The U.S. Federal Reserve performed a massive ‘secret liquidity lifeline’ bailout of the Wall Street financial sector, and failed their leveraged speculation strategies, during the great financial crisis (2007-2010).

Many of those same Wall Street banks are now taking another financial ‘hit’ from their Russia exposure.

…………………………………………………………………………………

Western Banks Brace For $10 Billion Hit Over Russia Exit

ZeroHedge, May 08, 2022 – Excerpts:

Western banks are bracing for a $10 billion collective hit as they prepare to shutter operations in Russia over the invasion of Ukraine – a move which mirrors several US lenders last month.

According to the Financial Times, international sanctions have “forced banks to consider turning their backs on a country that some lenders first entered more than a century ago.”

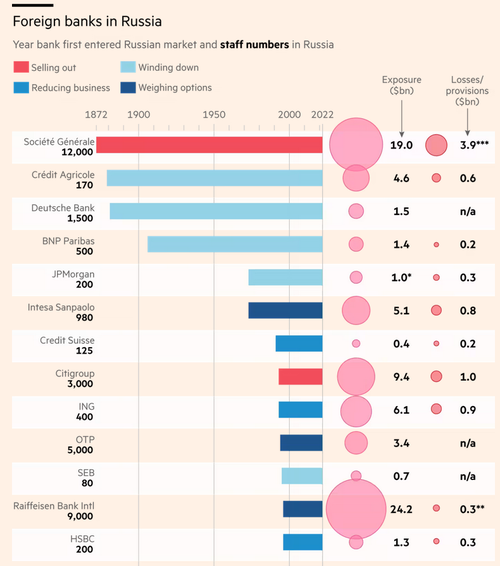

This week a string of European banks set aside billions of euros in provisions ahead of the closure of their Russian operations, following similar moves by US lenders last month. Western banks collectively have $86bn of exposure to Russia — with close to 40,000 staff — and are setting aside more than $10bn in expectation of losses on their ventures, according to Financial Times calculations. -FT

French lender Société Générale, which has operated in Russia for 150 years, has set aside €561mn for the first quarter, and expects to lose €3.1bn ($3.3bn) on the sale of its Rosbank subsidiary – which was founded by billionaire Vladimir Potanin. The bank has 3.1 million retail customers throughout Russia and €18bn ($19.3bn) of total exposure to the country. Around 12,000 people are employed by Rosbank.

Graphic via FT Research (Steven Bernard and Patrick Mathrin)

Other European banks preparing to take a hit are French bank Crédit Agricole, Austria’s Raiffeisen, Swiss lender UBS, and Credit Suisse.

____________________________________________

The Fed ‘fired up’ a line of credit facilities during the 2007-2010 crisis and again during the 2020-21 pandemic crisis to help these global banking operations to help them reduce their bad debt exposure and regain their ‘financial health.’

It is time now for the Fed to create a Citizens Credit Facility to grant the same direct access to liquidity to individual U.S. citizens – to reduce ‘ground level’ debt in America and restore financial health to American families.

The Leviticus 25 Plan – loaded up and ready to launch.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (4080 downloads)