Delusion Reigns At The Eccles Building

ZeroHedge – Tyler Durden, Monday, May 02, 2022

Authored by Shanmuganathan “Shan” Nagasundaram via InternationalMan.com,

Excerpts:

Never in the history of the world has the financial well-being of so many been tied to the economic competence of so few.…

Make no mistake—we are in extreme bubble territories for the asset classes of equities, bonds (despite the recent routing, valuations are still very frothy—more on that later), and real estate. US GDP (gross domestic product) numbers these days are pretty much largely dependent on the reserve currency status and is just a pin prick away from a cascading collapse on multiple fronts. What lies ahead is sheer mayhem in the equities, bonds, and real estate markets, and consequently on the economy and currency markets as well.

A legitimate question at this point would be what has changed in the immediate past to convert what was an inevitable event to an imminent one?

First, the fundamentals of the US Economy have been deteriorating for at least two decades, and it was the apparent low consumer price inflation despite all of the monetary inflation that masked the disease. Economists, investors, and the general public have been mistaking the equity, real estate, and bond bubbles (which are a direct consequence of the monetary inflation) as indicative of a sustainable economy.

The March FOMC Meeting

Interested readers can read the complete FOMC minutes on the Federal Reserve website. We will just examine two aspects that are relevant to the current discussion.Why Is Quantitative Tightening IMPOSSIBLE?

Let me explain. I am not saying that the Fed cannot embark on QT (quantitative tightening). They can, they have in the past (in 2018 under Yellen, and this was prematurely abandoned within a year due to adverse market conditions), and they will probably again do so in May.

But they can NEVER take it through to the projected closure. They will have to abandon the attempt midway due to tightening liquidity conditions that would manifest in ways such as the junk bond markets freezing, repo crises, etc. What causes the reversal of the oncoming QT is impossible to speculate, but suffice it to say that some weak link in this domino chain will break.

For the same reasons that each round of QE (quantitative easing) was bigger than its previous version, each QT would be shorter as compared to the previous attempt. It is also a reasonable supposition at this point that this will be last (unsuccessful) attempt at QT and all that we will have after 2022 is only QE to infinity. Mises provides the perfect QE/QT analogy with that of a drug addict on an artificial high—the victim will require increasing doses overtime and the withdrawal symptoms from a higher level of dosage would be that much more severe and difficult to endure.

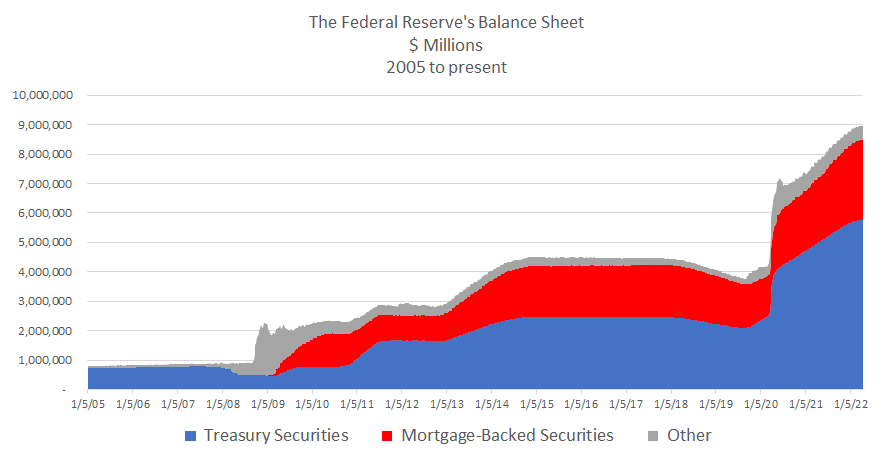

The Justification: QE is just a fancy way of stating inflation or monetization of deficits or buying assets that other investors / central banks will not buy, or at least not at the price at which it is offered. The US government has been running gigantic deficits to the tune of a few trillion dollars, and the US Fed has been buying up these treasury sales at pretty much “next-to-nothing” yields for the last decade. The pace has intensified over the years, as one can observe from the chart below.

Source: American Action Forum.

The deficit of the US government for 2022 would be to the tune of $3 trillion. If the US Fed, which has been the biggest buyer of Treasurys in the last few years, now becomes the second biggest seller (after the US Treasury, of course) who is going to be the buyer? Even assuming they can find a buyer, at what price can such transactions be effective?

The biggest buyers of these treasuries before the US Fed stepped in were the central banks of China, Russia and Saudi Arabia. It is doubtful that these buyers will return to the table for the foreseeable future. Not even the other “friendlier” central banks such as the Bank of Japan or the European Central Bank are going to step in, as they have their own inflation problems to deal with.

_________________________________________

America needs a powerhouse economic plan that will de-stress the system and set America back on track for long term stability and prosperity. This plan will need to:

(1) Generate massive new federal budget surpluses; (2) Eliminate trillions of dollars of debt for America’s hard-working, tax-paying middle-class families; (3) Re-ignite a powerful new economic growth cycle; (4) Solve the entitlement spending time-bomb; (5) Restore the long-term financial viability of the Medicare and Social Security Trust Funds; and help insulate the system from the dreadful effects of another major financial crisis.

That plan is loaded up and ready to launch – generating $583 billion surpluses over the course of the first five years of activation (2023-2027).

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (4095 downloads)