The Fed is off to a flying start – ‘pumping’ liquidity (newly created ‘electronic money’ to fund BTFP and Discount Window borrowing) into a currently wobbly banking system, in part to save wealthy principles (SVB) not covered for the large sums of money they were on tap to lose (above and beyond the paltry $250,000 FDIC deposit insurance).

U.S. citizens, meanwhile, remain mired in debt to the very financial infrastructure which the Fed is once again ‘bailing out.’

The U.S. government remains ‘buried’ in debt – with no plan whatsoever to get the country back on track for long-term solvency; the banking system remains ‘fragile’; the U.S. Dollar is in ‘erosion mode’; and economic liberties in America are in decline.

Solution: A powerful economic acceleration plan that will ‘reroute’ Fed liquidity transfusions first through a Citizens’ Credit Facility and then on to the financial institutions that need to clean up their balance sheets.

In this manner, Fed liquidity will first pass through the hands of U.S. citizens – who will use these funds to pay off, or substantially pay down, their indebtedness *mortgages, student loans, consumer loans, credit card debt) to various financial institutions in both the private and public sectors.

The banks will get the funds they need – after those newly-created ‘electronic dollars’ pass first through the hands of U.S. citizens.

End result: Banks will get their money; millions of ‘distressed’ loans will become ‘current’ of get paid in full; millions of U.S. citizen credit scores will, over time, regain respectability.

Millions of American families will not live in fear of losing their homes through foreclosure proceedings (banks foreclosed on 8.4 million homes during the 2008-2010 financial crisis), losing vehicles (auto delinquencies and repossessions are currently trending higher), and/or struggling to pay monthly rent bills and student loan pay-downs.

The Leviticus 25 Plan will restore financial health for millions of American families, generate massive federal budget surpluses, stabilize the banking system, strengthen the U.S. Dollar, and rejuvenate economic growth, and restore economic liberty in America.

______________________

Fed Balance Sheet Explodes By $300BN As Bank Bailouts Lead To Record Discount Window Surge

ZeroHedge, Mar 16, 2023 – Excerpts:

Earlier today we said that with Wall Street freaking out over the latest bank crisis, everyone’s attention would be focused on today’s weekly H.4.1 update from the Fed. And they weren’t disappointed because what we found was striking.

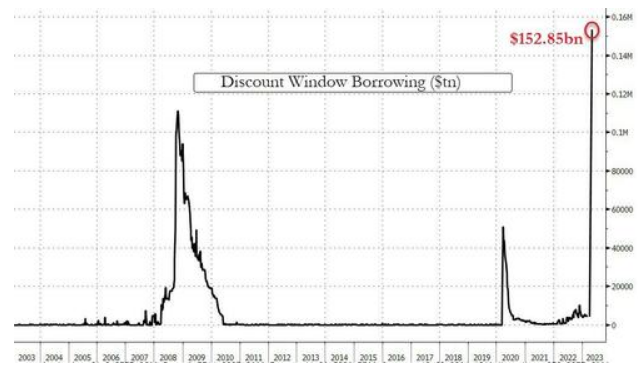

In the week ended March 15, borrowings under the Fed’s deeply stigmatizing last-ditch liquidity facility, the Discount Window, exploded to $152.85BN, a record $148BN weekly jump to an all-time high which surpassed even the borrowings during the financial crisis!

Just as importantly, those curious what the usage of the Fed’s new BTFP facility would be, got their answer – and the Fed won’t like it: at just $11.943BN, this was a very small amount as banks clearly fear the stigma associated with the BTFP program even more than they loathe the Discount Window. This is in line with what Goldman suggested: “While use of the BTFP is the most straightforward measure of the extent to which deposit outflows are putting banks under pressure, many banks say they will only use the BTFP once they have exhausted other funding sources such as FHLB advances, certificate of deposit issuance, and the wholesale debt market.”…..

Taken together, the credit extended through the two backstops showed a banking system that remains broken and is dealing with over $100BN in deposit migration in the wake of the failure of Silicon Valley Bank of California and Signature Bank of New York last week.

And then the Fed also revealed that $142.8 billion in reserves were released by “Other Credit Extensions” (this line item was $0 last week), and “includes loans that were extended to depository institutions established by the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve Banks’ loans to these depository institutions are secured by collateral and the FDIC provides repayment guarantees.”

Including loans that were extended to depository institutions established by the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve Banks’ loans to these depository institutions are secured by collateral and the FDIC provides repayment guarantees.

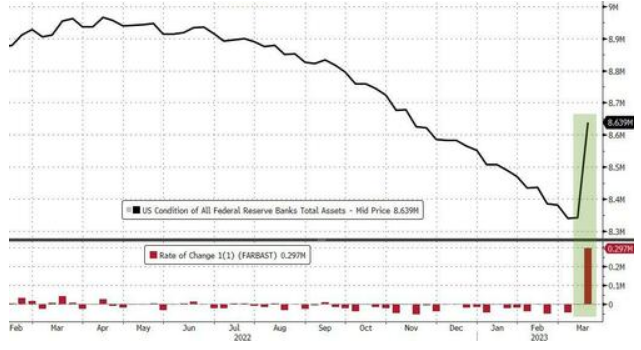

At the consolidated level, the surge in new liquidity created by the Fed meant that the Fed’s balance sheet rise by $297bn – its biggest jump since April 2020 and erasing 4 months of QT, or half of the entire program!

Separately, earlier today, we reported that JPMorgan’s Nick Panigirtzoglou estimated that the Fed’s new BTFP facility could rise as much as $2 trillion, and suggested that as a result of the massive reserves created by this facility it could serve as a Stealth QE. However, at $11BN per week, we will have to wait quite some time to get to JPM’s target.

Putting it together we said that we live in an interesting time: one when the Fed is hiking, the Fed is shrinking its balance sheet, and the Fed is also engaging in Stealth QE in hopes of injecting trillions in reserves in small banks….

___________________________________

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (5871 downloads)