The Federal Reserve’s ‘secret liquidity lifelines’ for major banks:

Bloomberg LP filed a Freedom of Information Act (FOIA) lawsuit on Nov 7, 2008 to gain access to information regarding special emergency lending programs that the U.S. Federal Reserve had been running to help borrower banks deal with cash shortages and collateral deficiencies. The Fed fought the lawsuit, but ultimately lost.

Bloomberg gained access to more than 29,000 pages of previously secret loan documents and Fed spreadsheets and published the highlights of those programs in late 2011.

According to Bloomberg, the top 15 recipients of Fed’s ‘secret liquidity lifelines’ were:

Morgan Stanley $107 billion

Citigroup Inc. $99.5 billion

Bank of America Corp $91.4 billion

Royal Bank of Scotland Plc $84.5 billion

State Street Corp $77.8 billion

UBS AG $77.2 billion

Goldman Sachs Group Inc. $69 billion

JP Morgan Chase & Co $68.6 billion

Deutsche Bank AG $66 billion

Barclays Plc $64.9 billion

Merrill Lynch & Co Inc. $62.1 billion

Credit Suisse Group AG $60.8 billion

Dexia SA $58.5 billion

Wachovia $50 billion

………………………………………………………………………..

Meanwhile, here’s how Main Street America made out.

8.7 million Americans lost their jobs during the financial crisis years.

4.1 million American families lost their homes through completed foreclosures from September 2008 through December 2012, according to CoreLogic..

________________________________________

Round and round we go – the Federal Reserve is once again bailing out troubled institutions in the banking sector.;;

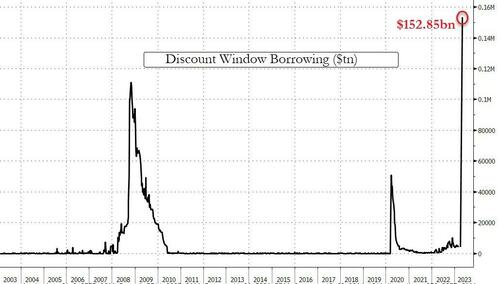

ZeroHedge, March 16, 2023: Today’s weekly H.4.1 update from the Fed :

In the week ended March 15, borrowings under the Fed’s deeply stigmatizing last-ditch liquidity facility, the Discount Window, exploded to $152.85BN, a record $148BN weekly jump to an all-time high which surpassed even the borrowings during the financial crisis!

It is time to re-target Fed liquidity extensions: U.S. citizens deserve nothing less than to be granted the same direct access to liquidity that has been so generously provided, time and time again, to Wall Street’s financial sector during times of financial stress.

Let the liquidity flow through the hands of U.S. citizens first – and then on up to the banks (to reduce/eliminate household debt, student loan debt, mortgage debt), instead of mass-pumping newly-created electronic ‘money’ into the banking sector, with mere crumbs falling through for America’s hard-working, tax-paying U.S. citizens.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizens – Leviticus 25 Plan 2023 (5967 downloads)