How Much Free Money is the Fed Giving Banks and Financial Institutions?

Mishtalk.com – Economics

July 29, 2023 – Excerpts:

The Fed pays interest to banks on all reserves, largely crammed down banks’ throats via past QE. How much free money is that?

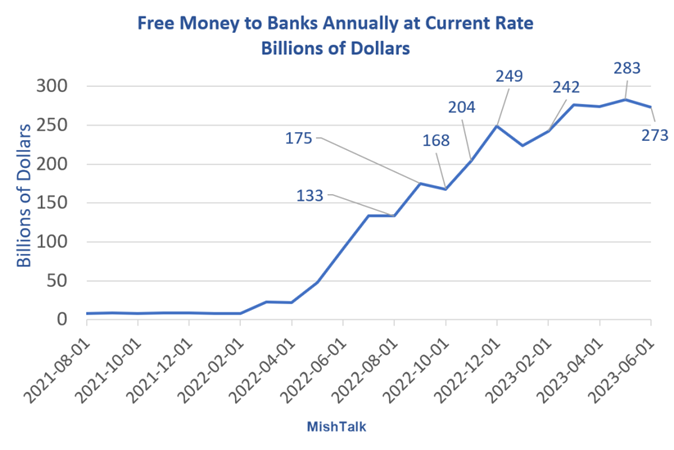

Free money to banks based on reserves, reverse repos, and current interest rate paid by the Fed. Chart and calculation by Mish.

Understanding Reserves

The Fed used to pay banks interest on “excess reserves”. Excess reserves are total reserves minus required reserves.

As announced on March 15, 2020, the Board of Governors reduced reserve requirement ratios on net transaction accounts to 0 percent, effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.

Since there are no reserve requirements on either checking or savings deposits, all reserves are effectively excess reserves, and the Fed pay banks interest on everything. That includes free money crammed down banks throats via QE.

Reverse Repos

The Fed also pay interest on reverse repos. A reverse repurchase agreement (RRP, or reverse repo) is a short-term agreement to sell securities in order to buy them back at a slightly higher price. The primary recipient of reverse repo interest are the money market funds.

It’s not important to understand these functions, just follow the math below.

Target Fed Funds Rate

The New York Fed explains: The New York Fed conducts repo and reverse repo operations each day as a means to help keep the federal funds rate in the target range set by the Federal Open Market Committee (FOMC).

In order to suppress a free market in interest rates and to help control the mess the Fed created via Quantitative Easing (QE), now Quantitative Tightening (QT), the Fed is handing out free money left and right.

To calculate free money, we need to watch three things: Interest rates, reserves, and reverse repos.

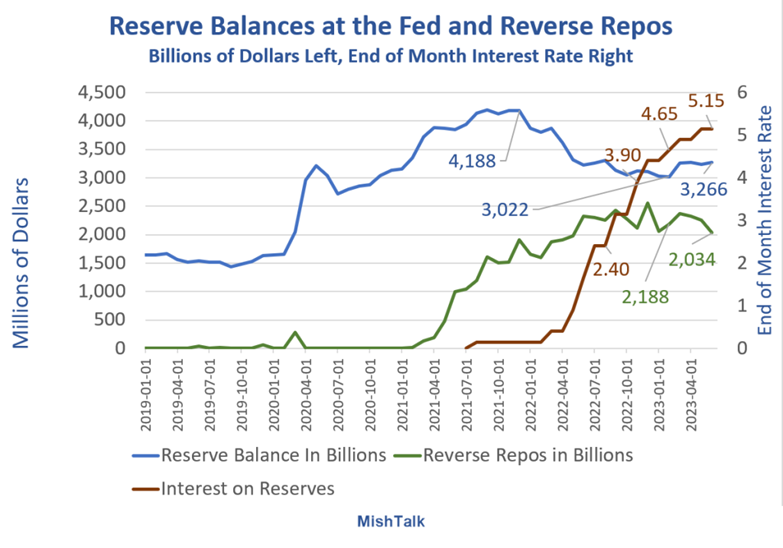

Reserve Balances at the Fed, Reverse Repos, Interest Rate

Reserve Balances at the Fed, Reverse Repos, Interest Rate, data from the Fed, chart by Mish

Understanding the Free Money Forces

- In isolation, rising interest rates add to the free money given to financial institutions.

- QT reduces bank reserves and thus free money.

- Reverse Repos are now slowly declining. This also reduces free money payouts.

The net impact of these forces has been pretty stable for about six months, roughly between $250 billion and $280 billion in free money given to banks at an annual rate.

The impact of QT is moving faster than rate hikes so net free money will decline over time.

Free Money at Taxpayer Expense

My numbers are approximate, using end of month interest rates and monthly average balances. In practice, this is all calculated daily. But within a few billion dollars, the Fed is giving banks about $273 billion annually at the current rate.

It’s important to note that free money that should be going to taxpayers. Instead the Fed gives it to banks because its QE/QT programs made a huge mess out of monetary policy.

Thank former Fed Chair Ben Bernanke for this. He is the one who lobbied Congress for the right to send out all of this free money. He said it was necessary for the QE program he launched, and every Fed president since maintained.

______________________________

The Fed’s current liquidity flow schemes does nothing to: 1) Shrink the federal government debt profile; 2) Nothing to restore financial health for millions of American families; 3) Nothing to revitalize long-term economic growth; 4) Nothing to strengthen the U.S. Dollar’s status as the global reserve currency.

The Leviticus 25 Plan corrects these glaring deficiencies by re-targeting Fed liquidity flows through the hands of tax-paying U.S. citizens — and then on to the banks through household debt and consumer debt elimination.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (6784 downloads)