Thank you, Hank Paulson, Tim Geithner, and Ben Bernanke, from the bottom of Warren Buffett and Bill Gates’ hearts.

The U.S. government responded to critical liquidity shortages within Wall Street’s financial sector and a crumbling U.S. economy during the 2008-09 financial crisis, by funneling trillions of dollars in direct cash transfers, emergency loans, credit guarantees, and balance-sheet-clearing toxic mortgage debt purchases – to many of America’s premier financial institutions.

Billionaire Warren Buffett lobbied hard for the massive bailouts…. and with good reason. At least eight of these companies receiving billions of dollars of taxpayer bailouts were owned by Mr. Buffett’s Berkshire Hathaway.

…………………………………………………

Buffett’s Betrayal: Rolfe Winkler | Reuters /

Aug 4, 2009 – Excerpts:

A good chunk of his [Warren Buffett’s] fortune is dependent on taxpayer largess. Were it not for government bailouts, for which Buffett lobbied hard, many of his company’s stock holdings would have been wiped out.

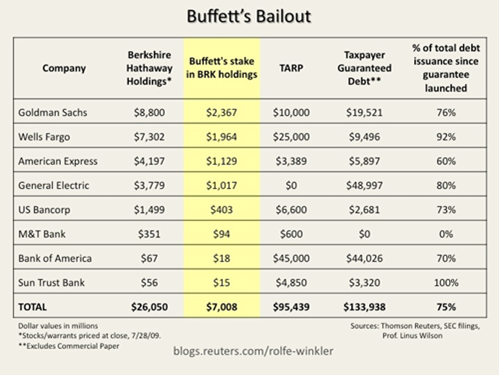

Berkshire Hathaway, in which Buffett owns 27 percent, according to a recent proxy filing, has more than $26 billion invested in eight financial companies that have received bailout money. The TARP at one point had nearly $100 billion invested in these companies and, according to new data released by Thomson Reuters, FDIC backs more than $130 billion of their debt.

To put that in perspective, 75 percent of the debt these companies have issued since late November has come with a federal guarantee.

[Note – the figures below are the dollar value in millions. Example – Berkshire Hathaway holdings in Goldman Sachs: $8,800,000,000]

Without FDIC’s debt guarantee program, even impregnable Goldman would have collapsed.

And this excludes the emergency, opaque lending facilities from the Federal Reserve that also helped rescue the big banks. Without all these bailouts, the financial system would have been forced to recapitalize itself.

Banks that couldn’t finance their balance sheets would have sold toxic assets at market prices, and the losses would have wiped out their shareholder’s equity. With $7 billion at stake, Buffett is one of the biggest of these shareholders.

…………………………………………………………….

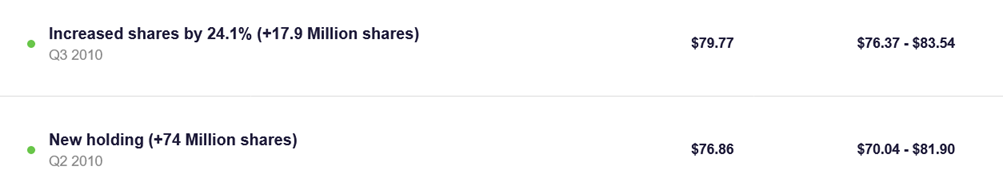

Mr. Bill Gates, who joined the Berkshire Board of Directors in 2004, also benefited handsomely during the period immediately following these bailouts – by virtue of his own Berkshire holdings (91.9 million shares):

Bill Gates – Berkshire Hathaway, Inc. – Class B

Source: https://stockcircle.com/portfolio/bill-gates/brk.b/transactions

……………………………………

Summary: The Fed ‘created’ trillions of dollars in ‘new money’ in their “Secret Liquidity Lifelines” to bail out Wall Street’s financial sector – ‘lathering up’ not only the ultra-wealthy, upper-level management teams of these American and European banking behemoths, but also their major billionaire shareholders like Warren Buffett and Bill Gates.

____________________________________

It is now high time to level the playing field – by granting U.S. citizens the same direct access to liquidity that was so generously provided to the likes of Goldman Sachs, Bank of America, Citigroup, Wells Fargo, Morgan Stanley JP Morgan, State Street, Barclays, Deutsche Bank, UBS AG, BNP Paribas, Royal Bank of Scotland… and others.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (4155 downloads)