The World has Learned Nothing from the Global Financial Crisis

ZeroHedge, Apr 3, 2019 – Excerpts:

After the 2008 crisis forcefully shoved the faces of most countries directly into the mess they had created, most major global economic participants arrived at the obvious conclusion that since debt caused the crisis to begin with, a deleveraging was necessary in coming years.

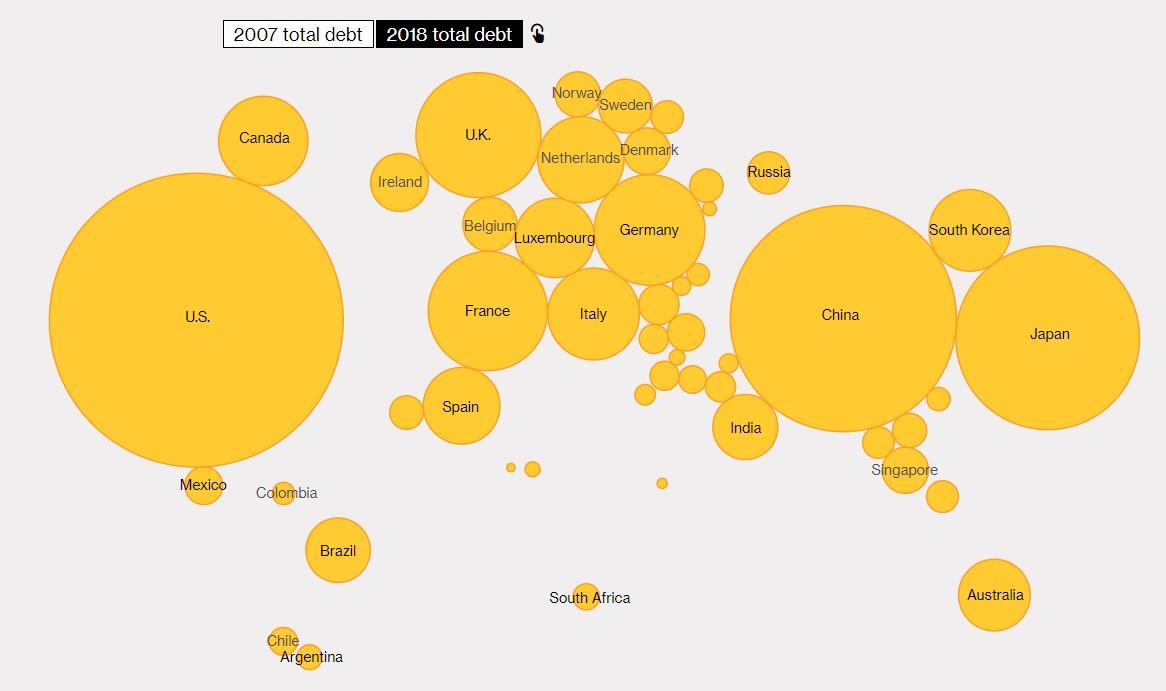

But instead, just the opposite has happened, according to Bloomberg: central banking cowardice and flawed monetary policy have, over the last decade, dug the world deeper into the hole it was in prior to the crisis. In the U.S., for instance, debt has shifted between industries, but it has not gone away. China, once relatively responsible in its debt positioning, has now emerged as the newest bastion for taking on debt to encourage growth.

