The Leviticus 25 Plan grants the same access to liquidity extensions that were provided to the likes of Morgan Stanley, Bank of America, Goldman Sachs, JP Morgan, Citigroup, UBS AG, Barclays, Deutsche Bank, Royal Bank of Scotland, BNP Paribas, Wells Fargo, along with brokerages and insurers like Merrill Lynch and AIG during the financial crisis, to bail them out of their subprime misadventures and restore them to ‘financial health.’

The Leviticus 25 Plan’s primary goal is to, in like manner, restore ‘financial health’ for American families, through a massive debt pay-down and a revitalization of economic liberty and free market dynamics.

The Plan will materially reduce the gross levels of U.S. citizens’ dependence on government subsistence programs, and thereby relieve citizens from the stifling, freedom-robbing effects of government influence and control over their daily affairs.

The Plan will re-energize vigorous, sustainable economic growth, and it will recapture massive amounts of tax refund and social welfare payouts, with a net result at the federal level of $383 billion budget surpluses over each of the first five years following launch.

The $383 billion federal budget surplus is based solely upon The Plan’s recapture benefits. It does not include the new tax revenues that would be generated from the substantial gains in economic growth.

The $383 billion estimate therefore understates the true growth in tax revenues that would accrue.

The power and agility of The Leviticus 25 Plan Imagine the dynamic growth benefits of an economic plan granting liquidity benefits sufficient to pay off 60% of the mortgage debt in the U.S..

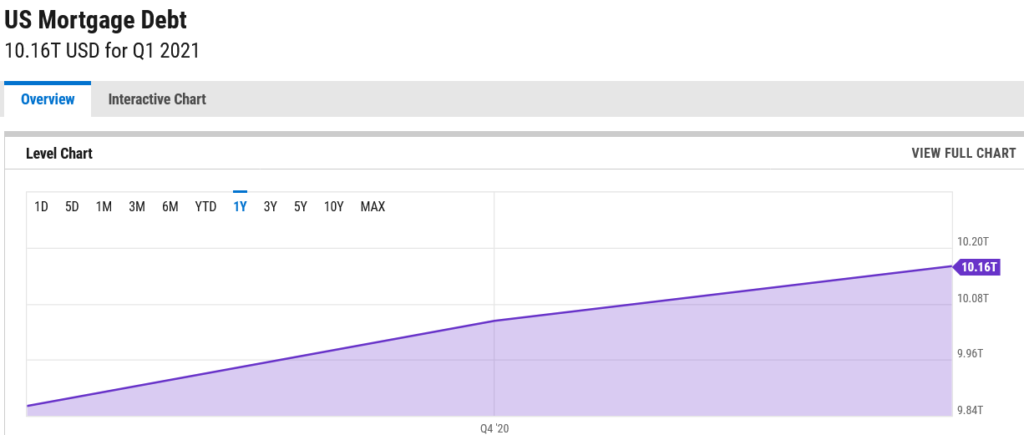

The chart below from Y-Charts shows a current mortgage debt load in the U.S. of $10.167 trillion. A 60% pay-down in that debt would eliminate $6 trillion in mortgage debt.

That $6 trillion would, in effect, pay off 30 million mortgages, each with a balance of $200,000. Assuming a 3.5% rate of interest and a period of 20 years to maturity, the “total cost of mortgage” on each of the mortgages would amount to $323,000. The net debt reduction benefit from the elimination of 6 million $200,000 mortgages over a 20 year period would be $9.69 trillion.

On a monthly basis, a $200,000 mortgage with a 3.5% rate of interest and 20 years to maturity would require principle and interest payment of approximately $898 in monthly debt service.

Eliminating that $898 monthly debt service payment for 30 million families would result in ~$900 of newfound discretionary liquidity for each family each and every month for the next 20 years. And that would amount to $27 billion in new money for main street America each month for the next 20 years.

This $27 billion in new liquidity flows for main street America would strengthen small business, increase growth in quality jobs, increase tax revenue and payroll tax growth.

________________________________

The Leviticus 25 Plan is a powerful economic growth engine like no other plan in existence. It is a powerful defender of individual freedom and liberty like no other.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3803 downloads)

………………………………………………………………………………..