Corporate Finance Institute: The 2008 Financial Crisis

Before the financial crisis of 2008, there was more money invested in credit default swaps than in other pools. The value of credit default swaps stood at $45 trillion compared to $22 trillion invested in the stock market, $7.1 trillion in mortgages and $4.4 trillion in U.S. Treasuries. In mid-2010, the value of outstanding CDS was $26.3 trillion.

Many investment banks were involved, but the biggest casualty was Lehman Brothers investment bank, which owed $600 billion in debt, out of which $400 billion was covered by CDS. The bank’s insurer, American Insurance Group, lacked sufficient funds to clear the debt, and the Federal Reserve of the United States needed to intervene to bail it out.

……………………………………..

The “Many investment banks” noted above received hundreds of billions of dollars through the Fed’s ‘Secret Security Lifelines,’ to include: Morgan Stanley, Citi, Goldman Sachs, JP Morgan, Bank of America, Merrill Lynch, Credit Suisse, Deutsche Bank, HSBC, Société Générale, RBS, Barclays, BNP Paribas, UBS, and many others.

An important review…

As the banking crisis intensified in the Fall of 2008, with major banking institutions assuming, or on the verge of assuming, the classical ‘snorkel’ position (‘underwater’ status), the Federal Reserve ran quickly to the rescue with ‘secret liquidity lifelines” (Bloomberg Uncovers the Fed’s Secret Liquidity Lifelines … 8-22-11).

The Fed substantially eased some important collateral rules for banks, “meaning that banks that could once borrow only against sound collateral, like Treasury bills or AAA-rated corporate bonds, could now borrow against pretty much anything – including some of the mortgage-backed sewage that got us into this mess in the first place…. ‘All of a sudden, banks were allowed to post absolute [expletive deleted] to the Fed’s balance sheet,’ [according to] the manager of the prominent hedge fund.” (Source: Bailout Hustle, Matt Taibbi).

The Federal Reserve invented the following credit “facilities” to fire-hose liquidity out to major banks and brokerage firms:

Primary Dealer’s Credit Facility

Term Securities Lending Facility

Temporary Liquidity Guarantee Program

Commercial Paper Funding Facility

Term Auction Facility

Public/Private Investment Program

And, here we go – from the top: Bloomberg – November 2011

Top recipient – Morgan Stanley

“Morgan Stanley, facing a crisis of confidence after the fall of Lehman Brothers Holdings Inc., got a $9 billion injection from Japanese bank Mitsubishi UFJ Financial Group Inc. and agreed to take a $10 billion bailout from the U.S. Treasury to shore up capital. As hedge-fund customers pulled funds out of the New York-based firm, it plugged the hole with $107.3 billion of secret loans from the Federal Reserve’s Primary Dealer Credit Facility and Term Securities Lending Facility, set up earlier in the year to supply brokerage firms with emergency financing.”

Peak amount of Debt on 9/29/2008: $107B

And now ‘Round 2’, another CDS default bonanza, is looking increasingly likely…

……………………………………………………………………

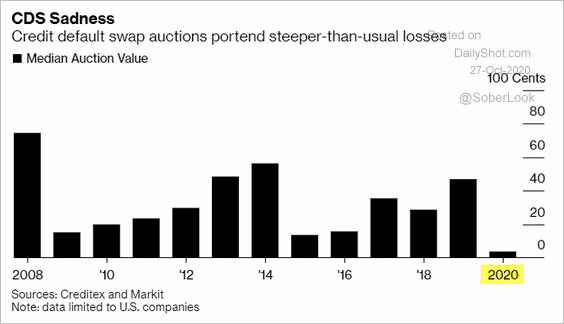

The Daily Shot, October 27, 2020 – Credit: CDS auction recoveries (defaulted debt) have been extremely low this year, dominated by leveraged retailers with broken business models. Cov-lite debt structures exacerbated the losses.

_______________________________________

America needs a plan that re-targets Fed liquidity infusions to flow directly to U.S. citizens.

NOT the global banking confederation and Wall Street’s Financial Sector.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2021 (3858 downloads)