How Debt-to-GDP Ratios Have Changed Around The World Since 2000

ZeroHedge, Apr 22, 2024

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

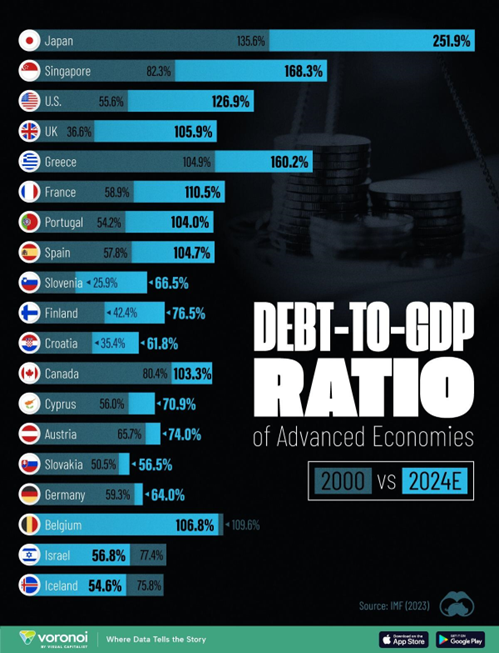

To gain perspective on this long-term trend, Visual Capitalist’s Marcu Lu visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

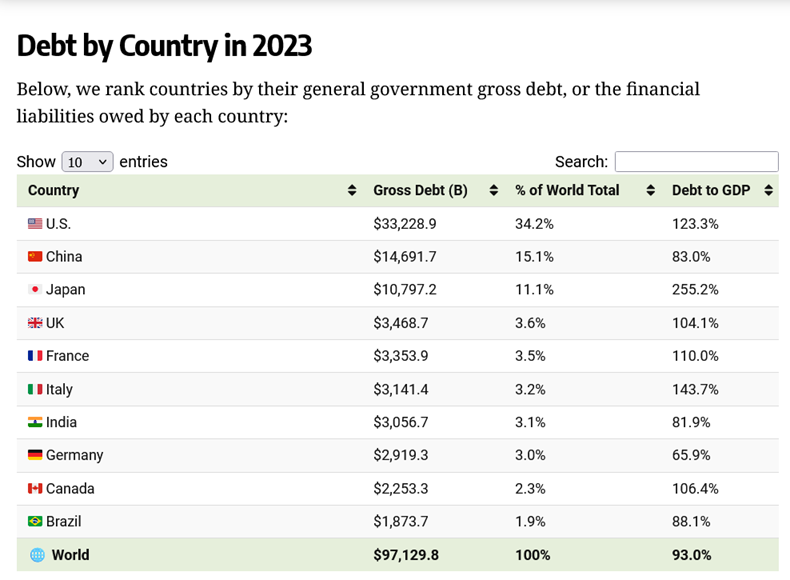

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

___________________________________

The global economic system is heading toward an inevitable ‘breaking point’ – which will collapse fiat currencies across the globe, followed by a coordinated conversion into a Central Bank Digital Currency (CBDC) system.

The World Economic Forum is paving the way for this conversion: April 2024 Insight Report, Modernizing Financial Markets with Wholesale Central Bank Digital Currency (wCBDC).

Washington Republicans and Democrats appear to be oblivious to this looming set up – and insensible to the foreordained loss of individual freedom and liberties.

Main Street America Republicans have the global economic reset plan with the raw power and dynamic efficiencies to eliminate vast sums of nation-by-nation debt, preserve freedom across the globe, and forestall the imposition of a CBDC system.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (13192 downloads )