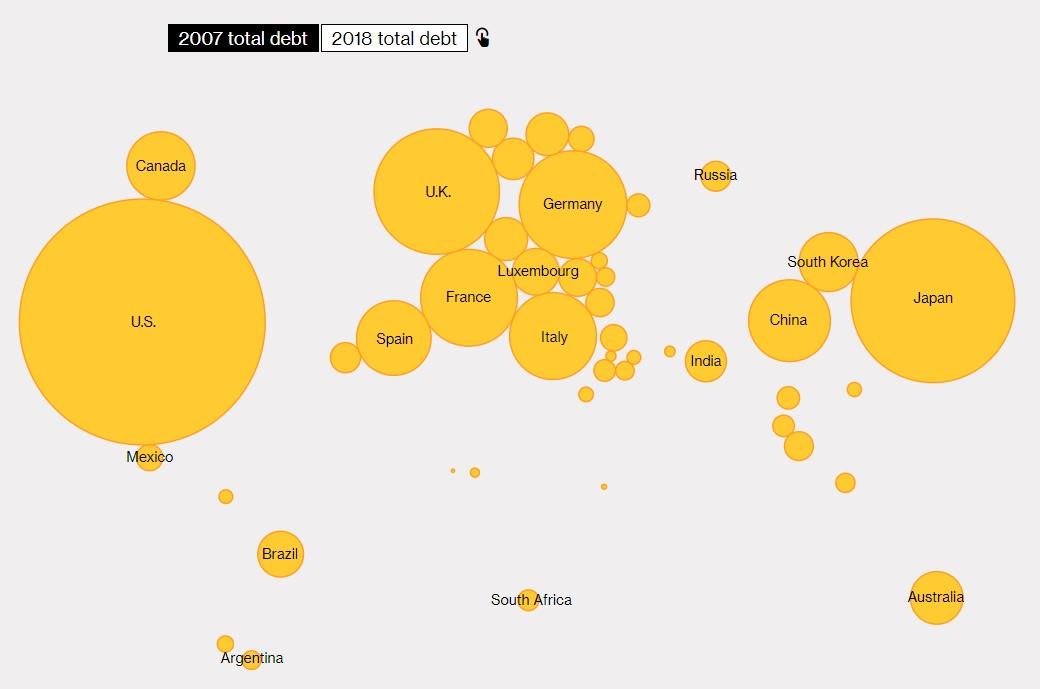

Here’s a graphic representation of debt in 2007:

And where we stood in 2018:

It was well known in Wall Street circles that there was simply too much leverage prior to the 2008 crisis.

[snip]

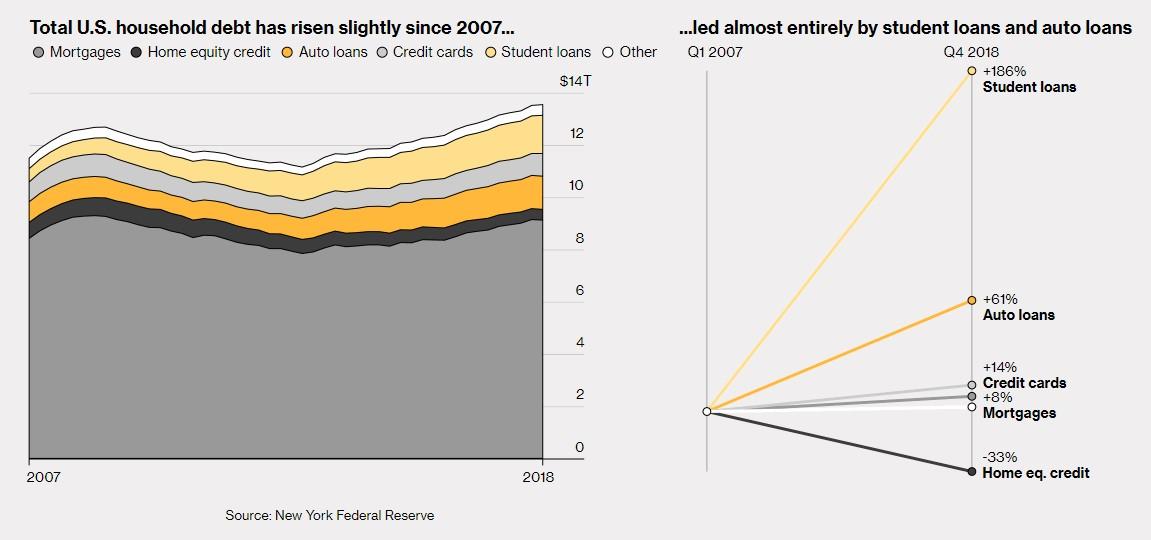

By 2008, household debt accounted for 98% of U.S. GDP. While spending excesses have been reined in to some degree, the country is seeing new types of debt come to prominence. Auto loans and student loans, for instance, have doubled since the crisis, moving from $1.36 trillion to $2.73 trillion.

___________________________________________

America’s powerful new deleveraging plan re-targets liquidity infusions into Main Street America rather than Wall Street’s financial sector – by granting U.S. citizens the same direct access to ‘liquidity-for-debt-relief’ that was provided by the Federal Reserve to major banks during the great financial crisis 2007-2010): Morgan Stanley, Citigroup, Bank of America, State Street, JP Morgan, Goldman Sachs, Merrill Lynch, Barclays, Deutsche Bank, UBS, Royal Bank of Scotland, BNP Paribas, and others..

It is time for America to restore financial health for citizens, unshackle itself from a massive debt load… and ‘power up’ the economic engines…

Main Feature: $465 billion budget surpluses for 2020-2025, plus robust debt relief for state and local governments: http://leviticus25plan.org/statistics/

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$75,000 per U.S. Citizen – Leviticus 25 Plan 2018 (3143 downloads)