The U.S. financial system desperately needs a fresh river of liquidity – not the kind which the Fed normally delivers (massive banking system injections/bailouts).

The U.S. financial system needs direct liquidity extensions targeting the backbone of the financial system – hard-working, tax-paying U.S. citizens.

………………………………………………………

The banking sector is currently reeling from a whirlwind ‘duration stress’ and deposit flight – having lent long-term money out in recent years at relatively low interest rates, and now having to borrow at much higher rates. Inflation hit, rates rose, and in due course market value of these paper assets on their balance sheets has declined significantly.

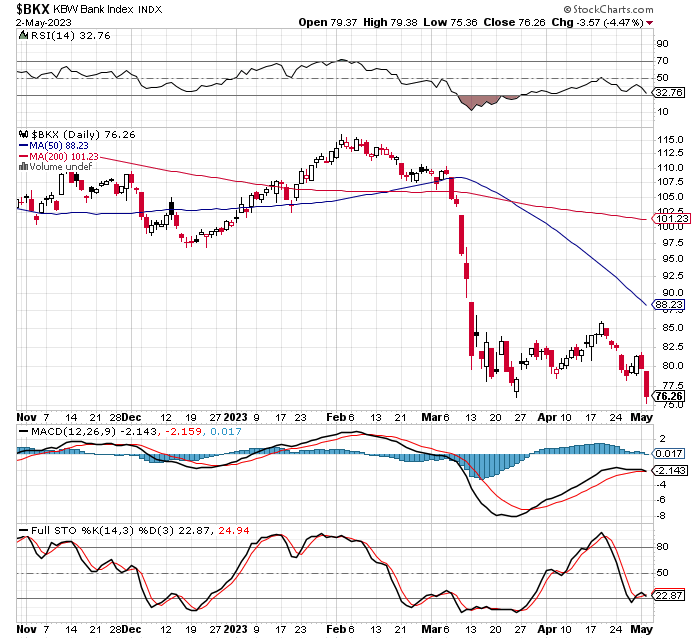

The KBW Bank Index, a bellwether indicator tracking the prices of 24 large banks in this sector, began crashing in March. It is now down 34% since early February.

Index Components – As of May 2021, the individual index components included:

- Bank of NY Mellon (BK)

- Bank of America (BAC)

- Capital One Financial (COF)

- Citigroup (C)

- Citizens Financial Group (CFG)

- Comerica (CMA)

- Fifth Third Bank (FITB)

- First Horizon (FHN)

- First Republic Bank (FRC)

- Huntington Bancshares (HBAN)

- JP Morgan Chase (JPM)

- Keycorp (KEY)

- M&T Bank (MTB)

- Northern Trust (NTRS)

- PNC Financial Services (PNC)

- People’s United Financial (PBCT)

- Regions Financial (RF)

- Signature Bank (SBNY)

- State Street (STT)

- SVB Financial Group (SIVB)

- Truist Financial Corp (TFC)

- US Bancorp (USB)

- Wells Fargo & Co (WFC)

- Zion’s Bancorp (ZION)

Source: Investopedia

…………………………………….

Charts: ZeroHedge

A handful of the ‘majors’ got slammed today…

The big story today: The “total collapse in regional banks…

“PacWest, Western Alliance, and Zions (among others) are in a free-fall…”

_______________________________

There is a ‘right way’ for the Fed to rescue troubled banks – by re-targeting liquidity flows directly into the hands of U.S. citizens.

The Leviticus 25 Plan, provides the tidal wave of fresh capital that will flow into banks through debt pay-downs by American families: Mortgage debt, Consumer debt, Household debt, Student Loan (unsubsidized) debt; credit card debt.

A good share of that debt, in ‘delinquent’ status, will be ‘satisfied,’ or ‘made current,’ which will be an important additional benefit.

The Leviticus 25 Plan will also reignite economic growth, which will help relieve pressure on Commercial Real Estate (CRE) debt service.

The Leviticus 25 Plan will generate massive new tax revenue flows, including a payroll tax (Social Security, Medicare) upsurge.

It will lead to federal budget surpluses of $619 billion annually over the initial five years of activation, thereby mitigating the need to raise the debt ceiling.

It will provide America with a fresh start, strengthen the long-term prospects of the U.S. Dollar, and restore financial health for millions of American families.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (6077 downloads)