The U.S. Federal Reserve generously infused major Wall Street global financial institutions, including foreign banks, with massive liquidity infusions during the height of the great financial crisis of 2007-2010.

One of the biggest recipients of the Fed’s generosity: Switzerland-based Credit Suisse…

……………………………………………..

Bloomberg Nov 28, 2011 – Excerpts:

“Credit Suisse Group AG, Switzerland’s second-biggest bank by assets, was the biggest user of the Fed’s single-tranche open market operations, or ST OMO, borrowing $45 billion in August 2008. Under ST OMO, securities firms swapped eligible mortgage bonds for cash.

The Zurich-based bank’s U.S. brokerage also used the Term Securities Lending Facility, which allowed firms to swap certain debt securities for Treasuries that could be loaned out or sold for cash. Credit Suisse took no part in any central bank’s collateralized funding facilities in the crisis, said Steven Vames, a bank spokesman in New York. TSLF doesn’t count because it involved no cash transfers, he said, and the bank borrowed from ST OMO only as a so-called primary dealer. Primary dealers weren’t required to bid in ST OMO.”

Peak Amount of Debt on 8/27/2008: $60.8B

………………………

What are single-tranche open market operations?

The Fed’s ‘secret liquidity lifelines that ran from 2007 – 2010 generally involved various credit facilities, set up to ‘rescue’ the banking system, and make banks ‘healthy.’

ST OMO’s were another unique form of liquidity infusions that provided “term funding” to the (big bank) Primary Dealers, primarily benefiting major European (Primary Dealer) banks. – for the purpose of “mitigating heightened stress in funding markets.”

These ST OMO “secretive bailout operation” pumped out $855 billion between “March and December 2008.”

“These operations were conducted by the Federal Reserve Bank of New York with primary dealers as counterparties through an auction process under the standard legal authority for conducting temporary open market operations. In these transactions, primary dealers could deliver any of the types of securities–Treasuries, agency debt, or agency MBS–that are accepted in regular open market operations. By providing term funding to primary dealers, this program helped to address liquidity pressures evident across a number of financing markets and supported the flow of credit to U.S. households and business.”

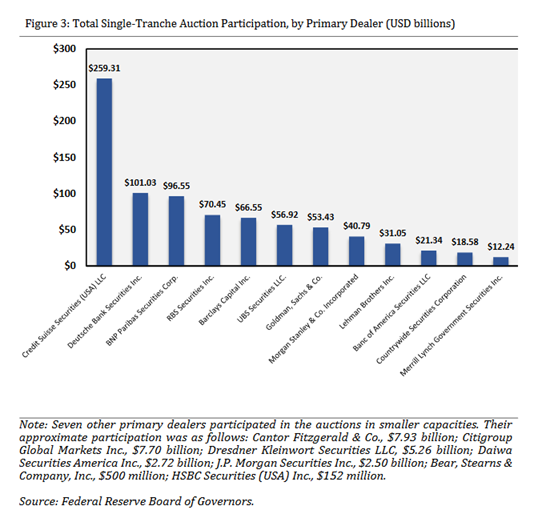

“Well, not really. As the chart below shows the banks, pardon, primary dealers, that benefited the most from this secret iteration of Fed generosity were once again foreign banks, with the Top 5 borrowers being Credit Suisse, Deutsche Bank, BNP Paribas, RBS and Barclays. Together these five accounted for $593 billion of total borrowings, or 70% of the total.”

Below is a summary of who borrowed how much in total from the Fed’s ST-OMO program.

__________________________________

Another highlight: Credit Suisse’s ‘corporate rap sheet’: https://www.corp-research.org/credit-suisse

__________________________________

And this brings us back again to the main point.

U.S. citizens deserve the same access to liquidity and credit guarantees that the Fed pumped out to rescue the banking system during the crisis period (2007 – 2010) when high-risk sub-prime debt took on ‘junk’ status, and fairly well ‘froze’ the system.

Certain Fed operations, like single-tranche open market operations, heavily favored major European banks – designed to mitigate “heightened stress.”

It is now time for the Fed to activate a U.S. Citizens Credit Facility to grant direct liquidity access to U.S. citizens – to eliminate debt and help relieve “heightened stress” at the family level in America.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3853 downloads)