America needs a clean path to reducing dependence on government… and eliminating the massive fraud and waste built into our big government social policy ‘solutions.’

It is shocking that Washington Republicans and Democrats, for all intents and purposes, have turned a blind eye to this gigantic, ongoing tax-payer rip off.

………………………………………………..

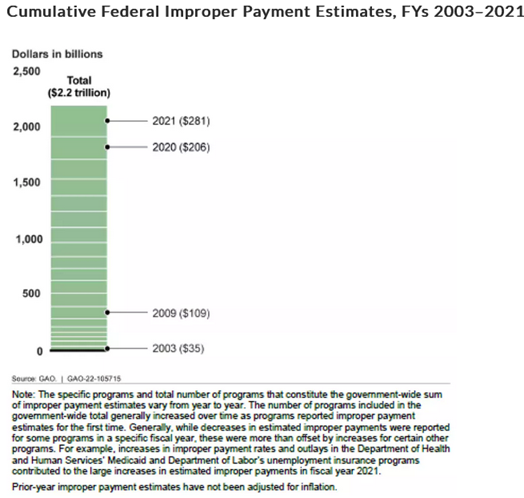

Government Accountability Office (.gov) | https://www.gao.gov › improper-payments

Improper payments—payments that should not have been made or were made in the incorrect amount—have consistently been a government-wide issue…

……………………………………………….

Welfare Fraud – Federal Safety Net

Federal Safety Net | https://federalsafetynet.com › welfare-fraud

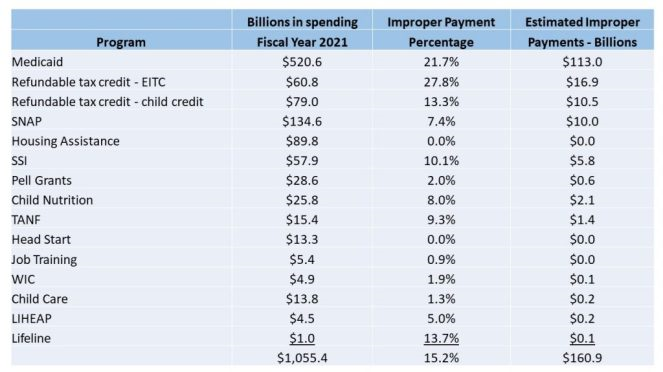

Improper welfare payments, including welfare fraud and welfare abuse, are estimated to be 15.2% of all federal welfare payments. They total $161 billion in the fiscal year 2021. The estimate stems from the Office of Management and Budget (OMB) [i] and The General Accounting Office (GAO) reports. Eight of the Welfare Programs make the OMB list of “High Priority Programs.” These are programs with improper payments greater than $2 billion annually. Shown below is information on each program.

The table below shows billions of dollars of estimated welfare fraud and improper payments by welfare programs. The table takes total expenditures by program and applies the improper payment percentage. Adding up the programs approximates the overall improper payments from the welfare system as a whole.

……………..

America’s Health Care Programs are Full of Improper Payments

Paragon Health Institute | https://paragoninstitute.org › americas-largest-health-c…

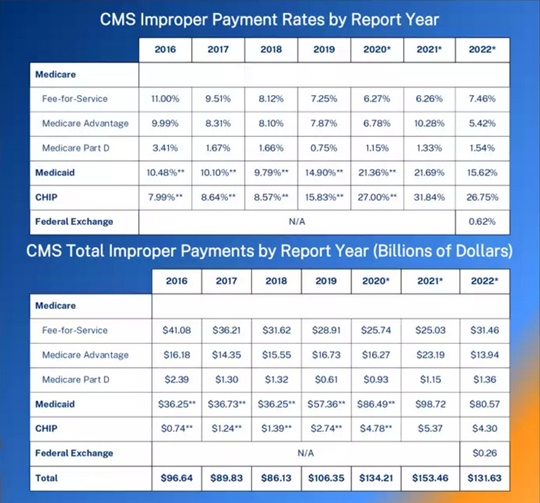

Dec 4, 2022 — A new report estimates official improper payments made by federal health programs are about $132 billion annually…

……………..

How Medicare and Medicaid fraud became a $100B …

CNBC | https://www.cnbc.com › 2023/03/09 › how-medicare-an…

Mar 9, 2023 — Medicare and Medicaid programs are being brazenly targeted by sophisticated criminals. Estimated annual fraud tops $100 billion…

………………………………………………..…

Social Security Fraud: What Is It Costing Taxpayers?

Millions, possibly billions, of dollars every year

By The Investopedia Team | Updated September 02, 2022

Reviewed by Charlene Rhinehart | Fact checked by Vikki Velasquez

Social Security fraud statistics can be difficult to pin down. Some are grouped inside a larger category that the Social Security Administration (SSA) calls “improper payments,” which includes everything from innocent mistakes to willful fraud. The SSA estimates that it made about $8.3 billion worth of improper payments during the 2020 fiscal year.

Social Security-related fraud can also take other forms, such as identity theft using stolen Social Security numbers and scams involving bogus phone calls and emails purporting to be from the SSA. Collectively, these frauds cost the U.S. government and individual taxpayers millions, if not billions, of dollars every year.

……………………………………………………..

Programs Susceptible to Improper Payments Are Not Adequately Addressed and Reported

Oversight.gov | https://www.oversight.gov › oig-reports › TIGTA

May 6, 2022 — Earned Income Tax Credit (EITC) – The IRS estimates 28 percent ($19.0 billion) of the total EITC payments of $68.3 billion were improper.

…………………

CHD, Apr 12, 2023: Biden to Spend $5 Billion on New Coronavirus Vaccine Initiative Supported by Gates, Fauci and Republican Lawmakers

___________________________________________

The Leviticus 25 Plan

Qualifying participants will each receive a $60,000 deposit into their Family Account – and, for five years, will no longer be enrolled beneficiaries in the following programs: EITC, child tax credits; SNAP, Housing Assistance, SSI, Child Nutrition, TANF.

Qualifying participants will also receive a $30,000 deposit into their Medical Savings Account, and will then have a $6,000 annual deductible for primary health care services accessed through Medicaid, Medicare, VA, TRICARE, FEHB for five years. This would eliminate tens of millions of claims and provide cleaner programs for improper payment and fraud prevention.

Participants will not receive Social Security Disability Insurance benefits for five years. OASI benefits would not be affected.

Participants would not receive free Coronavirus vaccinations.

……………………………..

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (5993 downloads)