“In this present crisis, government is not the solution to our problem, government IS the problem. It isn’t so much that liberals are ignorant, it’s just that they know so much that isn’t so.” – Ronald Reagan

…………………………………………………………………..

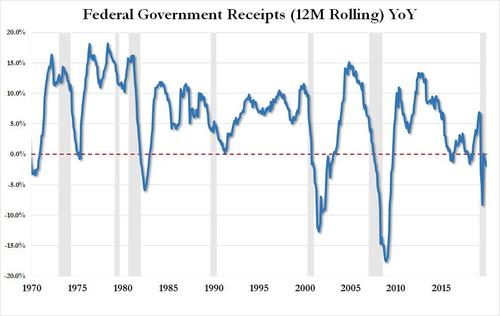

Federal Taxes Are Sending An S.O.S Signal

ZeroHedge, Dec 15, 2020 – Excerpts:

Submitted by Joseph Carson, former chief economist at Alliance Bernstein

Data on federal tax receipts paints a grim picture of the state of the US economy. Weak tax receipts are sending a signal of economic distress. Congress needs to act with urgency and pass federal support legislation to help broad parts of the economy.

Federal withheld income tax receipts represent hard contemporaneous data. Tax receipts are current and complete, unlike other economic data series such as household and payroll employment, which are based on a sampling of a small percentage of the working population and businesses.

The pandemic hit the economy in March, triggering widespread job loss and partial and full closing of many small businesses. In November, 9 months into the pandemic, federal gross withheld income tax receipts were off 13% from a year ago. That is roughly in line with the average decline of 15% recorded over the 9-month span, March through November.

Checking the tax data records from the US Treasury the decline in tax receipts over the last 9 months is the largest on record. The only comparable period is the 14% drop in 2009 during the Great Financial Recession.

………………

Congress has been negotiating for several months a second federal stimulus package. But political fighting over the scale and who gets support and who doesn’t has so far stymied a bi-partisan deal. I don’t support big government, but the federal government is supposed to step up during a crisis.

Taxes are sending an S.O.S signal, saying that significant parts of the economy are experiencing severe distress. Anyone in Congress that is on the fence over whether a second stimulus bill is necessary needs to look no further than the tax data.

Investors have been patient, banking on Congress to build a bridge of fiscal support until medical science develops a vaccine. Medical science has done its job, but Congress has not. If Congress doesn’t act soon the speculative gains in the equity markets could quickly reverse in scale.

_________________________________________

Congress “stepping up” with big-government stimulus programs has done nothing to solve any of America’s underlying problems, namely massive debts, ever-growing dependence on government, stifling bureaucratic business environment, and eroding economic liberty.

It is time for a powerful new comprehensive/decentralizing plan to get America back on track. It is time to abandon the big-government model and return to a citizen-centered, citizen-driven economy.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2021 (3896 downloads)