The Leviticus 25 Plan – annual economic scoring update. For each of the first five years of activation (2025-2029), The Leviticus 25 Plan will generate average annual budget surpluses of $112.6 billion vs current CBO-projected average annual deficits of $1.795 trillion for the same period.

Overview, Primary Assumptions, Economic Scoring

The Leviticus 25 Plan activation period is slated for the 5-year period beginning in 2025 and ending in 2029.

1. The Leviticus 25 Plan – Each participating U.S. citizen will receive a $60,000 deposit into a qualified Family Account (FA) and a $30,000 deposit into a qualified Medical Savings Account (MSA).

All U.S. citizens residing in the United States are eligible to participate, contingent upon meeting qualification standards and agreement to specified recapture provisions.

Participants (other than ‘custody account’ applicants) must prove stable credit history, stable job history, no recent drug/felony convictions.

These general recapture provisions include:

– Waiving all federal income tax refunds for a period of 5 years.

– Waiving benefits from economic security programs, select benefits from means-tested welfare programs, SSI, and SSDI for a period of 5 years.

– Enrollees in the Medicare, VA Healthcare system, Federal Employees Health Benefits (FEHB), and TRICARE will be subject to a $6,000 deductible for primary care and outpatient services annually for a period of 5 years. (See full plan for more details)

Primary scoring assumptions:

The Plan assumes an 80% participation rate by U.S. citizens. Wealthier Americans would choose not to participate, due to the comparative benefit of income tax refund amounts. Many individuals of lower socio-economic sector would also choose not to participate, due to the comparatively high benefits profiles that they would not wish to give up.

The Plan assumes that participating families would use significant funds to pay down / eliminate debt, and that these longer-term, lower debt service obligations would enhance the financial security of participating families for several decades beyond the opening activation period. Federal, state, and local government entities would benefit from longer-term tax revenue growth and reduced citizen dependence on government-based entitlement program benefits.

The Plan assumes that dynamic new efficiencies would emerge in the healthcare system – with more families managing/directing healthcare expenditures through their MSAs.

The Plan assumes that apart from the recapture provisions, there would also be significant tax revenue growth for federal, state and local government entities from free-market economic revitalization, more people working and paying taxes, and from the elimination of various income tax deductions (e.g. mortgage / HELOC interest expense).

The Plan assumes that there would not be a massive full-scale move back into the means-tested welfare programs, income security programs, SSI, and SSDI at the end of the initial 5-year activation period.

The benefits of a free-market economy and newfound economic liberty for American families would provide positive economic inertia throughout years 5-10, and for several decades beyond.

Recapture provisions would provide a substantial federal budget surpluses for each year of the initial 5-year period. Economic growth over the following 10-15 years would generate sufficient recapture funding and tax revenue growth to offset the entire initial Federal Reserve balance sheet expansion.

Significant inertia from The Plan would also provide on-going, market-based growth benefits over succeeding years that far exceed any prospect for healthy economic growth that may be expected under America’s current big-government, central-planning approach.

Dynamic economic benefits would flow from:

– Family level massive debt elimination, financial security gains.

– Timely, sweeping reversal of big government “central planning” control.

– Productivity gains from reversal of work disincentives currently embedded in social programs.

– Economic growth, improved productivity, job creation, free market dynamics.

– Stabilization of bank capitalization, housing market.

– Strengthen / stabilize long-term value of U.S. Dollar.

– Minimizing the role of government in managing, directing, controlling the affairs of citizens.

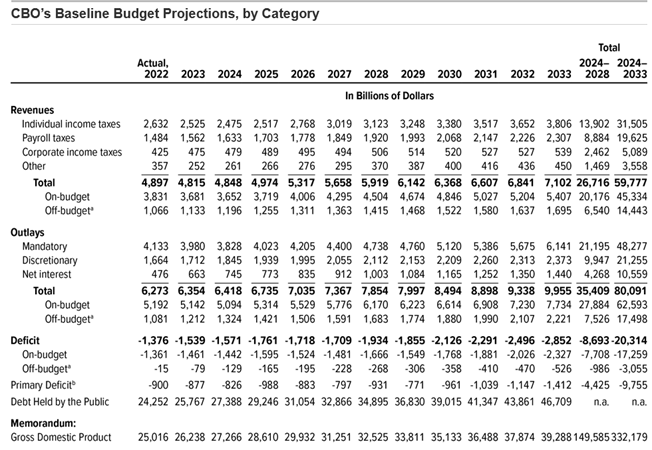

2. Federal Budget Deficit Projections – Congressional Budget Office

The Budget and Economic Outlook: 2023-2033 projects budget deficits ranging from $1,571 trillion in 2024, up to $1.855 trillion in 2029, and on up to $2.852 trillion by 2033. Actual deficits for the out years are likely to be higher than CBO projections, based upon history (“actual” versus “projected”).

Congressional Budget Office (CBO) Deficit Projections 2023-2033

CBO deficit projections for target period (2025-2029)

2022: $1.376 trillion (actual) vs $1.036 trillion (projected)

2023: $1.639 trillion

2024: $1.571 trillion

2025: $1.761 trillion

2026: $1.718 trillion

2027: $1.709 trillion

2028: $1.934 trillion

2029: $1.855 trillion

Total deficits projected 2025-2029: $8.977 trillion

Total- projected average annual deficits 2025-2029: $1.795 trillion

Source: CBO 10-Year Budget Projections (2023-2033) | https://www.cbo.gov/publication/59159

______________________________