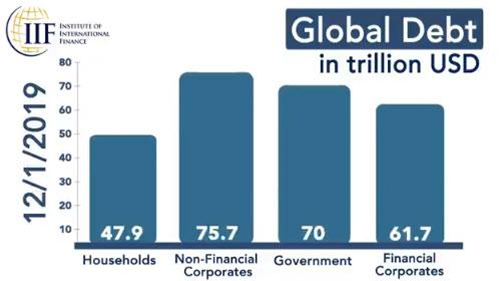

… and what it looks like today:

Something else the World Bank found that we already know: debt growth in the past decade was mostly concentrated in China which accounted for the bulk of the increase, with its debt-to-GDP ratio rising by nearly three-quarters to 255% since 2010, now totaling more than $20 trillion.

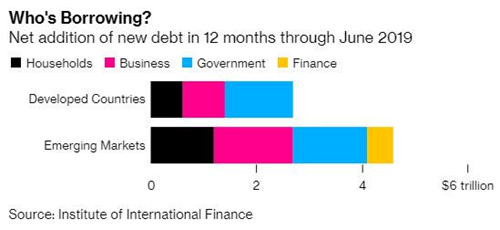

Of course, it’s not just China, as most emerging economies saw their debt rise over the eight years, and especially in the past 12 months.

With common knowledge out of the way, the World Bank report said the latest wave of debt was more challenging than the previous three waves because of the build up of both private and public debt, new types of creditors including foreign investors and the big rise in borrowing, which was global and not limited to one or two regions. Poorer countries have also increasingly borrowed from non-traditional lenders such as China, which offer less favorable loan conditions, including higher interest rates and requiring stakes in projects as collateral, according to ABC .

[snip]

“The size, speed, and breadth of the latest debt wave should concern us all”, the report noted.

The irony, is that even in its warning, the World Bank failed to isolate the root of the problem: the report said low interest rates globally reduced the risk of a crisis for the time being, which is true; it is also the main factor enabling governments around the world to issue another wave of debt layering even more debt upon debt, and prompting Bloomberg articles explaining how only more debt can “solve a debt crisis.“

World Bank’s vice president for equitable growth, finance and institutions Ceyla Pazarbasioglu said the dangers were building up.

“History shows that large debt surges often coincide with financial crises in developing countries, at great cost to the population,” she said.

The report focused on total developed nation debt, which remained near the record levels reached in the aftermath of the global financial crisis, at around 265% of GDP in 2018, or $US130 trillion: “While government debt has risen, to a high of 104 per cent of GDP ($US50 trillion), private sector debt has fallen slightly amid deleveraging in some sectors. Total debt has fallen since 2010 in two-fifths of advanced economies,” the report said.

Of course, none of this is new: the World Bank and the IMF – which on one hand have been enabling the world’s rush into more debt – have paradoxically also been warning for some years about the build up of global debt since the GFC.

Amusingly, according to some analysts, the World Bank report “has upped the pressure on governments to prevent another debt crisis” as it found that of 519 cases of debt surges in 100 emerging and developing countries since 1970 roughly half ended in financial crises.

______________________________________

The Federal Reserve, along with other major Central Banks, have been forced into ‘ratcheting down’ interest rates to prevent a global economic implosion (from snowballing interest expense burdens). And they have been pumping liquidity into the banking system, and through various mechanisms (Interest on Excess Reserves and Primary Dealer “Repo” transaction fees), flushing high profile banks with billions of of ‘free money.’

The results have been abysmal. Global debt is surging. Global economies are fragile. Long-term prospects for financial security and economic liberty are being squandered away.

It is time to activate the world’s most powerful economic acceleration plan.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$75,000 per U.S. citizen – Leviticus 25 Plan 2020 (3495 downloads)