WSJ: Rocky Treasury-Market Trading Rattles Wall Street

Mounting illiquidity raises concerns over a key market’s functioning should a crisis erupt

By Matt Grossman and Sam Goldfarb

Wall Street Journal, Oct. 30, 2022 – Excerpts:

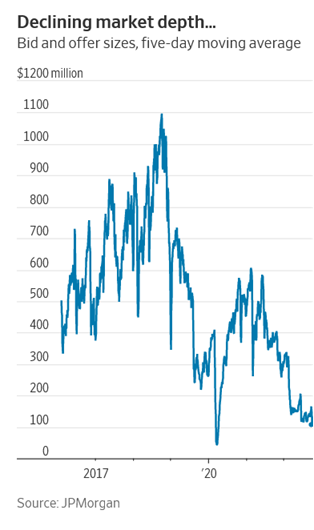

Rising friction in the trading of U.S. government debt has investors worried about the health of a $24 trillion market that is critical to the functioning of the broader financial system.

The ranks of traders ready to buy and sell Treasurys are shrinking. Individual trades are moving prices more. Treasury securities with similar characteristics are trading at larger-than-normal price differences. Major players, including the big banks and asset managers that have long been significant buyers, are in retreat.

Investors expect to be able to buy and sell Treasurys quickly at the listed price, no matter what else is happening. Difficulty doing so reflects a lack of what traders call liquidity, and it can scramble the most basic signals that help the economy run: How much home buyers should expect to pay for a loan, what kinds of investments businesses should make, and what kinds of stocks likely will perform the best in a given period.

Climbing Treasury yields have recently sent mortgage rates above 7% for the first time in two decades, slashed stock valuations and slowed corporate borrowing. While there hasn’t been a serious breakdown in Treasury trading so far, the possibility is far from unthinkable given the tumult this year. Many traders and portfolio managers warn that such a development would tear through other markets, potentially requiring intervention from the Federal Reserve to prevent a full-blown financial crisis.

Andrew Kreicher, a director at Wells Fargo, said liquidity in Treasurys has been about the worst he has seen over a sustained period recently.

“There are so many systems in other asset classes that use Treasurys as a building block,” he said. “If you have rot in the foundation, the whole house is at risk.”

Investors rely on easy Treasury sales to obtain quick cash for debt payments, margin calls and a variety of other pressing short-term needs. When that process hits hiccups, financial trouble can spiral, said Jim Caron, a fixed-income portfolio manager at Morgan Stanley Investment Management.

“If the Treasury market isn’t working, nothing is working,” he said.

While many agree trading Treasurys remains smoother than during the worst moments of 2020’s pandemic-fueled market breakdown, the current unease has built gradually over months without a single precipitating event, said Deirdre Dunn, co-head of global rates at Citi.

….Big banks function as Treasury-market dealers, helping match buyers and sellers. When they step back, trading stalls, said Ariel da Silva, director of fixed income at Wealth Enhancement Group, a wealth-management firm. Given the current regulatory regime, “It doesn’t behoove them to take on the inventory,” he said.

____________________________________

Budget Deficits – Treasury auctions

Problem: “Major players, including the big banks and asset managers that have long been significant buyers, are in retreat.”

Solution: It is time for the Federal government to undertake the unthinkable – begin running budget surpluses. Then let the “big banks and asset managers” continue their retreat.

The Leviticus 25 Plan will generate $583 billion federal budget surpluses for the initial 5 years of activation (2023-2027), and completely pay for itself over the next 10-15 years.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America 2023

Economic Scoring links:

Full Plan: Leviticus 25 Plan 2023 (5022 downloads)

Website: https://Leviticus25Plan.org