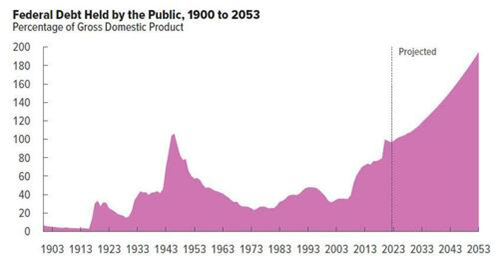

Washington Democrats are by any measure oblivious to America’s looming debt catastrophe.

Washington Republicans, shamefully enough, have no economically viable, politically feasible plan for solving the national debt crisis and getting America back on track.

……………………………………

Endgame: US Federal Debt Interest Payments About To Hit $1 Trillion

ZeroHedge, Jul 14, 2023 – Excerpts:

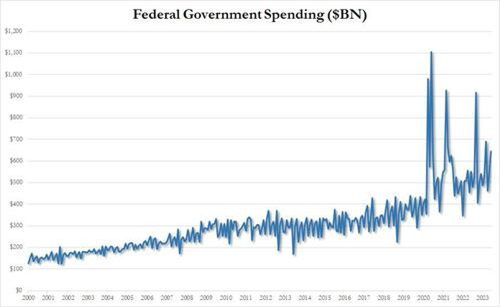

There was a shocking number in today’s latest monthly US Budget Deficit report. No, it wasn’t that US government outlays unexpectedly soared 15% to $646 billion in June, up almost $100 billion from a year ago…

…………………………………………………..

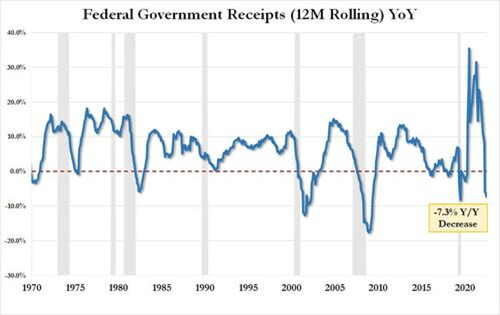

… while tax receipts slumped 9.2% from $461 billion to $418 billion, resulting in a TTM government receipt drop of over 7.3%, the biggest since June 2020 when the US was reeling from the covid lockdown recession; in fact never have before tax receipts suffered such a big drop without the US entering a recession.

Needless to say, surging government outlays coupled with shrinking tax revenues meant that in June, the US budget deficit nearly tripled from $89 billion a year ago to $228 billion, far greater than the consensus estimate of $175 billion. One can only imagine which Ukrainian billionaire oligarch’s money laundering bank account is currently enjoying the benefits of that unexpected incremental $50 billion US deficit hole: we know for a fact that the FBI will never get to the bottom of that one, since they can’t even figure out who dumped a bunch of blow inside the White House – the most protected and surveilled structure in the entire world.

And with the monthly deficits coming in higher than expected and also far higher than a year ago, it is also not at all surprising that the cumulative deficit 9 months into the fiscal year is already the 3rd highest on record, surpassed only by the crisis years of 2020 and 2021: at $1.393 trillion, the fiscal 2022 YTD deficit is already up 170% compared to the same period last year.

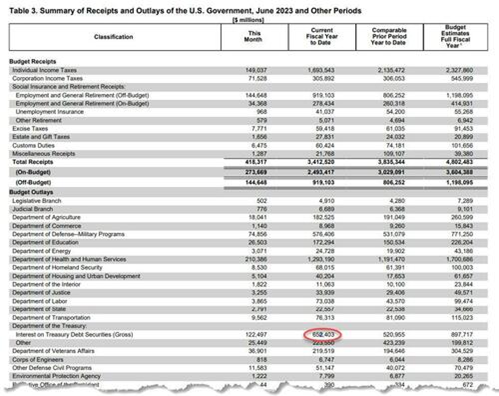

…[T]he one number that was truly shocking was found all the way on page 9, deep inside Table 3 of the latest Treasury Monthly Statement: the only highlighted below, and which shows that in the 9 months of the current fiscal year, the US has already accumulated a record $652 billion in gross debt interest.

This number was more than 25% higher compared to the Interest Expense payment for the comparable period a year ago, which amounted to $521 billion.

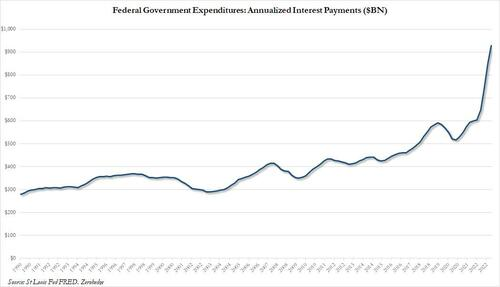

Soaring interest rates, driven by the panicked Fed’s scramble to undo its epic policy failure of 2020 and 2021 when the Fed kept rates at zero for far too long while injecting trillions into various asset bubbles, have been the key driver of the deficit, with the Federal Reserve boosting its benchmark rate by 5% since it began hiking in March last year. Five-year Treasury yields are now about 3.96%, versus 1.35% at the start of last year. As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on outstanding debt: that’s right – even when the Fed starts cutting rates, due to the delay of rolling over maturing debt, actual interest payments will keep rising for the foreseeable future.

For context, the weighted average interest for total outstanding debt at the end of June was only 2.76%, a level that’s not been surpassed since January 2012, according to the Treasury. That’s up from 1.80% a year before, the department’s data show, and if the Fed indeed keeps rates “higher for longer”, the blended rate on the debt will surpass 4% in one year.

That would be a complete disaster for the US, and it would mean that interest payments on total US debt of $32.3 trillion would hit $1.3 trillion within 12 months, potentially making interest on the debt the single biggest US government expenditure and surpassing social security!

But we don’t even have to wait that long until the exploding interest on US government debt becomes a major talking point ahead of the coming presidential elections. According to the St Louis Fed’s FRED and the BEA, the interest payments by the Federal Government have now surpassed $900 billion for the first time ever, and within a quarter will hit probably rise above $1 trillion, a historic benchmark that will probably begin the countdown to the US Minsky Moment.

………….

In short, the endgame has now arrived, and all the US can do now is rearrange the deck chairs.

_____________________________________

The endgame has not arrived, and there is no fatalistic need to “rearrange the deck chairs.”

It is all a simple matter of re-targeting Fed liquidity flows…

Main Street America Republicans have just such a plan – the most powerful, debt-busting, outside-the-box, economic acceleration plan in the world.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (6609 downloads)