Credit Suisse: What Exactly Is Going On At The … – Forbes

Oct 12, 2022 – Over the past year, Credit Suisse’s stock value has plummeted, with the company’s market capitalization dropping over 50%. This has happened due to a series of scandals that began in 2021.

Scandal after scandal…

- Greensill Capital: British financial services company focused on supply chain and accounts receivable financing. It originated loans, securitized them and sold them to investors. Credit Suisse had $10 billion invested in the company’s products. In March 2021, Greensill Capital failed, causing Credit Suisse’s clients to lose as much as $3 billion on their investments.

- Archegos Capital: This private company primarily managed the assets of Bill Hwang, an American trader and investor. Credit Suisse provided brokerage services to Archegos Capital, including lending. Archegos Capital reportedly experienced losses of as much as $20 billion in just a few days. A month after the Greensill losses, Credit Suisse lost $4.7 billion due to its involvement with Archegos Capital, and at least seven Credit Suisse executives were removed from their jobs.

- Drug-related money laundering: In February 2022, Credit Suisse was charged with being involved in money laundering by a Bulgarian cocaine trafficking gang. It was the first criminal trial of a major bank to occur in Switzerland. In June, the bank was found guilty, fined 1.7 million euros, and ordered to pay 15 million euros to the Swiss government. Credit Suisse announced plans to appeal.

- Information leaks: In the same month, the details of 30,000 customer accounts holding more than 100 billion Swiss francs in accounts at Credit Suisse were leaked to Süddeutsche Zeitung, a major German newspaper. Included in the leak were accounts held by people involved in human trafficking, drug trafficking and torture. One account was also allegedly associated with the Vatican and fraudulently invested in 350 million euros worth of property in London.

- Ukraine invasion: Following the Russian invasion of Ukraine, Switzerland placed sanctions on Russia. In response, Credit Suisse requested hedge funds and other investors to destroy documents that linked Russian oligarchs to things like loans. This led to probes into the bank’s compliance with sanction requirements.

…………………………..

More recently…

Credit Suisse Craters After “Staggering” Bank Run And Warning Of Continued Losses

ZeroHedge, Feb 09, 2023 – Excerpts

Back in late 2022, when Credit Suisse stock cratered to never before seen levels after a series of dismal earnings reports and regulatory “missteps” sparked a staggering bank run, amounting to some $88 billion forcing the bank to seek emergency liquidity from the Fed via SNB swap lines, and which also led to a historic corporate restructuring which included the de facto closure of the bank’s investment bank coupled with mass layoffs and bonus cuts, many thought that would be as bad as it gets as the (rapidly changing) management had finally thrown out the kitchen sink….

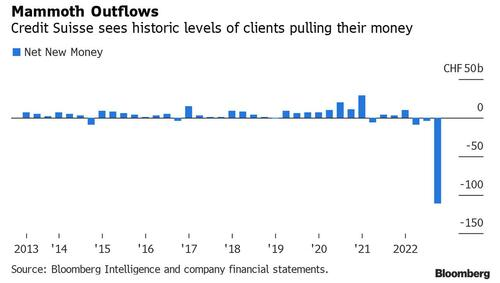

The second-largest Swiss bank (although it’s probably far smaller now) posted a fifth-straight quarterly loss of 1.39 billion Swiss francs ($1.5 billion), worse than consensus estimates of a 1.14 billion loss as revenue of 3.06 billion Swiss francs also handily missed expectations of 3.35 billion. But while the operating loss was hardly a shock for a bank which has been in a constant state of chaos and turmoil, what stunned analysts was what KBW analysts called a “quite staggering” level of customer capital outflows which hit a record 110.5 billion francs in the quarter, and although the bank said that some money has been coming back, it also concedes it’s now at a worse starting point for 2023.

______________________________________________________________

Credit Suisse: This is the very same Credit Suisse that the U.S. Federal Reserve so generously infused with massive liquidity injections during the height of the great financial crisis of 2007-2010.

