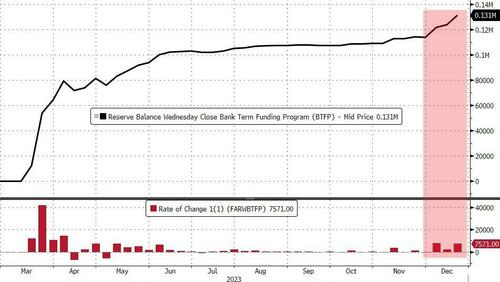

The BTFP has been running hot for the past 10 months, and is now surging up to new record highs. Banks with accounts at the Fed are also able, in the process, to engage in an arbitrage play by ‘borrowing’ funds and then immediately redepositing them with the Fed to earn ”free interest in the process.

America’s hard-working, tax-paying U.S. citizens should be so fortunate.

………………………………………………………

Banks’ Usage Of The Fed’s Bailout Facility Soars To New Record High

ZeroHedge, Thursday, Dec 21, 2023 – Excerpts:

Usage of The Fed’s BTFP bank bailout facility soared again last week, jumping $7.5BN to $131BN…

Source: Bloomberg

……An arbitrage for banks is growing more attractive thanks to traders who are betting the Fed will aggressively cut interest rates in 2024.

The rate on the Fed’s Bank Term Funding Program – which allows banks and credit unions to borrow funds for up to one year, pledging US Treasuries and agency debt as collateral valued at par – is the one-year overnight index swap rate plus 10 basis points.

That figure is currently 4.88%, down from 5.17% on Dec. 13.

For institutions that have an account at the Fed, they can borrow from the BTFP at 4.88% and park that at the central bank to earn 5.40% – the interest on reserve balances.

The 52bp spread matches the widest level since the Fed introduced the facility to support a struggling banking system after the collapse of California’s Silicon Valley Bank and Signature Bank in New York.

……………………………………….

Bank Term Funding Program: Definition, Why It Was Created

By Adam Hayes, Ph.D., CFA | Investopedia – March 23, 2023 – Excerpt:

The Bank Term Funding Program (BTFP) is an emergency lending program created by the Federal Reserve in March 2023 to provide emergency liquidity to U.S. depository institutions. It was established in response to the sudden bank failures of Signature Bank and Silicon Valley Bank, which were the largest such collapses since the 2008 financial crisis.

The program was created to support depositors, such as American businesses and households, by making additional funding available to eligible institutions to help assure that banks have the ability to meet the needs of all their depositors.

The BTFP offers loans of up to one year in length to U.S. banks, savings associations, credit unions, and other eligible depository institutions that pledge U.S. Treasuries, agency debt, mortgage-backed securities (MBS), and other qualifying assets as collateral.

The BTFP is intended as a temporary emergency measure and is set to wind down on March 11, 2024, unless renewed by the Federal Reserve.

_____________________________

Depository institutions remain in serious need of emergency funding.

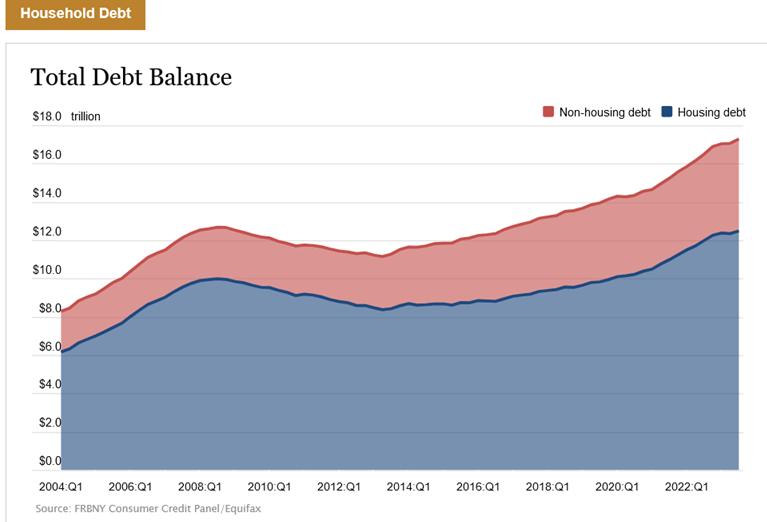

Main Street America is also in serious need of liquidity – and, neither the Fed or the U.S. Congress has any plan to address those growing needs.

“According to CNBC, while three-quarters of individuals earning $50,000 or less are living paycheck to paycheck, 65% of those earning $50,000 to $100,000 are in the same predicament. Of those earning $100,000 or more, 45% reported living paycheck to paycheck” (Yahoo Finance).

Total Household Debt rose to $17.29 trillion in Q3 2023; Driven by mortgages, credit cards, and student loan balances.

Small business bankruptcies in 2023 have been accelerating.

The Leviticus 25 Plan offers a dynamic economic reset for America – with direct liquidity extensions to qualifying U.S. citizens to eliminate vast expanses of ground-level debt across America, mortgage debt, installment debt, credit card debt, and student loan debt.

Depository institutions will, in the process, receive their much needed liquidity – after it has passed through the hands of U.S. citizens.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (10518 downloads)