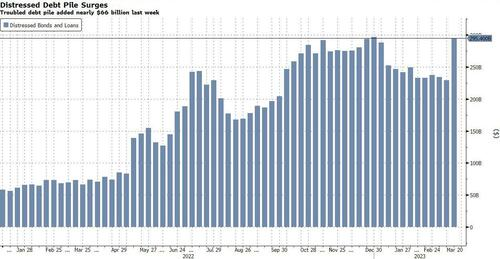

Distressed Debt Soars By 29%, Or $66 Billion, In One Week Amid Surge In Bankruptcies

ZeroHedge, Mar 23, 2023 – Excerpt:

The cascade of defaulted regional US banks is blowing out the circulating inventory of distressed debt which expanded by about $65.9 billion last week as US insolvency courts saw six new, large bankruptcy filings, according to data compiled by Bloomberg.

The heap of dollar-denominated corporate bonds and loans in the Americas trading at distressed levels rose to $295.4 billion in the week ended Friday, a 28.7% increase from $229.5 billion a week earlier, Bloomberg-compiled data show.

…..

In total, there were 48 large bankruptcy filings – those related to at least $50 million of liabilities – this year through March 20. That’s the highest since 2009, which saw 88 large cases through March 20, per Bloomberg-compiled data.

_______________________________

The U.S. business economy is, in many ways, limping along in a liquidity-starved environment….

America’s business world and millions of America’s hard-working, tax-paying families need properly targeted liquidity – of the type which flows directly to credit-worthy qualifying U.S. citizens, and then on up to U.S. banks (to reduce / bring current distressed household debt) and to large and small corporations (to relieve mounting corporate debt pressures).

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (5949 downloads)