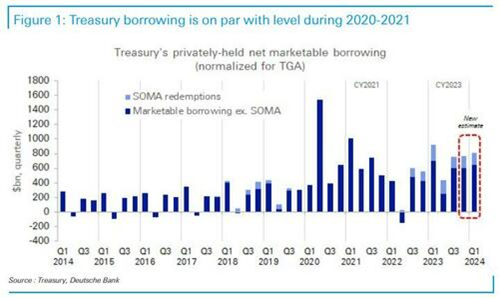

Treasury Borrowing Running At Crisis-Era Levels

ZeroHedge, Nov 06, 2023 – Excerpts:

With the November quarterly refunding announcement now in the rearview mirror, we look to the Treasury’s borrowing outlook in historical context….

[According to] Deutsche Bank rate strategist Steven Zeng who on Friday published a chart that takes the numbers from the Treasury’s sources and uses table with adjustments to remove the fluctuations in the TGA…. the Treasury borrowed $1.01 trillion during Q2’23, with $756bn used for financing the deficit and QT, and $254bn was “saved” in the form of a higher cash balance.

In this light, Zeng notes that the Treasury’s expected borrowing for the current and the next quarter is actually larger than Q3’s, growing by about $10 billion per month. In fact, Treasury borrowing is now on par with levels during the 2020-2021 pandemic with both weaker fiscal positions and Fed QT are contributing factors.

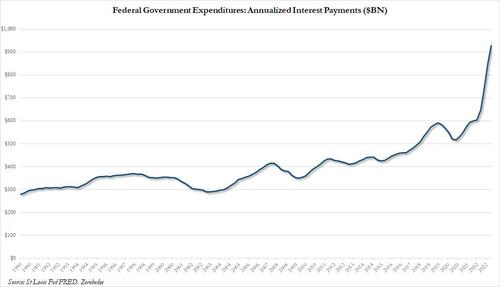

As Zeng puts it, “with a growing view that the Fed may lengthen the duration of QT, and annual deficits projected at around $1.7- $1.8 trillion over the next few years, these issues are unlikely to go away soon.” At the same time, the widening mismatch between supply and demand for Treasuries could exacerbate the issue through increased debt interest expenses.

Goldman has some even more disturbing numbers: according to the bank’s rates strategist Praveen Korapaty, his outlook for Treasury supply in 2024 shows net notional issuance of $2.4 tr, which is inclusive of both bills and coupons. Gross coupon issuance would be much larger, roughly $4.2 tr, which includes issuance to cover maturing debt.

These concerns will remain in the forefront in 2024, with the TBAC highlighting this week the linkage between term premium and fiscal sustainability…

The thing about Wall Street is that if everyone agrees to stick their head in the sand and ignore the elephant in the room, it’s easy to do.

The problem is when someone notices the elephant. That’s what the TBAC did today pic.twitter.com/mJLbzvbpD0 | — zerohedge (@zerohedge) November 2, 2023

_______________________________________

It is time to kickoff America’s ‘elephant roundup’ ...

The Leviticus 25 Plan will generate, conservatively, $619.5 billion budget surpluses annually in its first five years of activation.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America Leviticus 25 Plan 2023 (8623 downloads)