Much of the banking sector in the U.S. is reeling, primarily from ‘duration stress’ – having lent long-term money out in recent years at relatively low interest rates, and now having to borrow at much higher rates. Inflation hit, rates rose, and in due course market value of these paper assets on their balance sheets have dropped significantly.

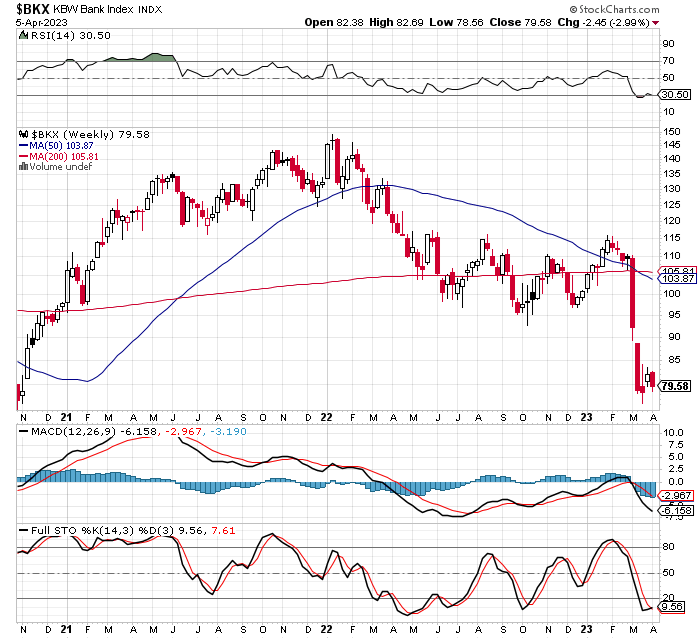

The KBW Bank Index, a bellwether indicator tracking the prices of 24 large banks in this sector, began crashing in March. It is now down 46.7% year-to-date.

Index Components – As of May 2021, the individual index components included:

- Bank of NY Mellon (BK)

- Bank of America (BAC)

- Capital One Financial (COF)

- Citigroup (C)

- Citizens Financial Group (CFG)

- Comerica (CMA)

- Fifth Third Bank (FITB)

- First Horizon (FHN)

- First Republic Bank (FRC)

- Huntington Bancshares (HBAN)

- JP Morgan Chase (JPM)

- Keycorp (KEY)

- M&T Bank (MTB)

- Northern Trust (NTRS)

- PNC Financial Services (PNC)

- People’s United Financial (PBCT)

- Regions Financial (RF)

- Signature Bank (SBNY)

- State Street (STT)

- SVB Financial Group (SIVB)

- Truist Financial Corp (TFC)

- US Bancorp (USB)

- Wells Fargo & Co (WFC)

- Zion’s Bancorp (ZION)

Source: Investopedia

…………………

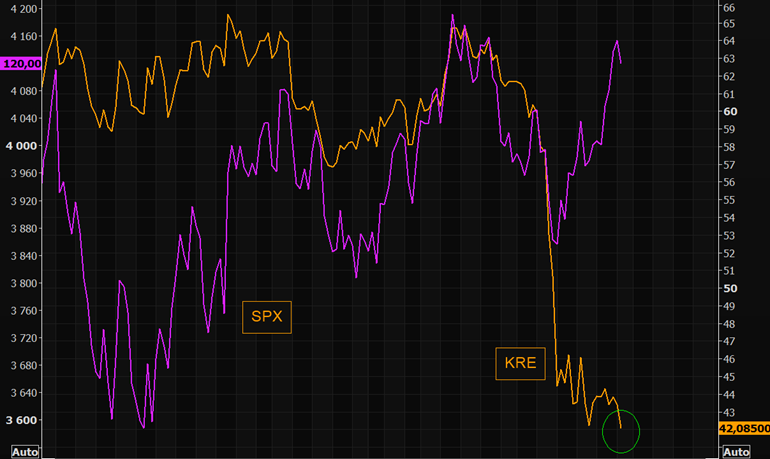

The S&P Regional banking ETF, KRE, is also under significant stress – down 35% from recent highs.

KRE vs SPX:

……………………..

The Fed has three apparent choices. Two bad. One good.

1. Bailouts. The Fed may be ‘forced’ into another round of bank bailouts to shore up capital requirements covering scores of Institutions within the sector – with the Fed recreating various credit facilities through which to pump hundreds of billions of dollars out to major banks (domestic and foreign) to stabilize the system.

Primary beneficiaries: Wealthy industry insiders, Board of Director members, wealthy major shareholders like Warren Buffett and Bill Gates (circa 2008-2011), and others.

Primary non-beneficiaries: Working class Americans, particularly those losing income, getting laid off, struggling to pay rents and mortgages.

Bad Choice: This would do nothing to restore credibility within the sector. Federal and State governments would remain mired in debt. There would be no positive long-term benefits for U.S. economic growth, no positive debt elimination benefits for American families.

……………………………

2. Rate Reduction: The Fed could embark on aggressive rate reduction. This would ostensibly shrink ‘lend long, borrow short’ rate gap that is plaguing the sector. Duration risk, theoretically, would be at least partially mitigated as the market value of banks’ paper assets rises.

Bad Choice: Fed would lose a lot of credibility. Inflation would likely come back to haunt the Fed (and millions of working class Americans). There would likely be severe repercussions to credit markets (actually, ‘all hell could break loose’). Federal and State governments would remain mired in debt. There would be no positive long-term benefits for U.S. economic growth, no positive debt elimination benefits for American families.

……………………………………..

3. Re-target liquidity flows. The Fed could create a new facility, a Citizens Credit Facility, to officially launch The Leviticus 25 Plan.

Primary beneficiaries: Working class U.S. citizens.

Good choice: 1) Bank sector duration risk would rapidly resolve as underwater paper assets would be converted to dollars assets at par value – for banks to re-lend at market rates. It would restore confidence within the sector.

2) Massive debt reduction / elimination across the board for millions of American families.

3) Marked gains in GDP growth as trillions of dollars previously earmarked for debt service boomerang back into the economy, creating jobs, re-incentivizing work, increasing economic productivity, generating enormous new flows of tax revenue and payroll tax revenue (Social Security, Medicare).

4) The Leviticus 25 Plan, through its recapture provisions, would generate $619 billion federal budget surpluses and major budget gains for most state and local governments, and would pay for itself entirely over a 10-15 year period.

……………………………

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (5969 downloads)