This “Unprecedented” Fiscal Doom Loop Is Getting Worse

ZeroHedge, Oct 24, 2023 | Submitted by QTR’s Fringe Finance

Excerpts:

Lawrence Lepard; US FISCAL DOOM LOOP GETS WORSE

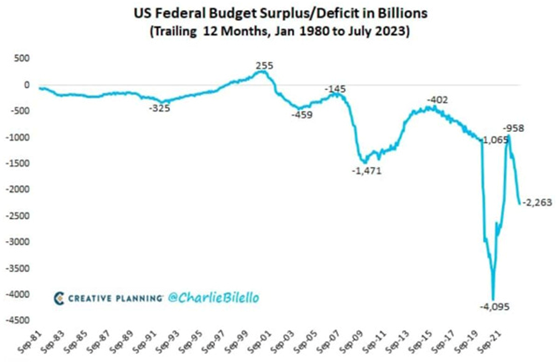

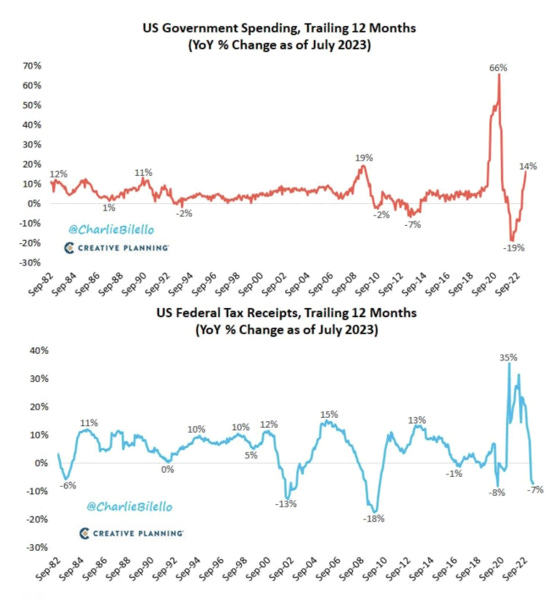

In our view, the biggest elephant in the room is the US Fiscal Doom Loop. To refresh: US Government spending is out of control, and there appears to be very little political will to stop it. As the chart below shows, Government spending is up 14% yoy and tax receipts are down 7% yoy. Fiscal year ended September 2023 is projected to have a deficit of over $2 Billion (or roughly 8% of GDP). In the past, deficits of this magnitude only materialized during significant downturns like the bursting of the Dotcom Bubble, the 2008 GFC and the COVID crisis. It is unprecedented to have deficits of this magnitude with the economy and employment being relatively strong.

One can only imagine where the deficit goes when the FED’s monetary jihad of rapid rate increases tips the economy over. Past economic downturns typically have increased the deficit/GDP ratio by 8-14%.

So as the economy moves into recession in 2024 (as we believe), the US could be looking at deficits as high as 20% of GDP ($5 Trillion) if the economy slows dramatically.

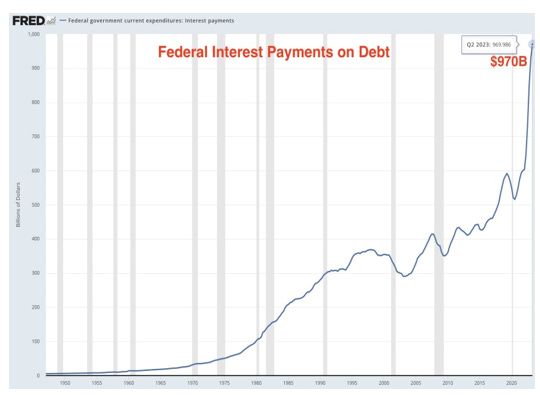

The reason we see it as a “doom loop” is that the current $33.5 Trillion of Federal Debt is continually costing more to service.1 The Fed’s rapid increase of interest rates, and elimination of Quantitative Easing (e.g., Fed buying Treasury bonds) has impacted US Treasury interest costs. Note below how interest payments have soared over the past two years.

Interest expense on the Federal Debt now exceeds our substantial annual national defense spending of $816B as well as every other category except Social Security and Medicare.

The Doom Loop occurs as higher interest costs drive higher deficits, forcing the Government to sell more bonds to finance the same. Ceteris paribus, more bond sales lead to higher interest rates which then increase the deficit further. Repeat until there is no market for the bonds. Of course, at that point the Fed is forced to step in and become the buyer of last resort for the bonds to keep the bond market functioning.

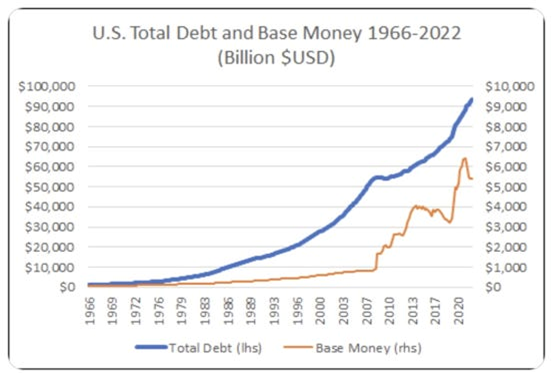

The fundamental issue is that without growing the money supply, there is not enough capital to support the inflated bubble valuations. When the Fed chose violence and went on a campaign of rapid rate increases (taking the Fed funds rate from 0.25% in 2021 to 5.25% today), coupled with the sale of some of its bond portfolio (Quantitative Tightening), it increased the cost and reduced the supply of capital necessary to support all financial markets. Government bond sales (which drive rates higher) are crowding out the debt markets. This is going to have to change or the financial markets as we know them are going to collapse. The only issue is the time scale. The subject is addressed nicely in the chart below by Lyn Alden:

