Mish: Tidal Wave of Money Leaving Banks Will Kill Bank Profits and Lending

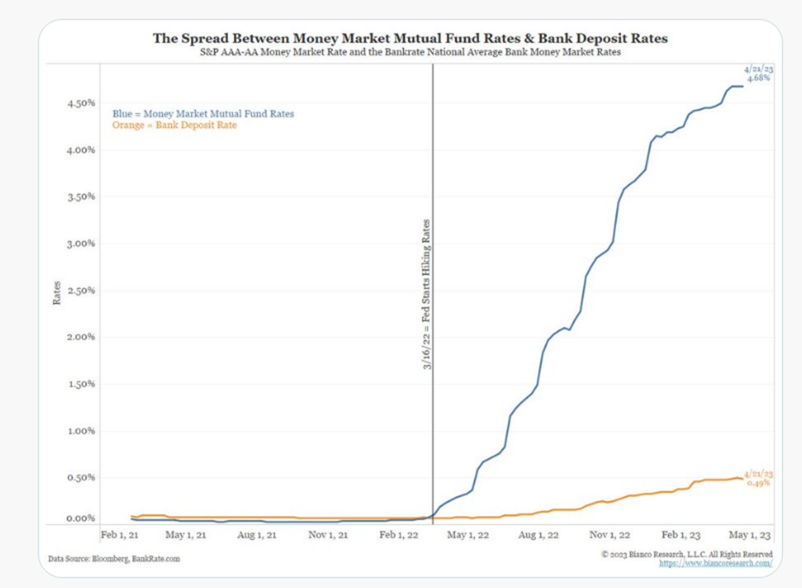

Let’s tune into a mass exodus of deposits at banks for money market mutual funds and what it means.

Mish, Apr 24, 2023 – Excerpts:

Jim Bianco 21-Tweet Thread / Mish opinions:

The “bank walk” becomes a “bank powerwalk” to 5%.

More Bank Failures? – “To be clear, a bank walk will NOT lead to another bank failure, wrong metric. But it will kill their profitability, especially the smaller banks.“

Giant Bank Sucking Sound – Question On Stopping the Run

Mish: “Banks need NEW Deposits because they already locked up existing deposits in 10-YR notes at 2.0% or so. Offering 3% will not attract much new money with others offering 5%.“

Bianco: “Exactly correct: They [banks] locked up securities and loans that generate much lower interest rates. Somewhere around 3%. Over time they mature and get rolled into higher rates. But not now. So, they lose money by trying to compete with market rates. This explains why the bank stocks cannot rally.“

Bianco The “bank walk’s” cumulative impact on markets, the economy, and lending. It will be a significant drag later this year.

Moody’s Downgrades 11 Regional Banks: Moody’s Downgrades 11 Regional Banks, Including Zions, U.S. Bank, Western Alliance.

Regional banks, Moody’s said, are more exposed to hard-hit commercial real estate. U.S. banks hold about half of total CRE debt outstanding, and some are concentrated in construction, office, or land development.

U.S. Bank has a “relatively low capitalization” as well as unrealized losses on its securities, Moody’s said. Zions has “significant” unrealized losses on its securities portfolio and its capital has deteriorated, Moody’s said.

Downgraded Banks

- U.S. Bancorp USB, with $682 billion in assets

- Zions Bancorp ZION with $89 billion in assets.

- Bank of Hawaii Corp., BOH with $24 billion in assets.

- Western Alliance Bancorp WAL, received a two-notch downgrade.

- First Republic Bank, which faced a run last month, had its preferred-stock rating cut.

- Six More: Associated Banc-Corp., Comerica Inc., First Hawaiian Inc., Intrust Financial Corp, Washington Federal Inc., UMB Financial Corp.

Banks will not be taking any extra risks. Nor will larger banks that also face the “powerwalk”. This will pressure bank lending across the board.

Like it or not, the Fed is purposely angling for recession to cure inflation.

And the Fed does not have an inflation ally in the White House. Biden is doing everything possible to fuel inflation with inept Green policies.

This post originated at MishTalk.Com

________________________________________

The right way for the Fed to rescue troubled banks:

The Leviticus 25 Plan, provides the tidal wave of fresh capital that will flow into banks through debt pay-downs by American families: Mortgage debt, Consumer debt, Household debt, Student Loan (unsubsidized) debt; credit card debt.

A good share of that debt, in ‘delinquent’ status, will be ‘satisfied,’ or ‘made current,’ which will be an important additional benefit.

The Leviticus 25 Plan will also reignite economic growth, which will help relieve pressure on Commercial Real Estate (CRE) debt service.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (6066 downloads)