Highlights:

For comparative context, the lower range of the estimate—$233 billion—is greater than fiscal year 2022 obligation levels for all but the eight largest agencies.

There are five agencies with total annual obligations greater than the upper range of $521 billion, based on fiscal year 2022.

……………………………………………………………..

GAO Fraud Risk Management, April 2024

Excerpts:

Annual Federal Losses Due to Fraud Are Estimated to be between $233 Billion and $521 Billion Based on Data from Fiscal Years 2018 through 2022, Reflecting Various Risk Environments

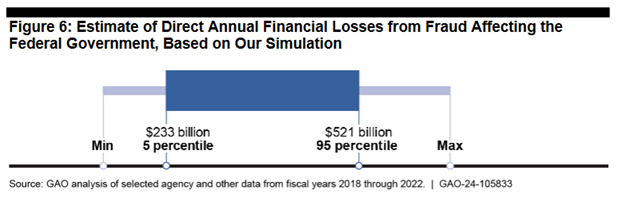

We estimated direct annual financial losses to the federal government from fraud to be between approximately $233 billion and $521 billion, as shown in figure 6. This range reflects the middle 90 percent of values, based on our model. The width of the range is a reflection of both the uncertainty associated with estimating fraud and the diversity in the risk environments that were present in fiscal years 2018 through 2022.

The estimate reflects fraud losses associated with direct federal spending on programs and operations.

Accordingly, fraud loss associated with revenues, such as tax credits or other fees collected by the federal government, are not included.

This estimate does not capture losses that occur at the state, local, tribal, or other government level unless those losses included a federal investigative, administrative, or related action.

Further, the estimate does not include the nonfinancial losses due to fraud or the value of nonfinancial benefits obtained fraudulently.

Figure 6: Estimate of Direct Annual Financial Losses from Fraud Affecting the Federal Government, Based on Our Simulation…

Our estimate is also in line with studies of domestic federal program fraud. For example, we and others conducted estimation work related to pandemic spending, which was at higher risk of fraud.

We estimated that between $100 billion and $135 billion (between 11 and 15 percent of total spending) in fraudulent unemployment insurance payments were made between April 2020 and May 2023.27 This analysis supported even higher fraud rates for the Pandemic Unemployment Assistance payments, which made up a subset of the unemployment insurance payments that were included in our review. The Small Business Administration OIG reported that it estimated $200 billion in potentially fraudulent pandemic related business loans as of May 2023.

Our estimate of direct annual financial losses due to fraud reflects significant financial impacts to the federal government.

For comparative context, the lower range of the estimate—$233 billion—is greater than fiscal year 2022 obligation levels for all but the eight largest agencies.

There are five agencies with total annual obligations greater than the upper range of $521 billion, based on fiscal year 2022.

______________________________

The Federal Government allocation of resources is not only inefficient and ‘special interest’ driven, it is also riddled with fraud – costing America’s hard-working taxpayers hundreds of billions of dollars in the process.

The Leviticus 25 Plan properly screens potential participants (favorable job histories, credit histories, tax payment records), and where necessary (for uncetain status), provides for custody account oversight to insure proper dispensation management.

The Leviticus 25 Plan thereby shifts trillions of dollars of resource allocation from the government directly to honorable, hard-working U.S. taxpayer citizens – saving the Federal Government massive sums of money in claims processing and middle-man involvement in its current “programs and operations.”

The Leviticus 25 Plan, furthermore, will generate $112.6 billion Federal Budget surpluses annually (2025-2029) vs projected $1.795 trillion annual budget deficits.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (13137 downloads )