As you can see, when any person, company or government takes on massive leverage, the proceeds better generate productive economic outcomes to support the debt. (e.g., levering to invest in education or nuclear plants has a payback, but if the money is used to finance War, virtually nothing is gained/produced). Thus, to support an over-levered entity, more financing or money supply growth is required. When markets enter chaotic times, like in 2008-2013 and 2018-2021, the Fed is forced to be very aggressive in growing the monetary base via expansion of their balance sheet (money printing). This is what has taken the Fed Balance Sheet Assets from $800B to roughly $8T in the past 15 years. With debt continuing to grow rapidly we see no reason why this will not occur again, perhaps in short order.

The Fed’s recent retrenchment in the Base Money Supply (orange line in the chart above) began in February of 2022. There is a lag effect in terms of its impact on the economy. We believe the lag is now starting to bite hard and that is showing up in the numbers as we will detail below.

EVIDENCE OF ECONOMIC SLOWDOWN – Despite recent Wall Street and CNBC cheerleading, we believe the economy is beginning to roll over.

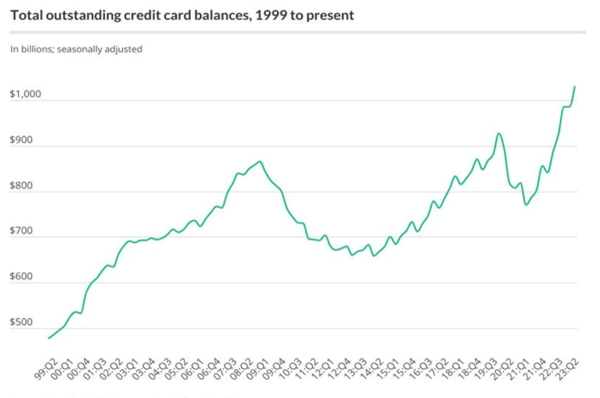

Post COVID, consumers regained confidence and went on a spending spree to maintain their lifestyles despite inflation and rising living costs. They did this by significantly increasing their borrowing on credit cards as seen in the chart below:

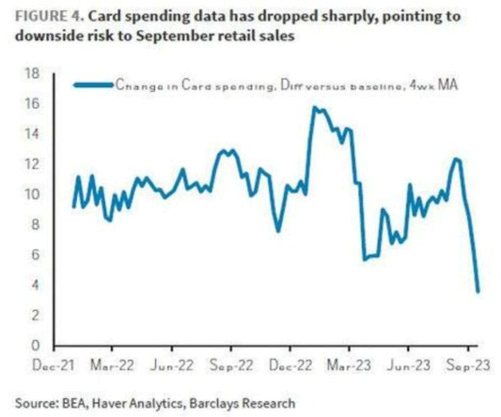

What is not shown on this chart is the average interest rate on these credit cards. Five years ago, the average interest rate on these cards was 13%. Today that rate is 22% – a significant burden for consumers carrying credit card balances. These higher costs have had an impact on consumer behavior and as the next chart shows credit card spending dropped sharply in September.

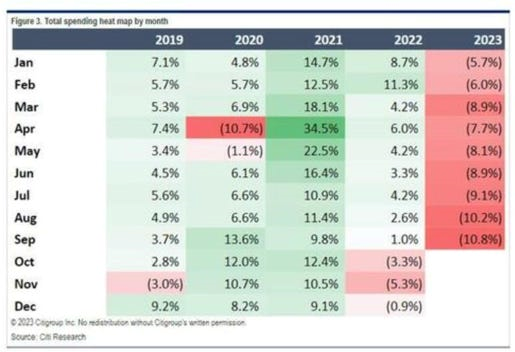

And as the following chart shows, total consumer spending has been dropping significantly year over year in 2023, and the trend is getting worse.

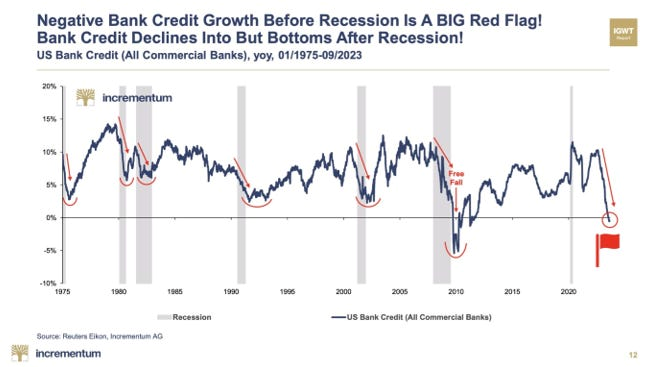

Further, signs of an imminent recession include the level of bank credit growth. The last time it was this negative was in the 2008 GFC. Negative bank credit growth is a very reliable recession indicator.

We believe the economy is very sick. The doctored employment figures are not telling the true story.

___________________________________

America needs a dynamic new, ‘outside-the-box’ resolution to this burgeoning economic crisis, a debt-busting behemoth economic acceleration plan.

The Leviticus 25 Plan is loaded up and ready to launch.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (8623 downloads)