America is drowning in debt – Household debt, Corporate debt, Government debt. And it’s going to keep getting worse.

And there will be a day of reckoning…. unless we come up with a dynamic new solution.

……………………………………………………

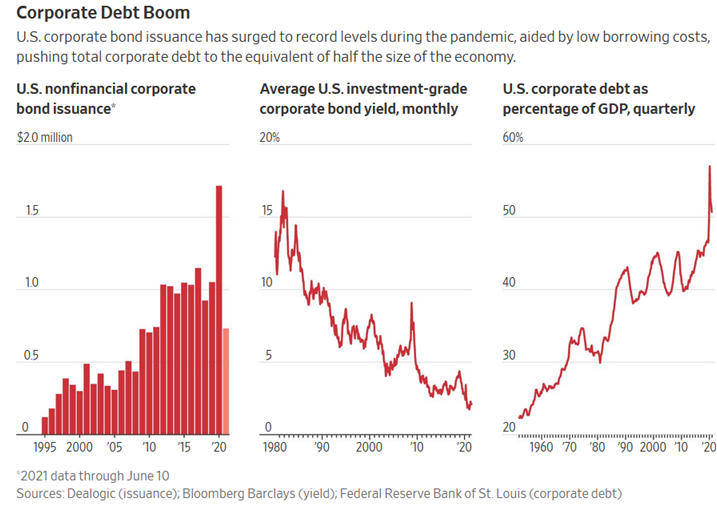

Pandemic Hangover: $11 Trillion in Corporate Debt – WSJ

Stressed companies piled on debt as interest rates plummeted, but could face a reckoning in the next economic downturn

The Wall Street Journal / Jun 14, 2021 – Excerpts:

Before the pandemic, U.S. companies were borrowing heavily at low interest rates. When Covid-19 lockdowns triggered a recession, they didn’t pull back. They borrowed even more and soon paid even less.

After a brief spike, interest rates on corporate debt plummeted to their lowest level on record, bringing a surge in new bonds. Nonfinancial companies issued $1.7 trillion of bonds in the U.S. last year, nearly $600 billion more than the previous high, according to Dealogic. By the end of March, their total debt stood at $11.2 trillion, according to the Federal Reserve, about half the size of the U.S. economy.

In a May report, the Federal Reserve noted that, by one measure, investors had rarely been compensated any less for the risk of holding corporate bonds, even as stock valuations were in line with historical averages. The report concluded that “vulnerabilities arising from business debt remain elevated.”

Some analysts say investors are willing to accept such low interest rates on corporate bonds not only because of the brightening economic outlook but because of the Fed’s aggressive response to the pandemic, which they think could to be repeated in future recessions.

Others are doubtful that even if the Fed announced that it would buy corporate bonds again, it would provide the same jolt to the market it did last year. They say that the normal risks of debt still apply, and that corporate bond investors could face significant losses in the next economic downturn.

_______________________________________

The #1 goal for America should be to enact the type of economic acceleration plan that has the power to properly, and in an orderly manner, eliminate massive quantities of ‘ground level’ debt – and restore financial health and economic liberty to American families.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3782 downloads)