Bloomberg Nov 28, 2011 – Excerpts:

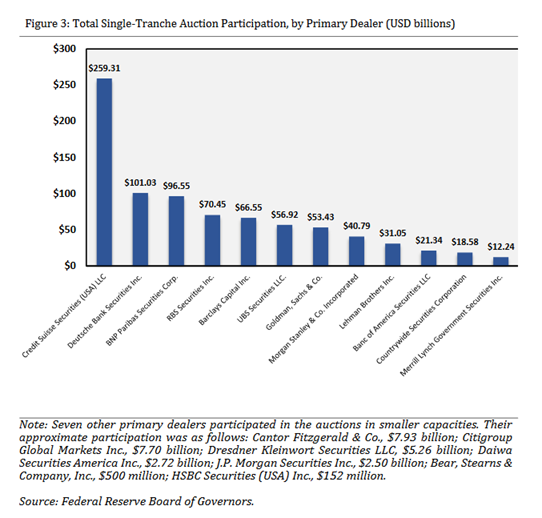

“Credit Suisse Group AG, Switzerland’s second-biggest bank by assets, was the biggest user of the Fed’s single-tranche open market operations, or ST OMO, borrowing $45 billion in August 2008. Under ST OMO, securities firms swapped eligible mortgage bonds for cash.

The Zurich-based bank’s U.S. brokerage also used the Term Securities Lending Facility, which allowed firms to swap certain debt securities for Treasuries that could be loaned out or sold for cash. Credit Suisse took no part in any central bank’s collateralized funding facilities in the crisis, said Steven Vames, a bank spokesman in New York. TSLF doesn’t count because it involved no cash transfers, he said, and the bank borrowed from ST OMO only as a so-called primary dealer. Primary dealers weren’t required to bid in ST OMO.”

Peak Amount of Debt on 8/27/2008: $60.8B

………………………

ST OMO’s were a unique form of liquidity infusions that provided “term funding” to the (big bank) Primary Dealers, primarily benefiting major European (Primary Dealer) banks. – for the purpose of “mitigating heightened stress in funding markets.”

These ST OMO “secretive bailout operation” pumped out $855 billion between “March and December 2008.”

“These operations were conducted by the Federal Reserve Bank of New York with primary dealers as counterparties through an auction process under the standard legal authority for conducting temporary open market operations. In these transactions, primary dealers could deliver any of the types of securities–Treasuries, agency debt, or agency MBS–that are accepted in regular open market operations. By providing term funding to primary dealers, this program helped to address liquidity pressures evident across a number of financing markets and supported the flow of credit to U.S. households and business.”

“Well, not really. As the chart below shows the banks, pardon, primary dealers, that benefited the most from this secret iteration of Fed generosity were once again foreign banks, with the Top 5 borrowers being Credit Suisse, Deutsche Bank, BNP Paribas, RBS and Barclays. Together these five accounted for $593 billion of total borrowings, or 70% of the total.”

Below is a summary of who borrowed how much in total from the Fed’s ST-OMO program.

Source: https://elischolar.library.yale.edu/cgi/viewcontent.cgi?article=1113&context=journal-of-financial-crises

__________________________________

Update: The U.S. Federal Reserve provided a cool $6.3 billion to ‘rescue’ Credit Suisse via SNB swap lines, as recently as last October.

Instead of continuing to prop up inept and corrupt global banks, it is time for the Fed to re-target their liquidity flows.

U.S. citizens deserve the same access to liquidity and credit guarantees that the Fed pumped out to rescue the banking system during the crisis period (2007 – 2010) when high-risk sub-prime debt took on ‘junk’ status, and fairly well ‘froze’ the system.

Certain Fed operations, like single-tranche open market operations, heavily favored major European banks – designed to mitigate “heightened stress.”

It is now time for the Fed to activate a U.S. Citizens Credit Facility to grant direct liquidity access to U.S. citizens – to eliminate debt and help relieve “heightened stress” at the family level in America.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (5757 downloads)