Household Net Worth Hits Record $142 Trillion, Up $31 Trillion Since COVID, But There Is A Catch…

“The biggest wealth redistribution in history continues..”.

ZeroHedge, Sep 23, 2021 – Excerpts:

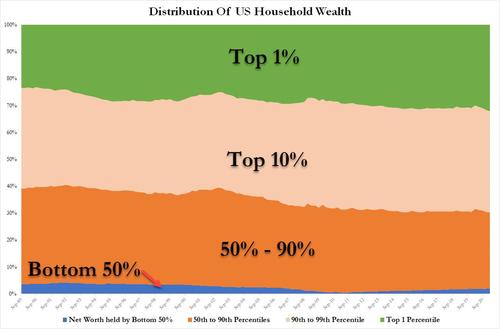

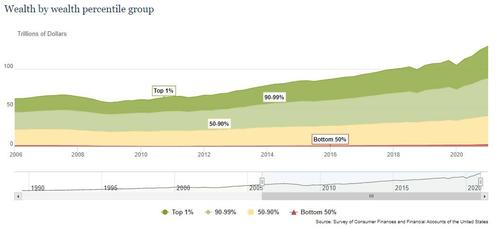

Indeed, the latest data as of Q1 shows that the top 1% accounts for over $41.5 trillion of total household net worth, with the number rising to over $90 trillion for just the top 10%. Meanwhile, the bottom half of the US population has virtually no assets at all. On a percentage basis, just the Top 1% now own a record 32.1% share of total US net worth, or $45.6 trillion. In other words, the richest Americans have never owned a greater share of US household income than they do, largely thanks to the Fed. Meanwhile, the bottom 50% own just 2% of all net worth, or a paltry $2.8 trillion. They do own most of the debt though…

And the saddest chart of all: the wealth of the bottom 50% is virtually unchanged since 2006, while the net worth of the Top 1% has risen by 132% from $17.9 trillion to $41.5 trillion.

Bottom line: the data underscore how the government’s fiscal scramble to speed up the “economic recovery” paired with the Fed’s continued ultra easy monetary policy have helped to protect and grow the wealth of the richest Americans: those who own assets, and who have seen their net worth hit an all time high… unlike the bottom 50% of Americans who mostly “own” debt.

_____________________________________

The Fed’s massive liquidity transfusions into the Wall Street financial sector during the great financial crisis (2007-2010) ‘lined the pockets’ and… ‘lathered up’ the top officers and Board of Director members of Wall Street’s financial sector, including: Morgan Stanley, JPMorgan, Goldman Sachs, Bank of America, Citigroup, State Street, Wells Fargo, AIG, Merrill Lynch, along with multi-national foreign banking interests like Deutsche Bank, UBS AG, BNP Paribas, Barclays, Royal Bank of Scotland, Credit Suisse, and numerous others.

The average working class American received ‘crumbs’ during the big scramble to rescue the financial system.

Again, “… the wealth of the bottom 50% is virtually unchanged since 2006, while the net worth of the Top 1% has risen by 132% from $17.9 trillion to $41.5 trillion.”

It is time to ‘re-balance’ the system and grant the same opportunity for direct liquidity extensions to U.S. citizens that was so generously provided by the Fed to Wall Street’s financial sector over a decade ago.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3880 downloads)