The Leviticus 25 Plan has undergone its annual economic scoring update. For each of the first five years of activation (2024-2028), The Plan will generate a per annum budget surplus of $619.5 billion.

Part 1: Overview, CBO Deficit Forecast 2024-2028

The Leviticus 25 Plan – Each participating U.S. citizen will receive a $60,000 deposit into a Family Account (FA) and a $30,000 deposit into a Medical Savings Account (MSA).

All U.S. citizens are eligible to participate, contingent upon agreement to specified recapture provisions.

These general provisions include:

– Federal income tax refunds waived for a period of 5 years.

– Waive Economic Security Program benefits, select means-tested welfare program benefits, and SSI / SSDI benefits for a period of 5 years.

– Participants enrolled in Medicare, Medicaid, VA Healthcare system, Federal Employees Health Benefits (FEHB), and TRICARE subject to a $6,000 deductible for primary care and outpatient services annually for a period of 5 years.

_________________________________

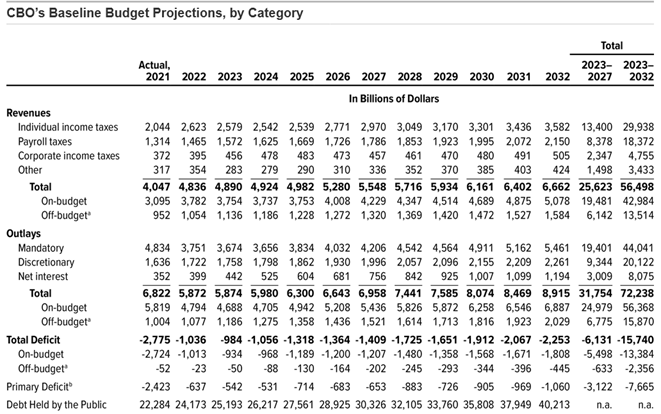

2. Federal Budget Deficit Projections – Congressional Budget Office

The Budget and Economic Outlook: 2022-2033 projects budget deficits ranging from $984 billion in 2023, up to $1.725 trillion in 2028, and on up to $2.253 trillion by 2032.

Actual deficits for the out years are likely to be higher than CBO projections, based upon history (“actual” versus “projected”).

Congressional Budget Office (CBO) Deficit Projections 2023-2032

CBO deficit projections for target period (2024-2028)

2022: $1.036 trillion

2023: $984 billion

2024: $1.056 trillion

2025: $1.318 trillion

2026: $1.364 trillion

2027: $1.409 trillion

2028: $1.725 trillion

Total deficits projected 2024-2028: $6.872 trillion

Source: CBO 10-Year Budget Projections (2022-2032) https://www.cbo.gov/publication/58147

________________________________

Note 1: Projected budget surpluses for 2024-2028 do not factor in the additional government tax revenue gains that would accrue from the massive shift in capital away from debt service and into productive economic activity.

Note 2: Projected budget surpluses for 2024-2028 do not factor in the additional government tax revenue gains that would accrue from significantly lower levels of debt deductibility on individual income tax filings.

Note 3: Projected budget surpluses from the Medicaid / CHIP recapture do not take into account the likelihood of fewer citizens actually qualifying for Medicaid / CHIP benefits.

Note 4: The Plan’s funding of individual Medical Savings Accounts (MSAs) with the $6,000 deductible provision per year would result in an enormous drop in the number of claims each year for Medicare reimbursement. Medicare payroll taxes would generate a growing revenue stream, due to stronger economic growth, while outlays would drop significantly from the reduced claims numbers – thereby providing the Fed with a powerful tool to recapitalize the Medicare Trust Fund, vis the Citizen’s Credit Facility.