Inflation Uncertainty Leaves Global Bonds On Thin Ice

ZeroHedge, Feb 12, 2024 | Authored by Simon White, Bloomberg macro strategist Excerpts:

Inflation may have fallen from its peak around the world, but in the inflationary regime in which we remain, upside surprises are more likely.

That would worsen already weak liquidity in global bonds and heighten the risk of rising yields….

Liquidity and inflation are related.

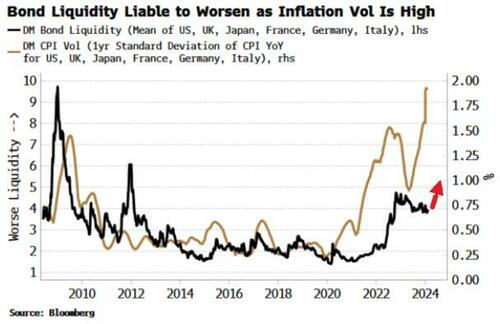

The volatility of inflation, which rises when inflation rises, tracks bond liquidity. Higher inflation volatility typically goes with poorer liquidity in bonds.

As we can see from the chart above, developed-market inflation volatility remains elevated, leaving bond liquidity liable to deteriorate.

Bonds have been trading with a negative skew, shown for the TLT (ETF of long-term USTs) below, which means that poor liquidity is more likely to lead to lower prices, higher yields.

This comes at a time when there are compelling signs of a cyclical upswing in global growth.

The combination of supported growth, receding US recession risk, heightened inflation uncertainty, and a deterioration in bond liquidity is a complete recipe for higher bond yields.

The risk is compounded when taking account of the rarefied view that US bond yields – which have a significant influence on DM yields – will move much higher this year, according to bank surveys.

_______________________________

Debt reduction / elimination is indispensable to restoring liquidity to bond markets.

There is precisely one plan on America’s table with the power to restore that liquidity.

The Leviticus 25 Plan will generate $112.6 billion annual federal budget surpluses over each of the first five years of activation (2025-2029) – taking an enormous amount of pressure off the credit markets.

The Plan will ignite a long-term economic growth cycle, restore financial security for millions of American families, stabilize the U.S. Dollar, and rejuvenate free-market dynamics and economic liberty.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (11631 downloads )