The Fed, over the course of the last 15 years, has spawned America’s current and enormous wealth disparity … in more direct ways than most people realize…

……………………………………………………..

Bailouts for Billionaires – Matt Taibbi, Sep 21, 2010 – Excerpts:

Warren Buffet and Berkshire-Hathaway made a $5 billion equity investment in Goldman Sachs at the height of the financial crisis. If Goldman doesn’t get $13 billion via the AIG bailout, that investment vanishes. If Goldman doesn’t get handed a federal bank charter overnight (allowing them to borrow huge amounts of cheap cash from the Fed) and doesn’t get a ban on short-selling and doesn’t get $10 billion from the TARP, again, B-H loses that $5 billion.

Moreover Berkshire-Hathaway is the largest shareholder in Wells Fargo, which got $25 billion from the TARP and also had government help in acquiring Wachovia in a shotgun wedding for $12.7 billion (W-F balked at buying Wachovia until it was given about $25 billion in tax breaks by the government).

So that’s just two of Berkshire-Hathaway’s biggest investments that collectively received at least $70 billion in government aid during the bailouts, by my count (this doesn’t even include the various Fed facilities and lesser-known bailout programs that helped banks like Goldman and Wells-Fargo stay afloat)…..

[Note: Forbes Billionaires list: #5 Warren Buffet, $124.4 Billion]

______________________________

Barrons: BlackRock Is Biggest Beneficiary of Fed Purchases of Corporate Bond ETFs

By Leslie P. Norton | une 1, 2020 2:05 pm ET – Excerpts:

As the Federal Reserve began its historic purchases of corporate bonds exchange-traded funds, almost half of the Fed’s purchases went into BlackRock funds, according to ETFGI, an ETF research and consulting firm.

The Fed is not the first central bank to buy ETFs as part of a stimulus package, but it is buying both ETFs and corporate bonds for the first time in its 107-year history. The Bank of Japan has been buying equity ETFs since 2012 as part of quantitative easing, says Deborah Fuhr, managing partner of ETFGI.

Between May 12 and May 19, the Fed bought $1.58 billion in investment grade and high-yield ETFs with a current market value of $1.31 billion. Six were high-yield ETFs and 11 were investment grade. Some 83% of the purchase went into investment grade ETFs; the rest into high-yield ETFs.

BlackRock’s iShares has 38.1% of the exchange-traded product market; Vanguard has 26.5%, and State Street ’s SPDR ETFs has 16.5%, says ETFGI.

[Note: 2022 Forbes, Black Rock Chairman and CEO Larry Fink – net worth: $1 Billion]

_______________________________

And then we have all of the CEOs, officers, board of directors members of the major Wall Street Banks that received hundreds of billions in bailout money and TARP funds during the 2007-2010 great financial crisis, the likes of: JPMorgan, Morgan Stanley, Citigroup, Bank of America, Goldman Sachs, Wells Fargo, State Street, Merrill Lynch, AIG… and foreign banks, including: Barclays, RBS, Deutsche Bank, BNP Paribas, UBS AG, and others..

_______________________________

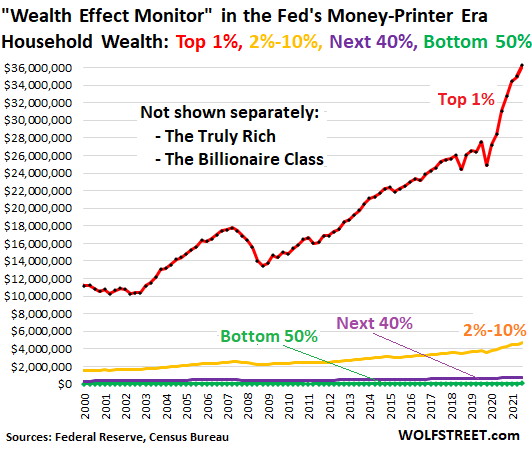

WOLFSTREET – The Major U.S. Wealth Gap:

“The Fed’s wealth distribution data divides the US population into four groups by wealth: The “Top 1%,” the “Next 9%” (2% to 10%),” the “next 40%,” and the “bottom 50%.” My Wealth Effect Monitor divides this data by the number of households in each category, to obtain the average wealth per household in each category. Note the immense increase in the wealth for the 1% households after the Fed’s money-printing scheme and interest rate repression started in March 2020″:

“As you can see from the steep curve of the red line, the “Top 1%” households were the primary beneficiaries of the Fed’s policies since March 2020. These policies were designed to inflate asset prices, and only asset holders benefited from that. The more assets they held, the more they benefited.”

_______________________________

The ‘Big Money’ flows freely to the ‘Big Players’ of the financial world when the Fed feels the need to ‘goose the economy.’ And the economy is no better for it. America is drowning in debt, U.S. Dollar stability is at risk, businesses are plagued by a skilled labor shortage, and the economy is now teetering on the edge of recession,

It is time for the Fed to ‘re-target’ its liquidity flows. It is time for U.S. citizens and their families to be granted the same direct access to Fed-generated liquidity extensions.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (4048 downloads)